US dollar index rises as Wall Street meltdown accelerates

American equity futures declined on Monday morning as the crisis in Ukraine escalated during the weekend. Vladimir Putin’s military continued shelling many Ukrainian cities as it continued facing fierce opposition from Ukrainian soldiers. As a result, investors are worried about the impact of this crisis on companies' growth and margins as the cost of doing business escalates. For example, the prices of key commodities like oil, wheat, palladium, and nickel has risen sharply in the past few days. Some of the top companies to watch this week will be software-related, which will publish their earnings. They include SentinelOne, GitLab, SmartSheet, and PagerDuty.

The price of crude oil and natural gas remained at elevated levels on Monday morning as the crisis in Ukraine escalated. On Sunday, the Russian military attacked a Ukrainian military base close to Poland. That attack came shortly after Russian officials warned the US against equipment shipments to Ukraine. Therefore, analysts warn that Russia will continue its assault in the country this week. With OPEC members like Saudi Arabia not cooperating, there is a likelihood that demand for oil will outstrip supplies and push energy prices higher.

The economic calendar will be significantly muted today, with no major data expected. The only important event will be a meeting of EU members, who will deliberate on the crisis in Ukraine. Another key report will be from Switzerland, where a panel of economists will provide a forecast of the country’s recovery. At the same time, investors will be looking at the upcoming interest rate decision by the Federal Reserve. Most analysts expect that the Fed will deliver a hawkish statement considering that the country’s inflation is surging.

EUR/USD

The EURUSD pair continued its bearish trend on Monday morning as demand for the US dollar rose. It is trading at 1.0900, which is lower than last week’s high of 1.1116. On the four-hour chart, the pair has managed to move below the 23.6% Fibonacci retracement level. It has also crashed below the 25-day and 50-day moving averages. At the same time, the Relative Strength Index and the MACD are pointing lower. Therefore, the pair will likely continue falling as bears target the next key support at 1.0800.

USD/CHF

The USDCHF pair has been in a strong bullish trend in the past few days. And on Friday, the pair surged to a multi-month high of 0.9347 as demand for the greenback rose. On the four-hour chart, the pair is along the upper side of the Bollinger Bands. It has also moved above the 25-day and 50-day moving averages. The Relative Strength Index and the MACD have pointed upwards. Therefore, the pair will likely keep rising as bulls target the next resistance at 0.9500.

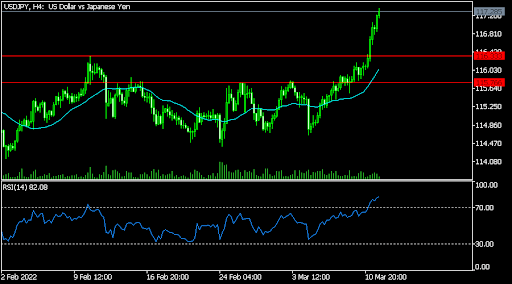

USD/JPY

The USDJPY also jumped sharply as dollar demand rose. It rose to 117.28, which was significantly higher than this month’s low of 114.70. On the four-hour chart, the pair has moved above the key resistance level at 116.33, which was the highest level this week. It has moved above the 25-day and 50-day moving averages. Therefore, the pair will likely keep rising this week.

Author

OctaFx Analyst Team

OctaFX

OctaFX is a market-leading forex broker, providing personalised forex brokerage services to customers in over 100 countries worldwide.