US Dollar Forecast: Under pressure on US economy jitters

- The US Dollar Index retreated to four-month lows.

- Lack of direction in US tariffs remained at centre stage.

- US Nonfarm Payrolls came in below estimates in February.

The resurgence in selling pressure punished the US Dollar (USD) severely this week.

That said, the Greenback saw its downside impulse gather extra steam over the past few days, prompting the US Dollar Index (DXY) to break below the key support at 104.00 for the first time since early November and nearly completely fade the so-called “Trump trade.”

The Greenback’s pronounced decline came amid choppy performance in US yields at the short end and in the belly of the curve, while the long end managed to secure a decent recovery.

Tariff zig-zag and inflation

As expected, US tariffs remained at the centre of debate once again this week.

Following 25% tariffs on Mexican and Canadian imports kicking in on March 4, a couple of days later President Donald Trump said that imports from those countries under the United States-Mexico-Canada Agreement (USMCA) would be paused until April 2.

In the meantime, there were no changes to the implementation of an additional 10% tariff on US imports of Chinese goods (bringing the total to 20%), nor were there any further announcements regarding tariffs on imports from the European Union (EU), which Trump had threatened would be around 25%.

As discussed before, it is important to differentiate between the first-round and second-round effects of tariff implementation.

In the first instance, the imposition of US tariffs on foreign imports could likely have an inflationary impact, eventually leading US consumers to pay more for those goods; in this "one-off" scenario, the Fed would be unlikely to modify its monetary policy.

However, if this trade policy persists or deepens over time, it could spark the emergence of second-round effects, where producers and retailers might increase prices in a context of dwindling competition or simply to extract additional profit.

The consequences of this stance could affect demand, potentially leading to more serious impacts on the broader economy — such as reduced economic activity, lower employment, and the resurgence of deflationary pressure — prompting the Fed to consider more serious measures.

US economy: Is everything OK?

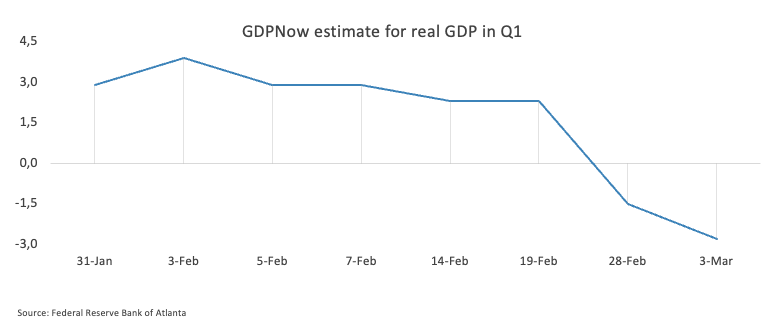

The recent decline in the US Dollar signals a slowdown in key economic fundamentals, sparking renewed concerns among market observers about a possible economic stumble.

Investor confidence has waned, sentiment indicators have slipped, and unexpected reversals in January — such as a significant drop in US Retail Sales, a contraction in personal spending, and further cooling of the labor market, as reflected in this week’s ADP and NFP data — have only intensified the unease.

Meanwhile, inflation remains stubbornly high, consistently surpassing the Fed's target, according to both the Consumer Price Index (CPI) and the Personal Consumption Expenditures (PCE) report.

Steady as she goes: The Fed's careful approach

In a robust vote of confidence for the US economy, the Federal Reserve (Fed) opted to hold interest rates steady between 4.25% and 4.50% during its January 29 meeting — pausing a streak of three consecutive cuts since late 2024. Despite the upbeat outlook, policymakers flagged "somewhat elevated" inflation as a lingering challenge, hinting that headwinds may still be on the horizon.

During his semi-annual testimony before Congress, Fed Chair Jerome Powell underscored that there was no pressing need to lower rates further. He pointed to a strong economy, historically low unemployment, and inflation that remains stubbornly above the 2% target as key reasons for maintaining the current stance.

In a series of remarks this week, Fed officials painted a complex picture of the US economy’s outlook amid ongoing challenges and uncertainty.

St. Louis Fed President Alberto Musalem expressed confidence that the US economy would keep expanding throughout the year, even as he acknowledged that softer-than-expected consumption and housing data — along with feedback from business contacts — had raised concerns about potential growth risks.

Over at the New York Fed, President John Williams noted that while Trump administration tariffs were likely to contribute to rising price pressures, significant uncertainty remained over how these measures would eventually play out. Meanwhile, Philadelphia Fed President Patrick Harker warned that trouble might be brewing. He observed that although the economy appeared robust on the surface, early signs of stress in the consumer sector and mounting risks to the inflation outlook could foreshadow deeper challenges.

Fed Governor Christopher Waller added his perspective on monetary policy. He suggested that, given the ongoing easing of inflation, the case for interest rate cuts later in the year was growing stronger, though he dismissed the possibility of a rate cut this month.

Echoing the theme of uncertainty, Atlanta Fed President Raphael Bostic described the current policy environment under the Trump administration as placing the US economy in "incredible flux." Bostic predicted that the Fed would likely need to wait until late spring or summer to gain enough clarity for any decisive action on interest rates.

Finally, in a signal of his cautious stance, Fed Governor Michelle Bowman indicated that she might increasingly rely on job market indicators to guide future policy decisions.

Together, these insights underscore optimism tempered by caution — a recognition that while growth is expected to continue, multiple headwinds and uncertainties could shape the Fed's policy choices in the months ahead.

Surge in speculation puts the Greenback under pressure

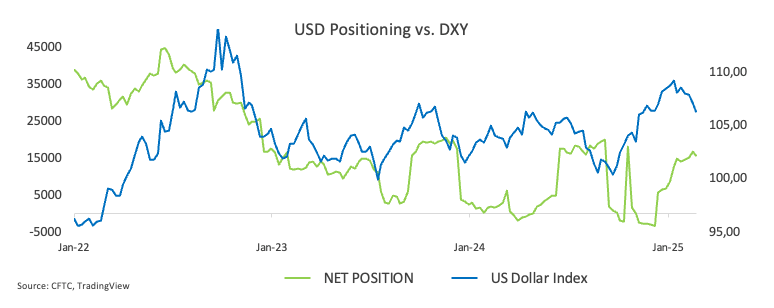

According to the CFTC Positioning Report for the week ending February 25, speculators trimmed their long bets on the US Dollar, breaking a four-week streak of net long increases.

It was reported that this corrective move coincided with a rise in gross short positions. Observers noted that, although long positions remain crowded, the currency is now more vulnerable to any negative headlines, which could potentially spark a rapid unwind and intensify any correction in the index.

Beyond today: What’s in store for the US Dollar

All eyes are on next week’s inflation data with the Consumer Price Index (CPI) taking centre stage, closely followed by Producer Prices and further labour market insights from the upcoming JOLTs Job Openings report.

Meanwhile, Fed rate setters will remain silent during the “blackout” period leading up to the March 19 FOMC meeting.

DXY analysis: From momentum shifts to essential price levels

From the technical perspective, it is worth noting that the index broke below the key 200-day SMA, prompting a shift in the outlook to a more bearish one. Secondly, the current oversold levels of the US Dollar could spark a technical rebound in the short-term horizon.

Having said that, if sellers maintain control, the index may find support first at the 2025 bottom of 103.45 reached on March 7, closely followed by the November 2024 trough of 103.37, and eventually the 2024 bottom of 100.15 hit on September 27, all prior to the psychological 100.00 threshold.

Occasional recovery attempts could motivate DXY to challenge the weekly high of 107.66 reached on February 28, an area reinforced by the provisional 55-day Simple Moving Average (SMA). Up from here lies the February top of 109.88 (set on February 3) and then the YTD peak of 110.17 from January 13.

Looking at the broader picture, while below the key 200-day SMA at 104.99, further losses should remain on the cards.

Meanwhile, momentum indicators are offering mixed signals. The daily Relative Strength Index (RSI) entered the oversold zone around 26, while the Average Directional Index (ADX) bounced past 22, suggesting that the overall trend could be gathering strength.

US Dollar FAQs

The US Dollar (USD) is the official currency of the United States of America, and the ‘de facto’ currency of a significant number of other countries where it is found in circulation alongside local notes. It is the most heavily traded currency in the world, accounting for over 88% of all global foreign exchange turnover, or an average of $6.6 trillion in transactions per day, according to data from 2022. Following the second world war, the USD took over from the British Pound as the world’s reserve currency. For most of its history, the US Dollar was backed by Gold, until the Bretton Woods Agreement in 1971 when the Gold Standard went away.

The most important single factor impacting on the value of the US Dollar is monetary policy, which is shaped by the Federal Reserve (Fed). The Fed has two mandates: to achieve price stability (control inflation) and foster full employment. Its primary tool to achieve these two goals is by adjusting interest rates. When prices are rising too quickly and inflation is above the Fed’s 2% target, the Fed will raise rates, which helps the USD value. When inflation falls below 2% or the Unemployment Rate is too high, the Fed may lower interest rates, which weighs on the Greenback.

In extreme situations, the Federal Reserve can also print more Dollars and enact quantitative easing (QE). QE is the process by which the Fed substantially increases the flow of credit in a stuck financial system. It is a non-standard policy measure used when credit has dried up because banks will not lend to each other (out of the fear of counterparty default). It is a last resort when simply lowering interest rates is unlikely to achieve the necessary result. It was the Fed’s weapon of choice to combat the credit crunch that occurred during the Great Financial Crisis in 2008. It involves the Fed printing more Dollars and using them to buy US government bonds predominantly from financial institutions. QE usually leads to a weaker US Dollar.

Quantitative tightening (QT) is the reverse process whereby the Federal Reserve stops buying bonds from financial institutions and does not reinvest the principal from the bonds it holds maturing in new purchases. It is usually positive for the US Dollar.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.