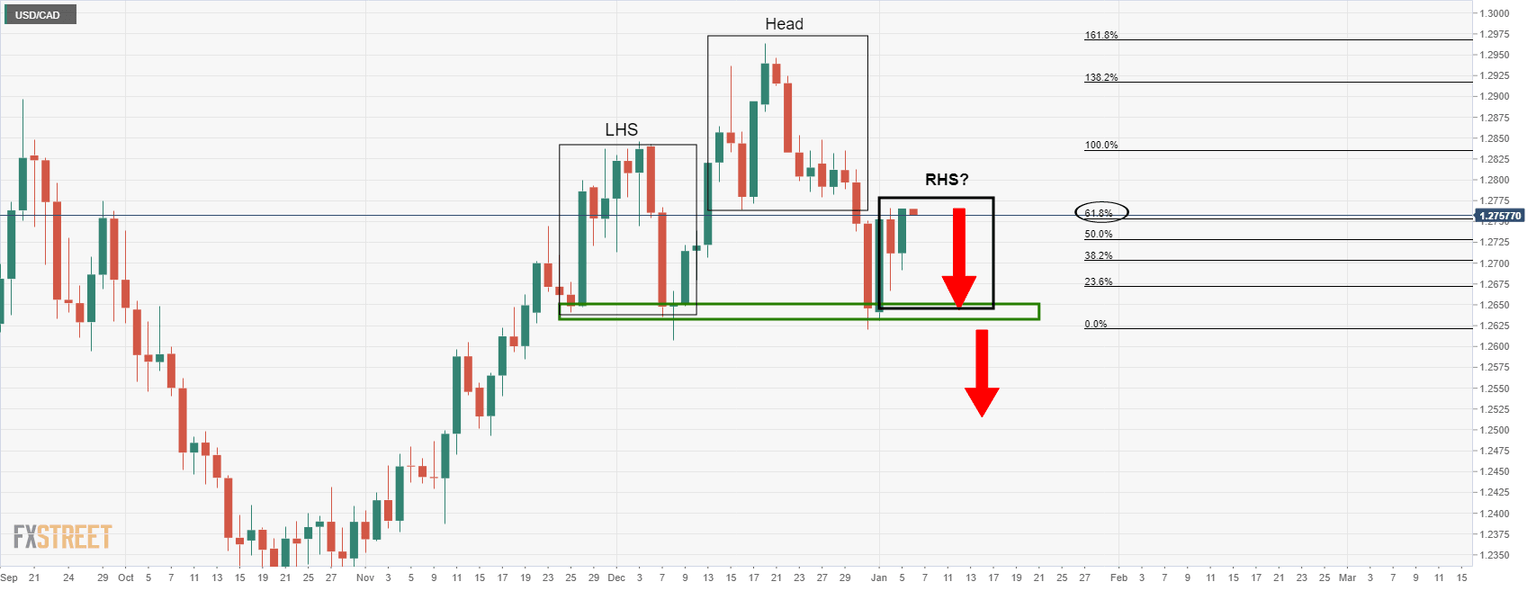

The Chart of the Week: USD/CAD has complied with the medium term bearish bias

- USD/CAD bears are in playtesting critical support territory

- On a break of the head & shoulders, the downside is all to play for.

As per prior analysis, USD/CAD is shaping up to be a medium-term play following a classic visit and retest of prior highs fortifying a downside bias as follows:

USD/CAD daily chart, prior analysis

As illustrated above, the head and shoulders were in the making...

In the prior sessions, the price has mitigated the imbalance of price and subsequently, the bears have moved in and driven the price into daily support. This makes for a compelling scenario.

USD/CAD H4 chart

With a bias to the downside below the counter trendline, we have a bearish structure. above the local support. The price would be expected to move into the 1.27 area prior to a sell-off.

USD/CAD H1 chart

From a shorter-term perspective, the 61.8% Fibo on the hourly char aligns within a prior structure that could well draw in the price prior to a downside correction. The bearish playbook also rhymes with positioning considering net speculators’ CAD net positions remain in positive ground for several straight weeks following the hawkish tone of the BoC.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.