Silver prices: Bank of Japan had a suprise up their sleeve

Is the era of ultra-dovish monetary policy in Japan ending? Maybe, but the Bank of Japan remains cautious; it tightens without tightening.

The Bank of Japan surprised the markets on a hawkish side. No, it didn’t raise interest rates. Instead, it decided to review its yield curve control policy and widened the trading band for the 10-year yield on the Japanese Treasuries. To be more specific, the BoJ expanded the 25 basis point band around its 0% target into 50 basis points. It means that the market’s long-term yields are allowed to move 50 basis points on either side of the target now. As a result, the 10-year yields on Japan’s government bonds jumped from the previous cap of 0.25% to 0.46%.

Governor Kuroda said that the change was introduced to improve bond market functioning, and it’s not an interest rate hike. But the net effect is the increase in the interest rates, just as the BoJ would hike them. Nevertheless, officially, the BoJ remains very dovish. However, the shift could signal slow unwind of the yield curve control and ultra-low interest rates.

Yen Surged, Dollar Declined

In reaction to the Bank of Japan’s surprising shift, the yen strengthened against its major peers by over 3%. As American-Japanese yield differentials improved modestly, the yen surged to a four-month peak against the dollar. The USD/JPY declined from above 137 to about 131. Euro and sterling also slid significantly against the yen. The US stock market declined initially after the news from Japan but managed to rebound later. The price of gold jumped again above $1,800.

Implications for Silver

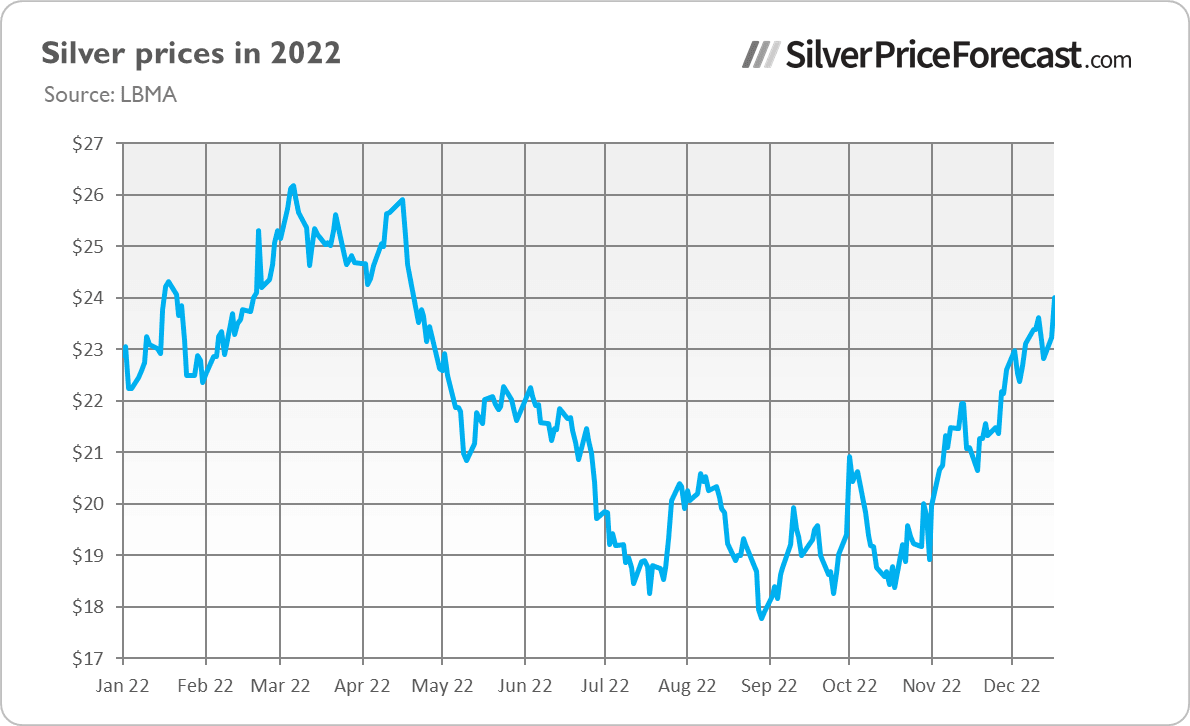

What do the BoJ’s last decisions imply for the silver market? Well, a stronger yen is fundamentally positive for the precious metals. There is a positive correlation between yen and gold – and, thus, also between yen and silver. It makes sense that when the yen strengthens, the US dollar weakens, which supports the precious metals market. Indeed, the price of silver increased after the BoJ’s surprising tweak, as the chart below shows.

Compared to other major central banks, the Bank of Japan remained very dovish (although inflation reached 3.7% in October). The recent change could signal the central bank’s dissatisfaction with the recent depreciation of the yen or the upcoming normalization of monetary policy in Japan. Either way, it should fundamentally support the yen and precious metals against the dollar.

Want free follow-ups to the above article and details not available to 99%+ investors? Sign up to our free newsletter today!

Author

Arkadiusz Sieroń

Sunshine Profits

Arkadiusz Sieroń received his Ph.D. in economics in 2016 (his doctoral thesis was about Cantillon effects), and has been an assistant professor at the Institute of Economic Sciences at the University of Wrocław since 2017.