Gold overtakes the Euro in reserves: A historic turning point

For the first time since the end of Bretton Woods, Gold has overtaken the Euro (EUR) to become the world's second-largest reserve asset behind the US Dollar (USD), according to a report by the European Central Bank (ECB). This overhaul reflects record purchases, historically high prices and a strategic reorientation by central banks in a tense geopolitical context.

A spectacular rise in Gold in central bank vaults

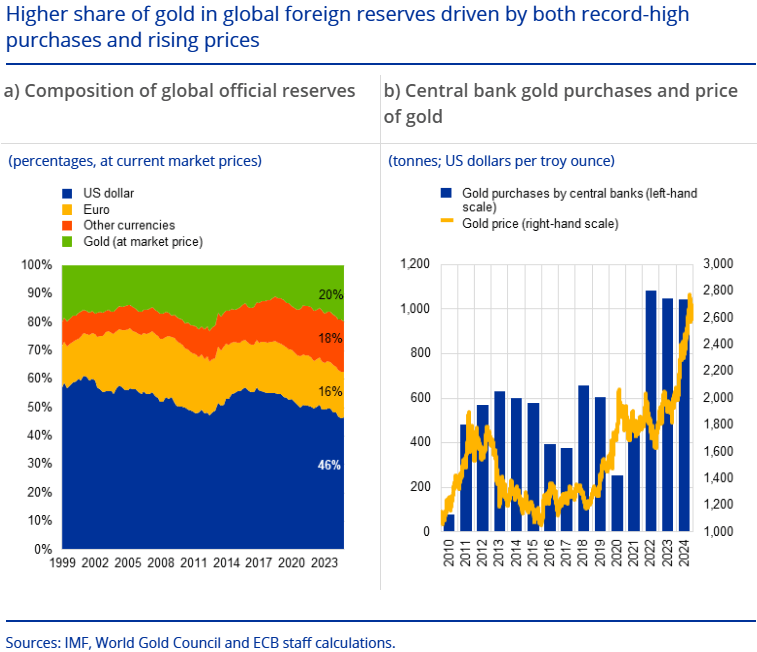

By 2024, Gold accounted for 20% of the world's official reserves, compared with 16% for the Euro and 46% for the US Dollar, according to data published by the ECB in its annual report on the international role of the Euro.

"The share of Gold in total official foreign reserves - comprising foreign exchange and Gold holdings - increased to 20% at the end of 2024, surpassing that of Euro, on the back of historically high Gold prices and purchases", wrote the ECB in its report.

This historic shift is explained by Gold purchases exceeding 1,000 tonnes for the third year running, double the average volumes of the 2010 decade.

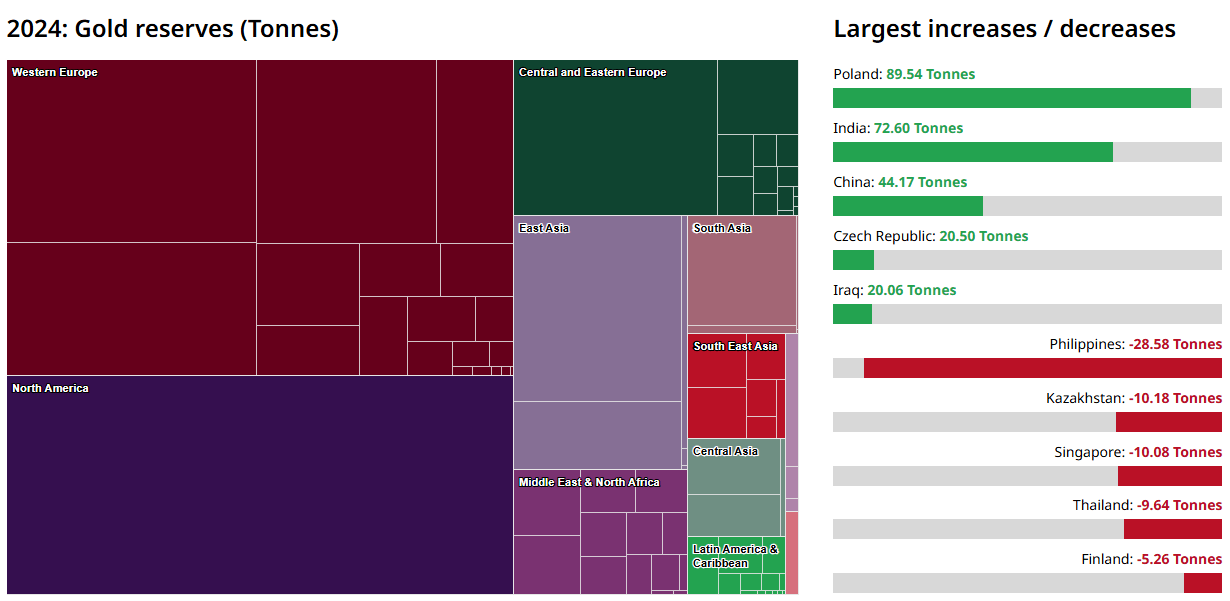

The biggest buyers were Turkey, India and China, jointly accumulating more than 600 tonnes of Gold since the end of 2021, according to the ECB report.

Meanwhile, data from the World Gold Council shows that the countries accumulating the most Gold during 2024 were Poland (89.54 tonnes), India (72.60 tonnes) and China (44.17 tonnes). The Philippines, Kazakhstan and Singapore reduced their reserves over the same period.

Source: World Gold Council

In total, central banks currently hold 36,000 tonnes of Gold, close to the record level of 38,000 tonnes reached in 1965, at the height of the Bretton Woods system. It's a symbolic return to an era when the value of currencies was directly backed by Gold.

Why this craze for the yellow metal?

Gold is an asset with no counterparty risk, highly liquid and independent of any political authority. Faced with rising geopolitical tensions – the war in Ukraine, Sino-American rivalries or Washington's unpredictable trade policies – many countries are seeking to protect themselves from potential sanctions and reduce their dependence on the US Dollar.

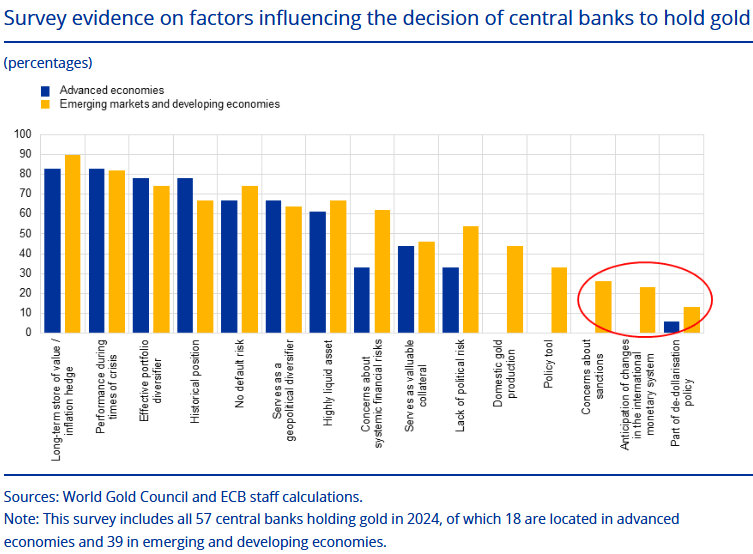

According to a survey cited by the ECB in its report, conducted by the World Gold Council among 60 central banks worldwide between February and April 2024, over 60% of central banks that have increased their reserves cited geopolitical risk as the main factor behind the move.

"Survey data suggest that Gold is held by central banks primarily for diversification purposes but also to hedge against geopolitical risk", noted the ECB.

The central bank adds:

"Two-thirds of central banks invested in Gold for purposes of diversification, while two-fifths did so as protection against geopolitical risk."

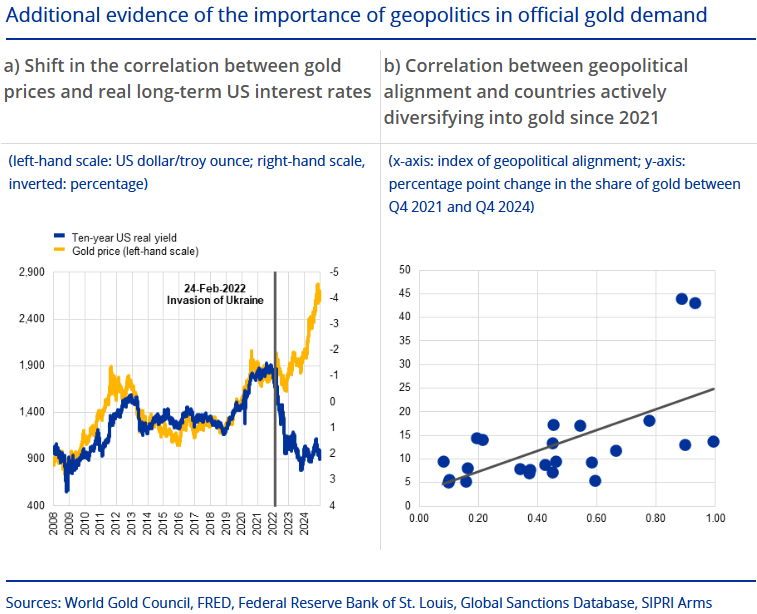

Traditionally negatively correlated with real interest rates, Gold now seems to be following a new logic, more focused on protection against geopolitical risks than on inflation alone since Russia's invasion of Ukraine.

It's a paradigm shift. Gold is now seen as a political shield, rather than simply a bulwark against inflation.

"This correlation broke down after Russia's full-scale invasion of Ukraine, suggesting that Gold prices have been influenced by other factors, such as geopolitical risk", mentions the ECB.

Another phenomenon contributing to this dynamic is the gradual loss of influence of the US Dollar in certain regions of the world, particularly in countries close to China and Russia. The "de-dollarization" movement, which began several years ago, appears to be gaining momentum.

However, the main factors identified by the World Gold Council remain historical factors intrinsic to Gold's characteristics:

- A long-term store of value and an inflation hedge.

- Good performance during times of crisis.

- An effective portfolio diversifier.

The key role of soaring prices

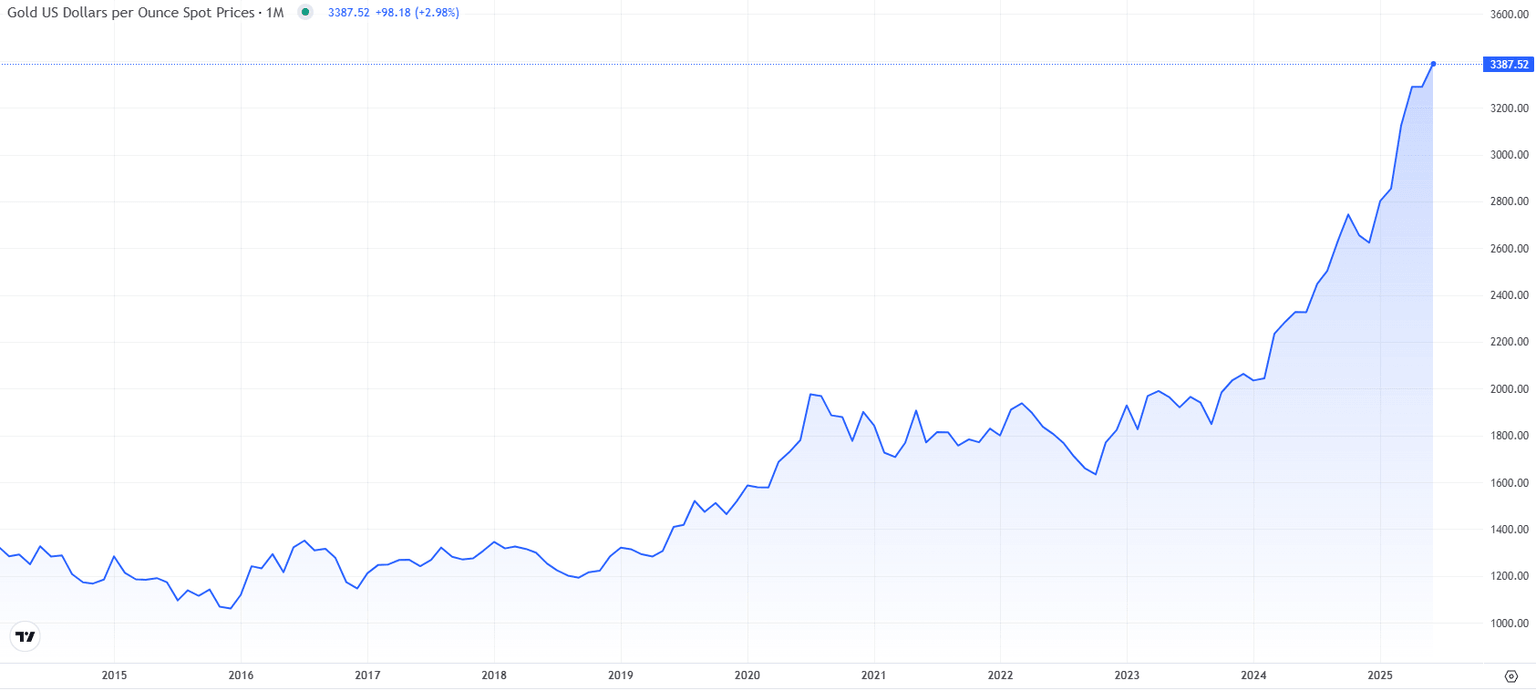

The price of the yellow metal increased sharply in 2024, rising by almost 62% to an all-time high of $3,509 per troy ounce in April this year. This surge mechanically inflated Gold's share of global reserves, even without additional purchases, helping to overtake Euro reserves.

Source: FXStreet, Gold price chart

"This stockpile, together with high prices, made Gold the second largest global reserve asset at market prices in 2024 - after the US dollar", wrote the European Central Bank.

The Euro: a stable currency but losing relative momentum

While attention is focused on Gold's meteoric rise, the slight erosion of the Euro's place in global reserves is also worthy of note.

By 2024, the Euro's share of official reserves fell to 16%, compared with 16.5% in 2023 (on par with Gold), according to a CNBC estimate based on ECB data. The current gap, with the Euro at 16% and Gold at 20%, is no longer symbolic.

This decline does not reflect a sudden mistrust of the Euro, but rather a strategic reorientation of reserves, particularly in emerging countries, where the Euro is struggling to compete with Gold's perceived geopolitical neutrality.

Not to mention the rise in the share of other currencies, which would total 18% of global reserves in 2024, up sharply on 2011 levels, according to ECB data.

Indeed, the Euro remains a widely used currency around the world.

"The share of the Euro across various indicators of international currency use has been largely unchanged, at around 19%, since Russia's invasion of Ukraine. The Euro continued to hold its position as the second most important currency globally", notes ECB President Christine Lagarde in the report.

The ECB also recognizes that new challenges are emerging for the Euro's international role, including:

- The rise of cryptocurrencies and alternative payment platforms.

- Geopolitical uncertainties that favor tangible assets such as Gold.

- The need to improve cross-border payment systems, an issue that could be addressed by the development of the digital Euro.

In short, the Euro remains a pillar of the world's monetary architecture, but it now faces competition that is more symbolic than technical, embodied by the growing appeal of the yellow metal.

Towards a pause in Gold buying?

Despite this frenzy, there are signs that the pace of Gold buying may be slowing. In the first quarter of 2025, Gold purchases by central banks fell by 33% compared with the previous quarter, particularly in China, according to a report by ING Bank.

But experts believe that the underlying trend remains bullish in the long term, driven by persistent uncertainty and the structural need for diversification.

"Given the strong run in Gold prices, the momentum in Gold buying could slow. But on a long-term basis, the uncertain geopolitical backdrop and desire for diversification will support the accumulation of Gold as reserves," Janet Mui, CFA, head of market analysis at RBC Brewin Dolphin, told CNBC.

"As the U.S. wants to take a more isolationist approach in trade, it makes sense for central banks of its key trading partners to diversify their reserves away from the U.S. dollar," she added.

The institutions "have played a key role in the Gold rally and will probably continue buying Gold, albeit at a slower pace than in the past couple of years," Hamad Hussain, climate and commodities economist at Capital Economics, told CNBC.

Discreet monetary revenge

This shift in favor of Gold does not signal the end of the US Dollar or the Euro, but it does highlight a major development: the resilience of the yellow metal as an international monetary asset, even in the age of digital currencies and floating rates.

For central banks, Gold has once again become a strategic pillar in a world where financial stability seems less and less guaranteed. And for investors, this renewed institutional interest is a strong signal that Gold still occupies a unique place in the world's monetary architecture.

Author

Ghiles Guezout

FXStreet

Ghiles Guezout is a Market Analyst with a strong background in stock market investments, trading, and cryptocurrencies. He combines fundamental and technical analysis skills to identify market opportunities.