Gold steady above $3,200 amid US Dollar weakness and Fed cut hopes

Gold (XAU/USD) continues to attract buyers, holding steady above the $3,200 level. The precious metal has found strong support from escalating trade tensions between the US and China. The rising uncertainty in global markets, driven by US tariff policies and China's retaliation, has increased investor interest in safe-haven assets. Meanwhile, a weakening US Dollar and expectations of rate cuts by the Federal Reserve further support gold’s bullish outlook.

Gold gains momentum on rising tariff tensions and Fed rate cut expectations

Gold prices remain firm as safe-haven demand rises amid growing global tensions. The trade war between the US and China escalates, creating uncertainty in financial markets. China has responded strongly to US tariffs, raising import duties to 125%. Investors seek safety in gold, driving prices higher above the $3,200 mark. This move reflects a lack of confidence in economic stability.

The US dollar struggles as recession fears grow. Trump's aggressive tariff stance raises concerns about economic fallout. At the same time, market bets increase that the Federal Reserve will cut interest rates. Fed officials warn that tariffs could weaken the US economy and force policy changes. Lower interest rates reduce the appeal of the Dollar and boost demand for gold, a non-yielding asset.

Temporary tariff exemptions by the US offer limited relief to markets. However, Trump’s threat of more tariffs keeps uncertainty alive. The mixed signals from Washington fuel volatility and maintain investor caution. As a result, gold benefits from a defensive investment stance. Until clarity returns, gold is likely to hold strong on both technical and fundamental grounds.

Technical analysis: Gold breaks out of ascending channel

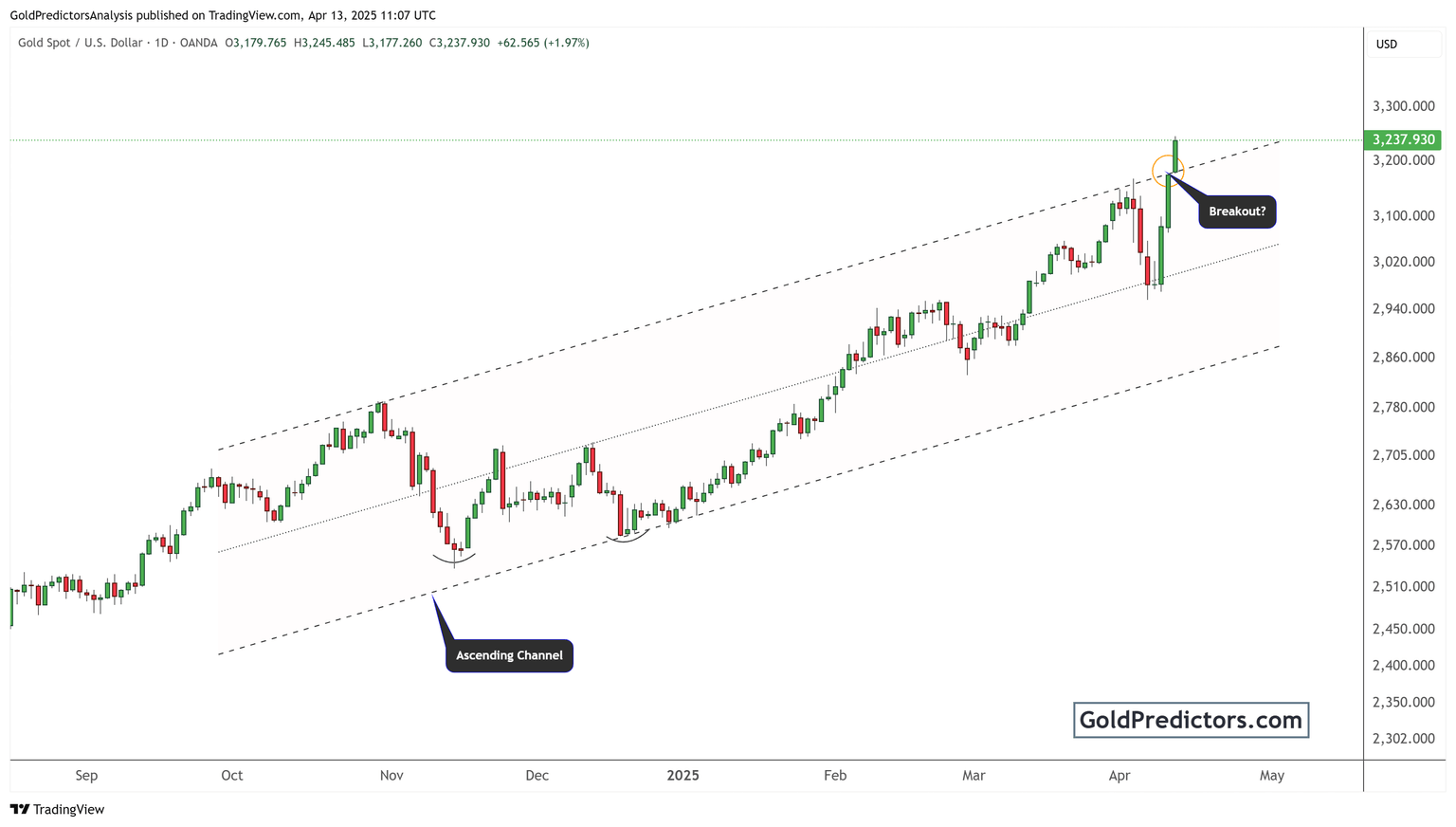

The chart below shows a well-defined ascending channel that began in late 2024. Each dip within the channel has found support and has been followed by a higher rally. The two curved arrows in November and December indicate a double bottom—a strong reversal pattern that helped re-establish the bullish trend.

Recently, price action tested the upper boundary of the channel. It initially struggled to break through but eventually succeeded with a strong bullish candle. The move above the channel occurred on increased volatility and larger candle bodies—typical characteristics of a breakout.

If this breakout holds above $3,200, the market could be entering a new phase of acceleration. However, false breakouts can occur. For confirmation, traders often look for a retest of the breakout level followed by a continuation of bullish price action.

Support is now expected near the previous channel resistance, which may act as new support. If prices fall back below the breakout zone, the bullish case weakens, and gold may resume trading within the channel.

Given the current geopolitical uncertainty and the macroeconomic backdrop, technical conditions support the bullish bias. The breakout above the ascending channel adds further strength to this view.

Conclusion

Gold’s breakout above the ascending channel aligns with broader macroeconomic uncertainty. With the US-China trade war intensifying and the US Dollar showing signs of weakness, gold has emerged as a reliable safe-haven asset. The technical chart suggests a strong bullish structure, confirmed by the recent breakout above the channel. While caution is warranted to confirm the breakout’s sustainability, the overall trend remains positive. As long as gold holds above the $3,200 level, bulls are likely to maintain control.

Unlock exclusive gold and silver trading signals and updates that most investors don’t see. Join our free newsletter now!

Unlock exclusive gold and silver trading signals and updates that most investors don’t see. Join our free newsletter now!

Author

Muhammad Umair, PhD

Gold Predictors

Muhammad Umair is a financial markets analyst and investor who focuses on the forex and precious metals markets.