USD/CAD Price Forecast: Struggles near weekly low ahead of Canadian jobs report

- USD/CAD drifts lower as the USD languishes near a two-week low amid rising Fed rate cut bets.

- Bearish Oil prices and trade uncertainties undermine the Loonie, offering support to the major.

- Traders now look forward to the release of Canadian employment details for a fresh impetus.

The USD/CAD pair attracts fresh sellers on Friday and slides back closer to a one-week low during the first half of the European session. The US Dollar (USD) continues with its struggle to gain any meaningful traction amid dovish Federal Reserve (Fed) expectations and turns out to be a key factor exerting downward pressure on the currency pair. Traders ramped up their bets that the US central bank will resume its rate-cutting cycle in September following the disappointing release of the US Nonfarm Payrolls (NFP) report last week, which pointed to a sharp deterioration in labor market conditions.

Furthermore, the US ISM Services PMI released on Tuesday underscored the ongoing drag on the economy amid the uncertainty surrounding US President Donald Trump's erratic trade policies. In fact, Trump signed an executive order on Wednesday imposing an additional levy on Indian imports as "punishment" for buying oil from Russia, taking the total tariffs to 50%. Earlier this week, Trump announced that US tariffs on semiconductor and pharmaceutical imports will be imposed within the next week or so. This, along with questions about the Fed's independence, keeps the USD bulls on the defensive.

Trump on Thursday nominated Council of Economic Advisers Chairman Stephen Miran to serve out the rest of Fed Governor Adriana Kugler's term until January 31, 2026. Moreover, Trump has shortlisted four candidates to replace Fed Chair Jerome Powell. Apart from this, a generally positive tone around the equity markets is seen undermining the Greenback's safe-haven demand and weighing on the USD/CAD pair. That said, a combination of factors might keep a lid on any meaningful appreciation for the Canadian Dollar (CAD) and limit deeper losses for the currency pair, warranting caution for bearish traders.

Crude Oil prices languish near a two-month low amid concerns that higher US tariffs would hamper the global economy and dent fuel demand. This might hold back traders from placing aggressive bullish bets around the commodity-linked Loonie. Apart from this, persistent trade-related uncertainties could undermine the Canadian Dollar (CAD) and offer some support to the USD/CAD pair. Trump last week lifted the tariff rate on Canada from 25% to 35%. Adding to this, the Bank of Canada's (BoC) dovish tilt should cap the CAD as traders keenly await the release of Canadian monthly employment details.

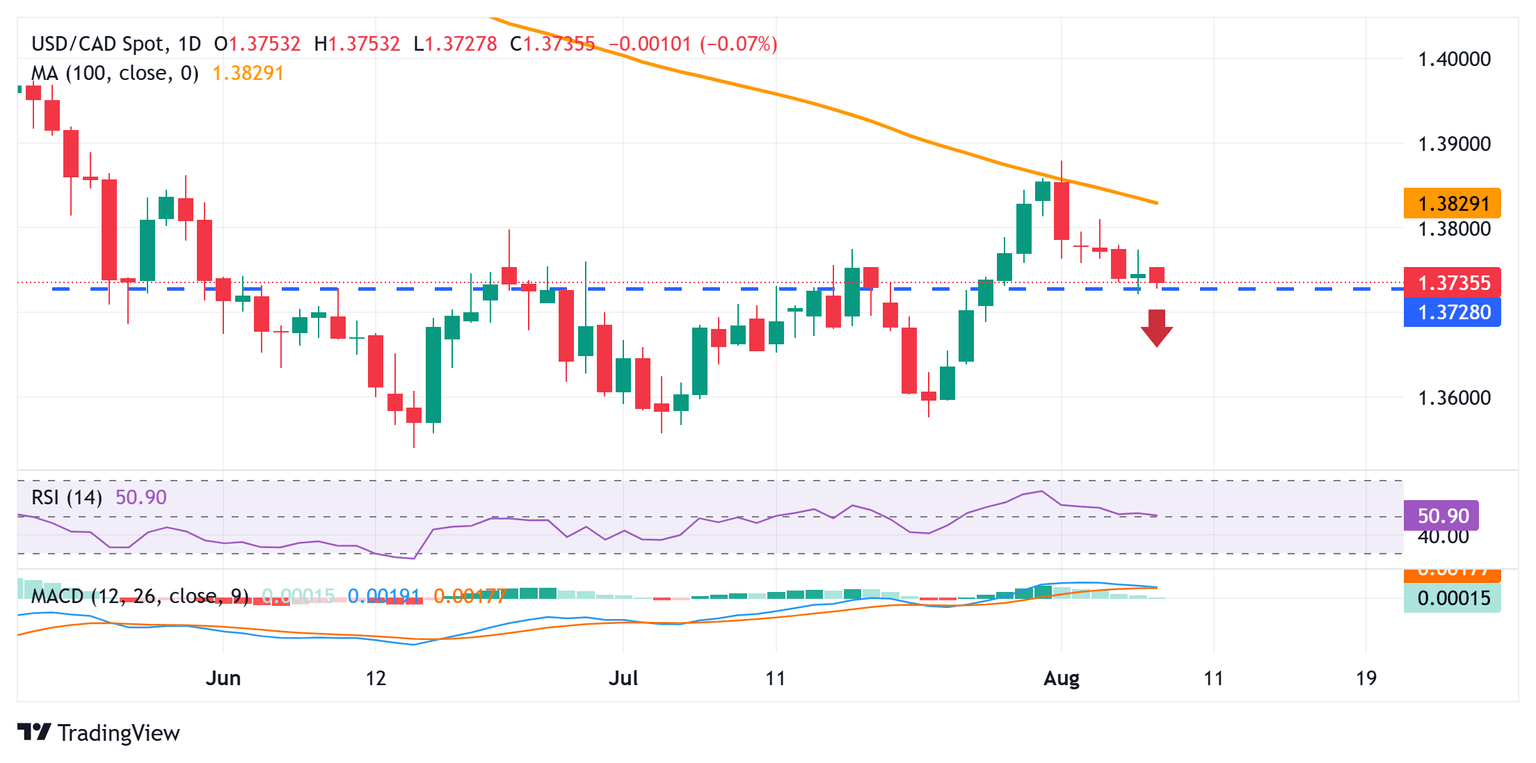

USD/CAD daily chart

Technical Outlook

The USD/CAD pair last week failed to find acceptance above the 100-day Simple Moving Average (SMA), and the subsequent slide favors bearish traders. However, neutral oscillators on the daily chart make it prudent to wait for some follow-through selling before positioning for deeper losses. In the meantime, weakness below the weekly low, around the 1.3720 area, could find some support near the 1.3700 round figure. A convincing break below the latter will reaffirm the negative bias and make spot prices vulnerable to accelerate the fall towards mid-1.3600s. The downward trajectory could extend further towards the 1.3600 round figure en route to the year-to-date low, around the 1.3540 region touched in June.

On the flip side, the overnight high, around the 1.3775 region, could act as an immediate hurdle ahead of the 1.3800 round figure. This is closely followed by the 100-day SMA barrier, currently pegged near the 1.3825 area, above which the USD/CAD pair could retest last week's swing high, around the 1.3875-1.3880 region. Some follow-through buying, leading to a subsequent strength beyond the 1.3900 mark, might shift the bias in favor of bullish traders. Spot prices might then climb to the next relevant hurdle near the 1.3950 region before aiming to reclaim the 1.4000 psychological mark.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Haresh Menghani

FXStreet

Haresh Menghani is a detail-oriented professional with 10+ years of extensive experience in analysing the global financial markets.