USD/CAD Weekly Forecast: Will the central bank pas de deux continue?

- USD/CAD turns in a 20-month high despite the BoC 100 bps rate hike.

- Persistent US dollar safety-buying and Fed rate prospects aid greenback.

- WTI fades below $100 dragging the loonie down.

- FXStreet Forecast Poll argues for a lower USD/CAD.

The Bank of Canada’s surprise 1.0% hike on Wednesday, the first since 1998, was just a temporary setback in the US dollar's relentless rise.

Inflation in the US climbed to 9.1% annually in June, the highest since November 1981. When the Federal Reserve's agressive rate policy combined with the markets' search for safety from the anticipated global recession, the USD/CAD forged its highest top and closing rates in 20 months on Thursday at 1.3224 and 1.3119. Friday’s trading brought the pair back to the 1.3025 start line for the series of stop-loss runs above 1.3050 that had defined Thursday’s action.

USD/CAD 60 minute chart

West Texas Intermediate (WTI) lost 8.6% from Monday to Thursday’s close at $93.65, materially subtracting from the Canadian dollar, before recovering 0.9% to $94.51 on Friday. Oil has lost 9.7% this month and 20.7% since its close at $118.14 on June 8.

Friday’s close at 1.3026 was just under the 1.3045 effective top of the range for the last three months, the pinnacle for the pair since November 2020.

American Retail Sales rose 1.0% in June, slightly stronger than forecast though the difference and more, is likely due to price inflation and not higher spending volumes. The apparent lack of a negative impact from inflation on consumer purchases reduced fears of an immediate recession. Treasury yields and the dollar fell on Friday and US equities saw a strong rally. The odds in Treasury futures for a 100-basis point increase on July 27 fell back to 30% from over 70% previously. Comments from several Fed presidents plumped for both aggression and restraint at the meeting in two weeks.

One aspect of the pending Fed decision that does not receive much play is the second quarter GDP report due the following day. The governors may wish to secure as large a rate increase as possible before fading economic growth precludes further action. Second-quarter activity is estimated to be -1.5% by the Atlanta Fed GDPNow model, and, coming after the 1.6% contraction in the first three months, the US could be in a traditional recession come July 28.

In addition to the US CPI and Retail Sales releases, producer prices rose 11.3% in June, up from 10.9% in May with core prices fading a bit to 8.2% from 8.5%. Industrial Production and Capacity Utilization were weaker than expected in May though Michigan Consumer Sentiment for July rose to 51.1 and did not fall into contraction as had been forecast.

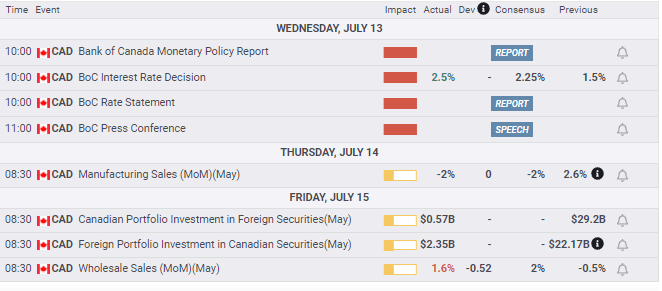

Canadian data was limited with manufacturing and wholesales sales in May weaker than expected.

USD/CAD outlook

The near future for the USD/CAD depends on market perception for a 100-basis point hike at the Federal Open Market Committee meeting in two weeks. American data in the week ahead will provide few direct clues though Existing Home Sales on Wednesday will chronicle the impact of higher mortgage rates. Home purchases are already 16.6% below January’s 6.49 million annualized sales pace.

If the Fed chooses the more contained 75-basis point increase, the Canadian and US base rates will be at 2.5%. Given the last BoC increase a smaller US hike would liklely boost the loonie. Canadian inflation is expected to rise to 8.8% in June when reported on Wednesday. This could also provide the loonie with an advantage should it come in hot.

The outlook for the USD/CAD is to consolidate lower. Technically, the area from 1.2980 to 1.3020 should provide substantial support.

Thursday’s top is more than two figures away and the stop buy orders above 1.3000 that drove the market higher have been executed and are unlikely to have been replaced. With little new information scheduled and WTI back to its pre-Ukraine level, the USD/CAD will necessarily look to the Fed for fresh impetus.

Canada statistics July 11–July 15

US statistics July 11–July 15

FXStreet

Canada statistics July 18–July 22

FXStreet

US statistics July 18–July 22

FXStreet

USD/CAD technical outlook

The MACD (Moving Average Convergence Divergence) and the Relative Strength Index (RSI) moved further into the bullish zone this week as might be expected after Thursday's stop run. Since the last week of June the MACD price line has entwined the signal line without a decisive move. Thursday's ascent opened a minor positive divergence that is not a firm signal. The Average True Range (ATR) had a sharp increase with Thursday's stop-loss run, that is likely to diminish as the USD/CAD slips into the technically congested area around 1.3000.

The 21-day moving average (MA) a 1.2962 and the 100-day MA at 1.2865 indicate the likely stability of the USD/CAD around 1.2900.

Resistance: 1.3050, 1.3075, 1.3120, 1.3135

Support: 1.3000, 1.2965, 1.2945, 1.2930, 1.2900

Moving Averages: 21-day 1.2962, 50-day 1.2865, 100-day 1.2765, 200-day 1.2699

FXStreet Forecast Poll

The FXStreet Forecast Poll portrays an expected technical consolidation as the interest rate drivers await the Fed's July 27 decision.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Joseph Trevisani

FXStreet

Joseph Trevisani began his thirty-year career in the financial markets at Credit Suisse in New York and Singapore where he worked for 12 years as an interbank currency trader and trading desk manager.

%20tech%201-637935208115383197.png&w=1536&q=95)

%20tech%202-637935213292768995.png&w=1536&q=95)