USD/CAD Weekly Forecast: Hurry up and wait

- USD/CAD weakens on US COVID-19 economic concerns.

- Potential for further Federal Reserve easing adds weight.

- Canadian Retail Sales stronger than forecast.

- Modest crude oil rise aided the Canadian dollar.

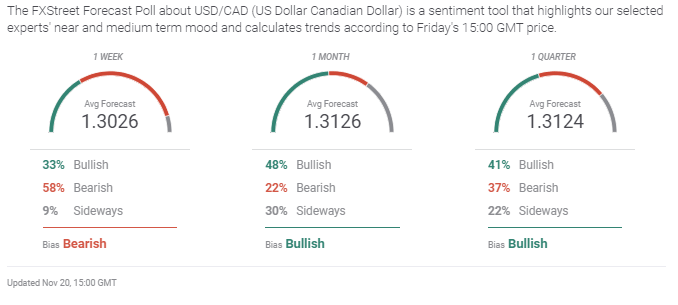

- FXStreet Forecast Poll suggests consolidation to year end.

The USD/CAD drifted lower on concerns that the pandemic counts in the US may force damaging economic closures in some states and could induce the Federal Reserve to further loosen credit.

Although viral diagnoses are rising around the world the particular surge in the United States has mooted the dollar's risk-off premium that has been the standard market response for the past eight months. That premium had reached over 1.4600 in late March and its withdrawal has been a general feature of currency trading since the end of June.

Technically, the USD/CAD rebounded from weak support at 1.3050 with stronger deterrence at 1.3000. Initial resistance is at 1.3150. The upper border of the descending channel is about 1.3250 with the lower around 1.2800. Overall the range on the week was 1.3034 to 1.3142, with an open on Monday at 1.3135 to the Friday's close at 1.3084.

October Retail Sales in the US missed expectations and the lower revisions to September drew attention to the possible COVID-19 impact ahead.

West Texas Intermediate rose 5.1% on the week closing at $42.44, assisting the Canadian dollar and the resource rich economy, but it remains below resistance at $43.50. It has not challenged the pandemic gap that has blocked all attempts to move higher since the March collapse. Crude oil and commodity prices are pinned until the pandemic releases its grip and permits a wholesale global recovery.

USD/CAD outlook

The continuing decline in the USD/CAD is the superannuated pandemic scenario. The US dollar drifts lower, removing a viral premium that no longer exists, because the market is blocked from recovery judgments until the pandemic recedes.

The USD/CAD has been trading at pre-February levels for three months. Eventually traders will have to decide which North American democracy will have a faster post-viral surge.

For most US dollar based pairs, the advantage will lie with the American economy's historically better growth. That might not be as true for the USD/CAD as the initial stage of a worldwide recovery will play to its resource economy.

Technically, all indicators point lower for the USD/CAD but there are all weak. The descending channel is intact and well-defined with substantial room to the borders above and below the market level. Resistance lines at 1.3150 and 1.3200 and support at 1.3050 and 1.3000 are close as the market has run out logic for a move in either direction.

The COVID-19 drama has dominated markets for nine months. The end appears to be in sight but it is, for the moment, too far for practical market planning. After this dismal year, traders will wait for concrete signs of improvement before they put their hopes into market positions.

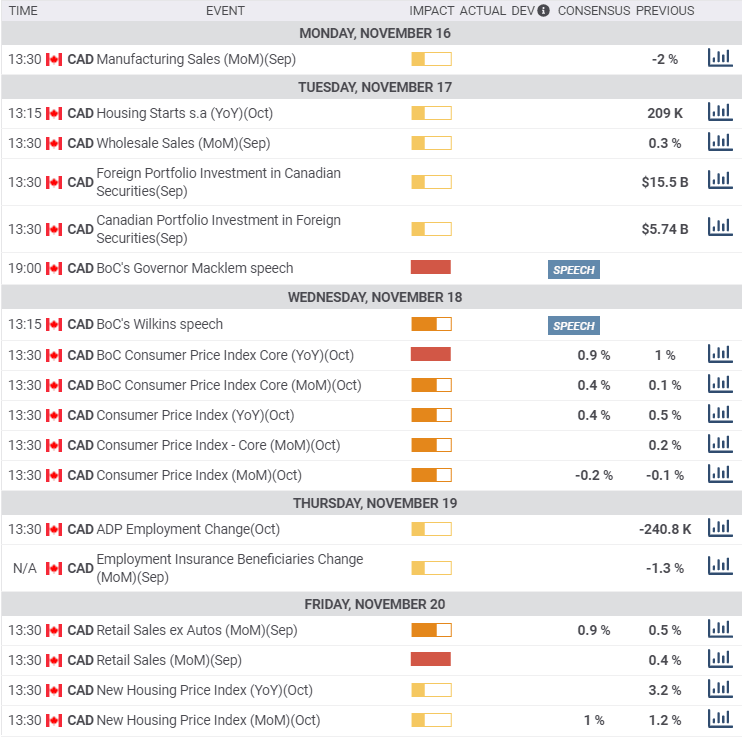

Canadian statistics November 16-November 20

Manufacturing Sales rose 1.5% in September as expected reversing the 1.4% decline in August. Housing Starts were 214,900 on the year in October, a bit below the 222,000 forecast, though up from September's 208,700. Starts have averaged 228,540 from June to October. Wholesales Sales rose 0.9% in September, more than double the 0.4% prediction and three times the August rate.

The Consumer Price Index climbed 0.4% in October and 0.7% on the year. The forecasts had been 0.2% and 0.4%. The Bank of Canada Core Consumer Price index for the month was as expected at 0.4% and 1% for the year on a 0.9% projection.

Retail Sales rose 1.1% in October, far better than the 0.2% forecast and August's 0.4% gain. Retail Sales ex Autos increased 1% also on a 0.2% expectation. They rose 0.5% in September. The preliminary reading for October was 1.1%.

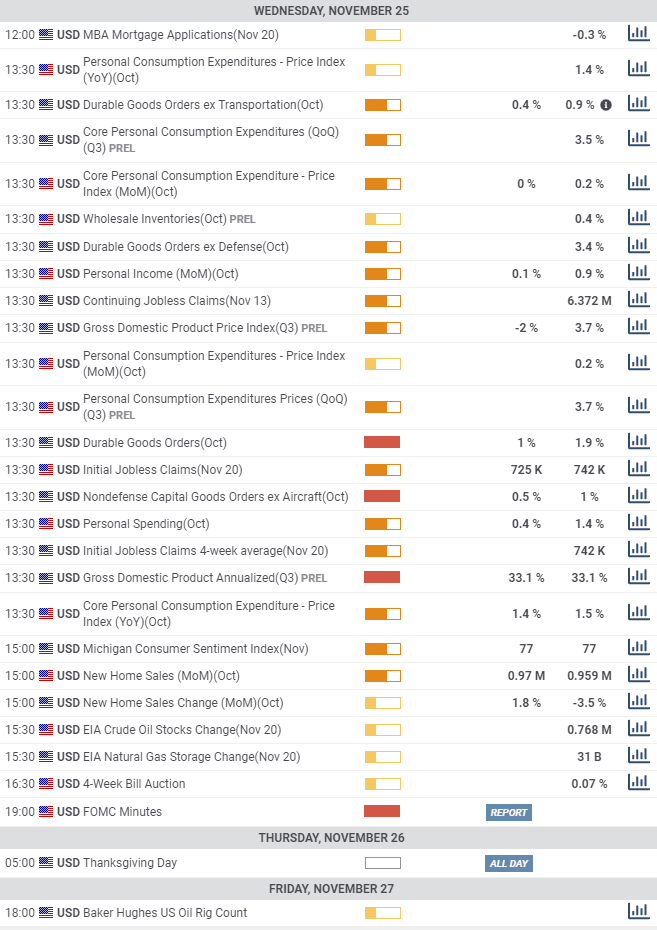

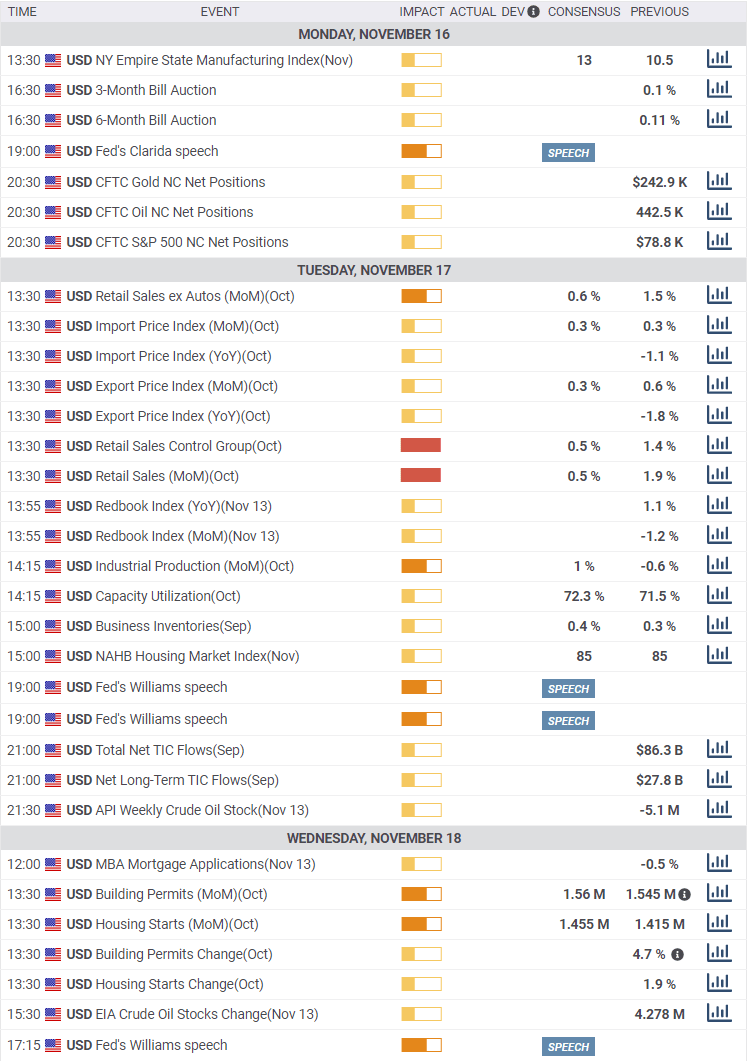

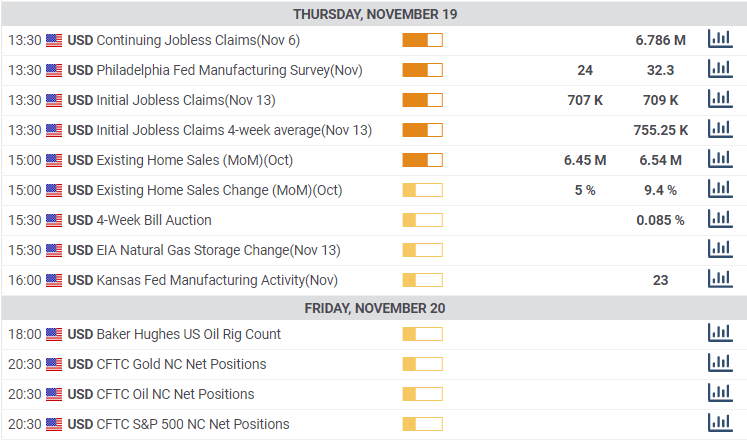

US statistics November 16-November 20

American economic information was also limited and overshadowed by the economic impact of the pandemic.

Retail Sales in October missed expectation after five strong months, rising 0.3% on a 0.5% prediction and September was revised to 1.6% from 1.9%. Sales ex-Autos rose 0.2% with a 0.6% projection and September's result was reduced to 1.2% from 1.5%. The Control Group added 0.1% on a 0.5% forecast and its prior was revised to 0.9% from 1.4%.

Industrial Production added 1.%% in October, just about the 1.0% forecast while September was revised to -0.4% from-0.6%. Capacity Utilization rose to 72.8% from 72% in October.

The home construction industry remained strong. Building Permits were unchanged at 1.545 million in October, and Housing Starts rose to 1.53 million from1.459 million annualized.

Initial Jobless Claims climbed to 742,000 in the November 13 week from 711,000. It was the first rise in nine weeks and underlined concerns that the pandemic restrictions imposed in several states are driving layoffs. Continuing Claims dropped to 6.372 million in the November 6 week from 6.801 million prior.

Existing Home Sales, 90% of the US market, rose 4.3% in October to an annualized rate of 6.85 million. It was the highest rate of sales since the housing bubble of over a decade ago.

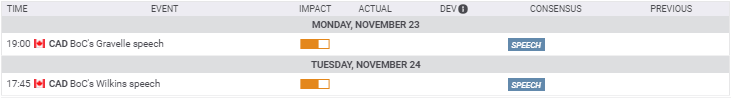

Canada statistics November 23-November 27

There are no statistics this week

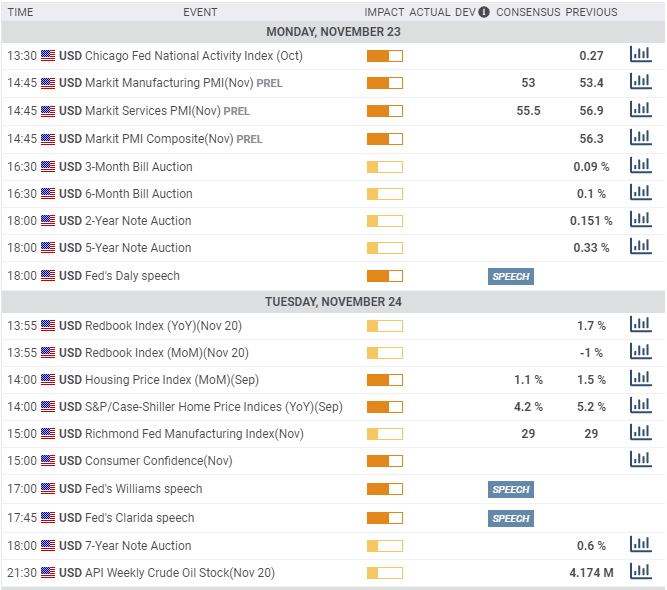

US statistics November 23-November 27

In the slew of US data that arrives on Wednesday, doubled for the Thanksgiving Day holiday that follows on Thursday, Initial Jobless Claims take precedence. Last week's unexpected rise of 31,000 may have been the first notice of a new round of layoffs from the business restrictions imposed in many states or it may be normal variation. If it is seconded by another rise, look for markets to take it out on the dollar.

Markit's Manufacturing and Services PMI for November are expected to confirm that sentiment is marking time--53 in manufacturing from 53.4 in October and 55.5 in services from 56.9.

Durable Goods Orders for October are expected to rise 1% after September's 1.9% increase. Durable Goods Orders ex Transportation should rise 0.4% following 0.9% in September. Nondefense Capital Goods Orders ex aircraft are forecast to add 0.5% in October. They rose 1% in September.

Personal Income in October is expected to gain 0.1% after 0.9% prior and Personal Spending to rise 0.4% following the 1.4% increase in September.

Initial Jobless Claims in the November 20 week are forecast to fall to 725,000 from 742,000. Continuing Claims were 6.372 million in the week of November 13.

Third quarter annualized GDP is expected to be unchanged at 33.1% in its final revision.

New Home Sales should rise 1.8% in October to an annual rate of 970,000.

The Personal Consumption Expenditure Price Index rose 0.2% in September and 1.4% on the year. The Core PCE Index is expected to be flat on the month in September and 1.4% on the year.

USD/CAD technical outlook

Technical indicators point lower, but none are convincing for a sustained move. The Relative Strength Indicator tiled higher on Friday to 44.22, but it is still a weak sale. All three moving averages are above the market. The 21-day average at 1.3139 fronts resistance at 1.3150. The 100-day at 1.3256 leads the line at 1.3275 and the 200-day is irrelevant at 1.3534.

The descending channel, the fewer and weaker support lines and the lack of a competing scenario are the main reasons for the weak bias down.

Resistance: 1.3150; 1.3200; 1.3275; 1.3330

Support: 1.3050; 1.3000; 1.2955

USD/CAD Forecast Poll

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Joseph Trevisani

FXStreet

Joseph Trevisani began his thirty-year career in the financial markets at Credit Suisse in New York and Singapore where he worked for 12 years as an interbank currency trader and trading desk manager.