Gold: The king remains in place, but other precious metals steal the show

While Gold prices continue to break records, its dominance of the precious metals market is beginning to be challenged. A new dynamic is at work: the spotlight is increasingly turning to previously long-neglected metals such as Silver, Platinum, Palladium and Copper.

Driven by a combination of industrial, financial and geopolitical factors, these precious metals are sometimes outperforming Gold, a sign of a broader rebalancing in the universe of safe-haven assets.

Why are certain hitherto undervalued metals suddenly attracting investors' attention? What do the pressures on physical stocks reveal? And above all, are we at the beginning of a silent rewriting of the precious metals hierarchy?

A less favourable context for Gold

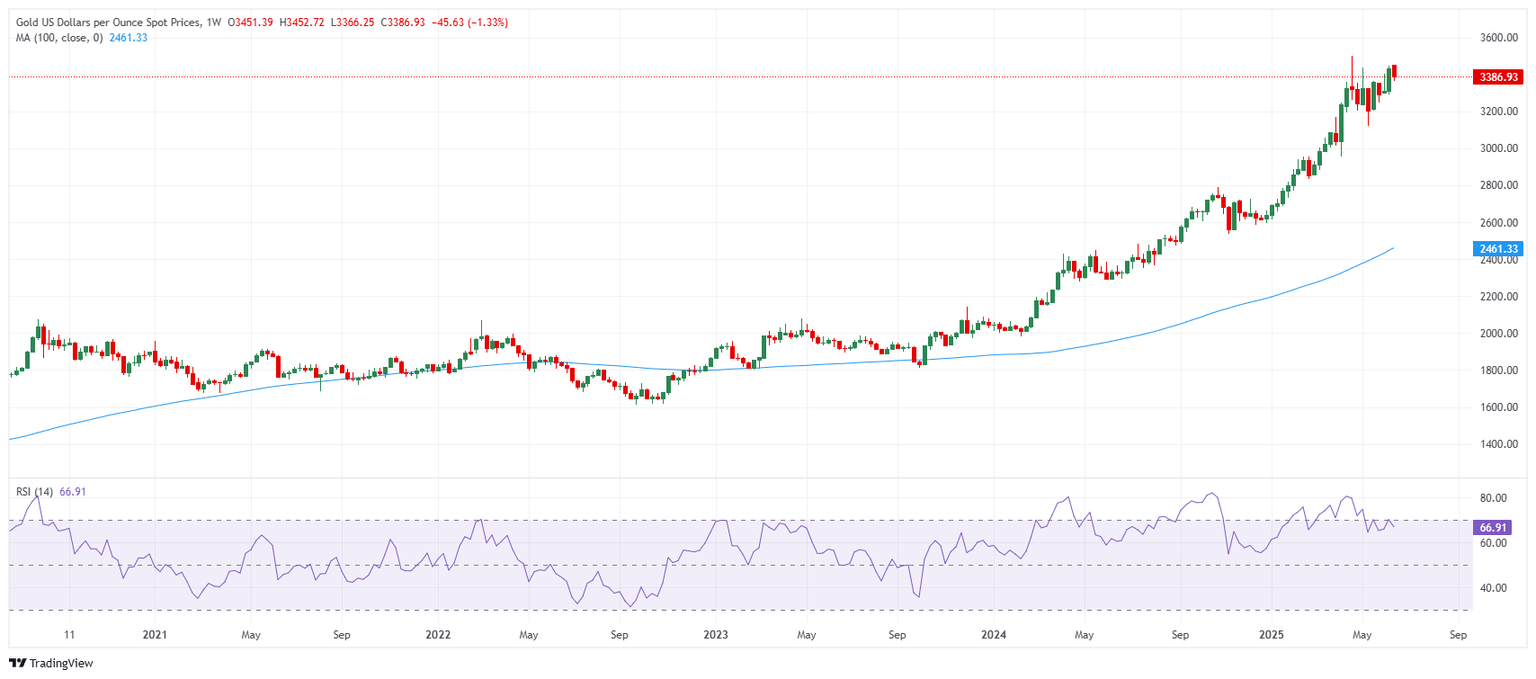

Gold retains its safe-haven status. Faced with volatile markets, tensions in the Middle East, a weak US Dollar (USD) and an increasingly risky fiscal policy in the United States, investors – particularly central banks – continue to hoard the yellow metal. Since the beginning of the year, the price of Gold has soared by over 30%, flirting with $3,500 a troy ounce.

Investment flows into Gold-backed ETFs, speculative positioning on the COMEX and central bank purchases bear witness to this structural demand.

"Gold is probably the best thing that we added to our portfolios in the middle of last year. It's both helping us when we see rising tensions in the Middle East, but also weighing against debt fears, inflation fears, etc.", noted Mark Andersen, co-head of global asset allocation at UBS.

But this rally now seems to have reached a plateau. Gold is now trading at record levels, limiting its immediate upside potential. Against this backdrop, some investors are turning to more affordable – and more explosive – alternatives.

Gold price chart. Source: FXStreet.

While Gold price consolidates, other precious metals have accelerated. Silver, Platinum and Copper are also up by nearly 30% this year.

Silver: explosive leverage to watch

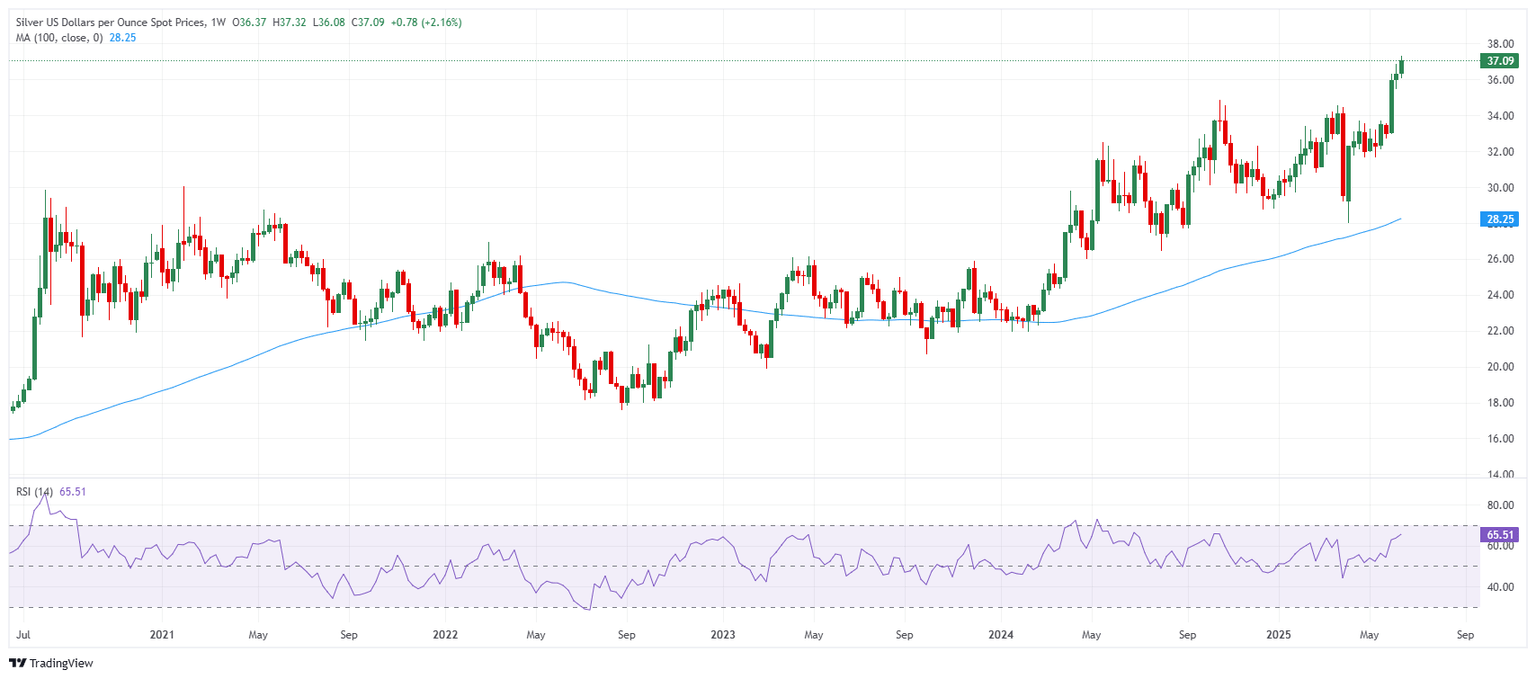

Silver is not to be outdone. With an increase of over 29% since the start of the year, the metal recently broke through the $37/oz barrier, a threshold not reached for over a decade. The dual nature of the metal, both monetary and industrial, makes it particularly sensitive to market tensions.

Silver-backed ETFs are seeing an influx of capital, while industrial demand for solar, electronics and semiconductors remains robust.

Nevertheless, the physical market is disrupted, particularly in London, where inventories are in freefall.

If Gold continues to consolidate, Silver could quickly take over.

Silver price chart. Source: FXStreet.

Platinum: the underdog back in the limelight

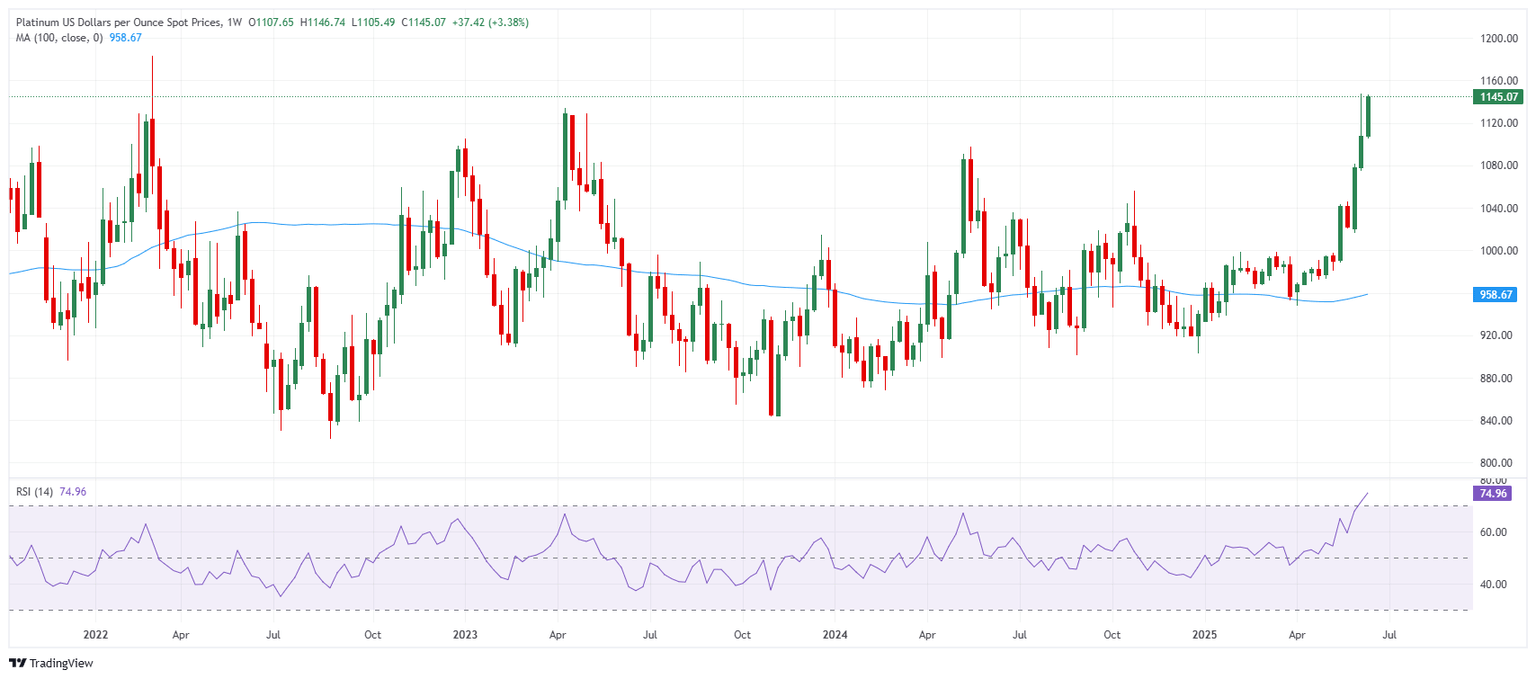

Platinum surprised everyone this year. Its performance now exceeds that of Gold, with a year-to-date rise of over 35%.

This metal, essential for catalytic converters in internal combustion engines, is benefiting from the slowdown in the transition to electric vehicles, particularly in China. Platinum, long undervalued, is once again a strategic asset, and demand for it is rising.

In addition, demand for Platinum jewelry in China jumped by 50% year-on-year, according to Barrons, citing a report by the World Platinum Investment Council. The rise has been helped in particular by increasing substitution for Gold, which has become too expensive.

At the same time, supply is declining. South African production, which accounts for over half the world's supply, fell by 12% in the first quarter, according to Bank of America.

Furthermore, Platinum-backed ETFs are in high demand, further drying up the physical market. A veritable "short squeeze" appears to be underway, amplified by the low liquidity of the Platinum market, whose size is minuscule compared to that of Gold.

"Platinum is incredibly cheap relative to Gold, and Platinum supply is very constrained", noted John Ciampaglia, CEO at Sprott Asset Management, according to Barrons.

Platinum price chart. Source: FXStreet.

Copper: from industrial metal to strategic barometer

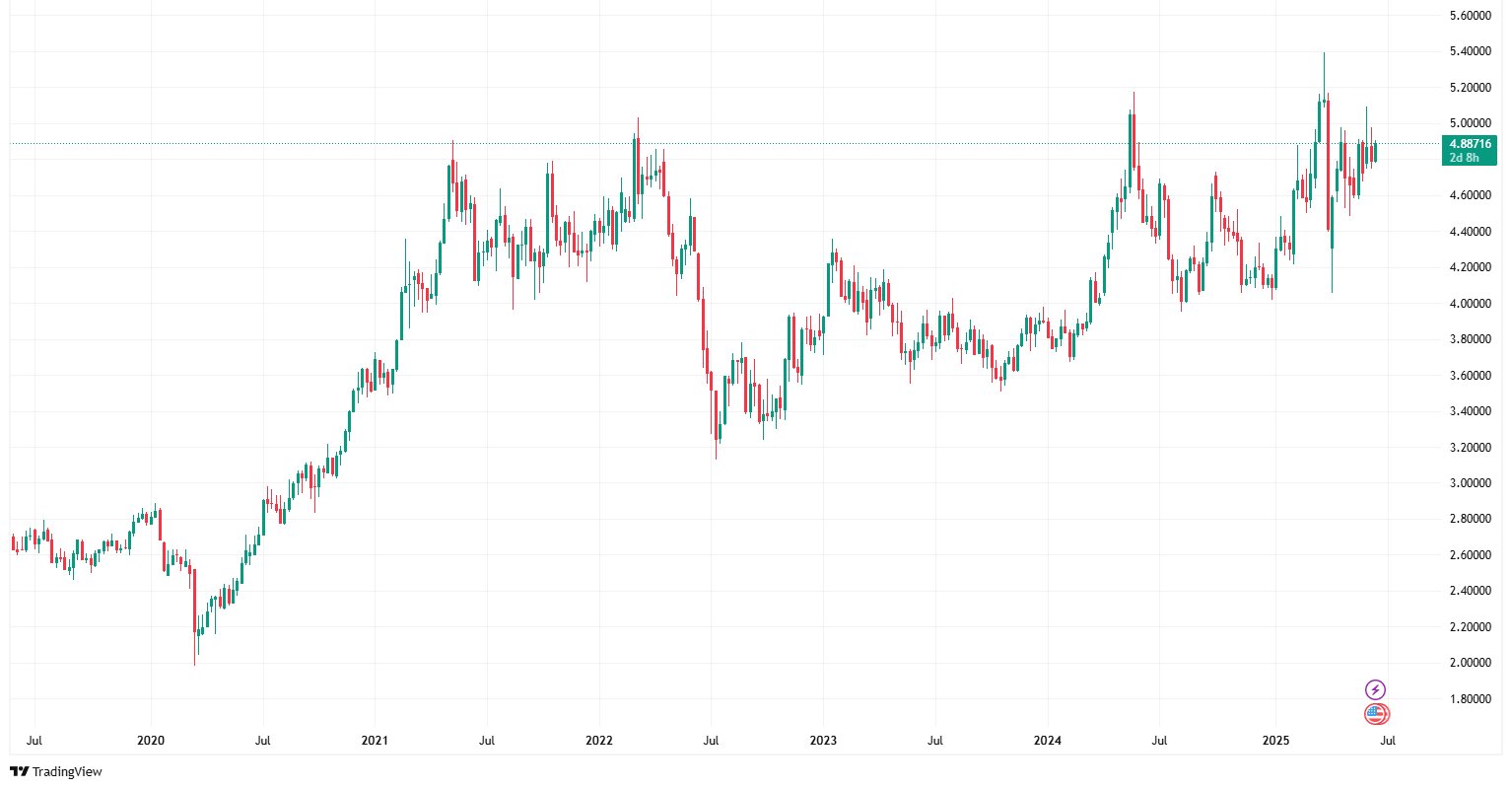

Copper is not a precious metal in the strict sense of the term, but it plays a central role in the current dynamic. Used extensively in electrical infrastructure, electric vehicles and the energy transition, it is also attracting the attention of Commodity Trading Advisor (CTA) funds, which are now heavily exposed to the upside.

Its recent rise reflects both fears of a structural imbalance between supply and demand, fuelled by Sino-American trade tensions, and a return of speculative flows.

Indeed, the fragmentation of supply chains, the threat of new customs barriers and historically low stocks on the London Metal Exchange (LME) have pushed prices above $10,000 per tonne.

Copper is thus becoming a leading indicator of macroeconomic sentiment, and a growth driver for investors seeking exposure to "real assets".

"CTA positioning is now extremely skewed to the upside in LME Copper, with no scenario likely to contribute to selling activity. Fears of a stock-out in Copper will re-emerge unless physical makes its way back into the LME," noted TD Securities.

Copper price chart. Source: TradingView.

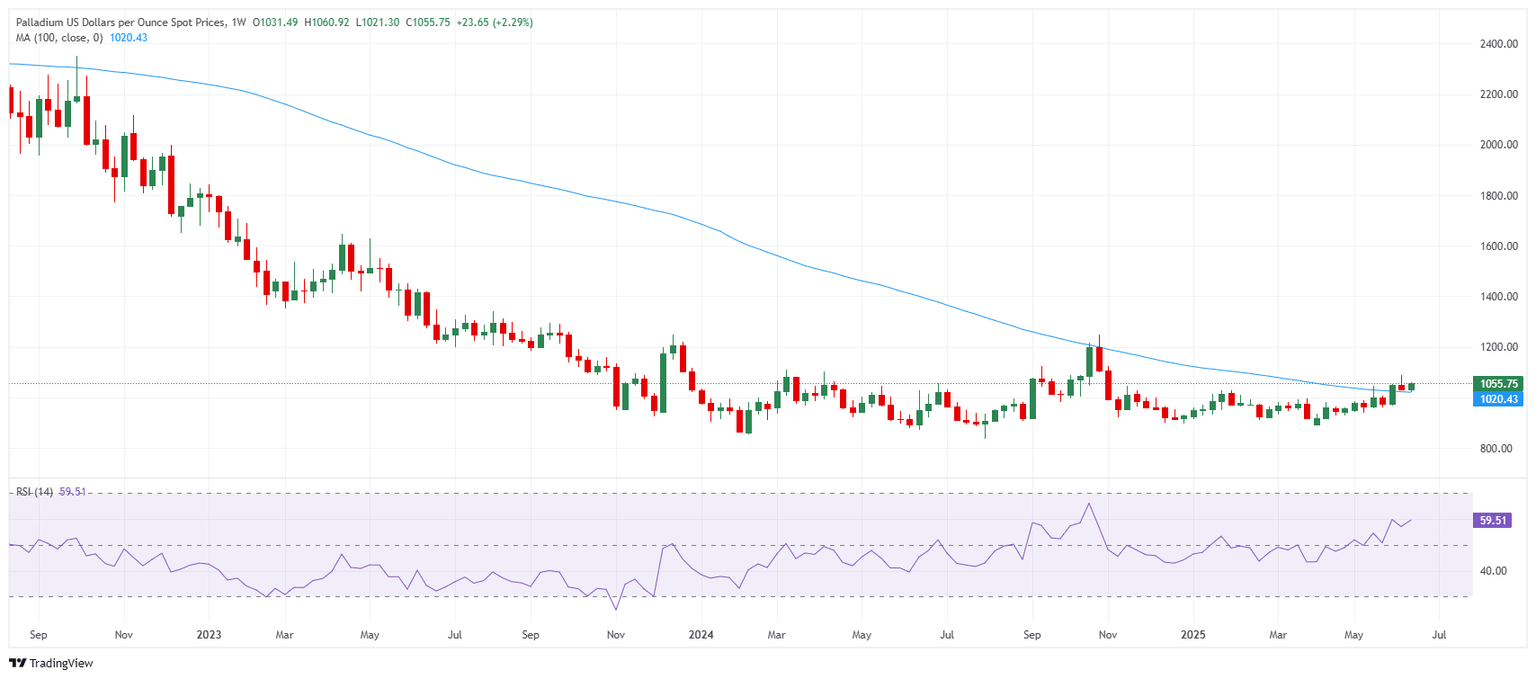

Palladium: a discreet deficit, a possible awakening

Palladium, often ignored in recent months, is also enjoying a significant recovery. The metal gained over 8% in a single day recently, climbing back above $1,050 an ounce.

Yet the fundamentals remain tense: the market is undersupplied, according to Johnson Matthey, quoted by UBS, despite a slight increase in supply in 2024.

Automotive demand, the main use of Palladium, is declining with the slowdown in sales of gasoline-powered vehicles, but investment demand is growing strongly, increasing fourfold in one year. UBS forecasts a deficit of 300,000 ounces this year, compared with only 17,000 anticipated by Matthey, pointing to the metal's persistent undervaluation.

Although the short-term outlook remains uncertain, Palladium could benefit from a catch-up effect if macro instability persists.

Palladium price chart. Source: FXStreet.

A collective revaluation of precious metals?

Gold's high valuation is driving investors to explore undervalued alternatives. Platinum, Palladium, Copper and Silver are benefiting from this sectoral rotation. What they all have in common: a restricted physical market, more attractive valuations, and a solid fundamental outlook, sometimes reinforced by structural supply imbalances.

This is not the end of Gold. But it is perhaps the beginning of a broader cycle, in which several precious metals are taking over. For investors, diversification within precious metals is becoming a necessity.

Author

Ghiles Guezout

FXStreet

Ghiles Guezout is a Market Analyst with a strong background in stock market investments, trading, and cryptocurrencies. He combines fundamental and technical analysis skills to identify market opportunities.