Gold Price Forecast: XAU/USD bears eye daily closing below November 30 lows

- Gold off multi-month lows but downside bias still intact.

- US Treasury yields hold higher amid hopes of US stimulus.

- Markets focus on Friday’s close amid EZ/US PMIs.

Gold (XAU/USD) is attempting a bounce from seven-month lows of $1761 but the bears are likely to regain control if the US Treasury yields extend their advance on expectations of a bigger US fiscal stimulus. The benchmark 10-year US yields sit at yearly highs amid hopes that the US stimulus would help boost the economic recovery. Meanwhile, a broad-based US dollar rebound, amid fears over the new covid strains and nervousness ahead of the preliminary Markit PMIs on both sides of the Atlantic, also weighed on gold.

Markets also rethink the implications of the rising US rates on the equities and its eventual impact on the recovery prospects. Meanwhile, US Treasury Secretary Janet Yellen’s appeal to back the $1.9 trillion stimulus package could bode well for the Treasury yields. Focus remains on the Eurozone/ US PMIs, virus and stimulus updates for fresh trading incentives.

Gold Price Chart - Technical outlook

Gold: Daily chart

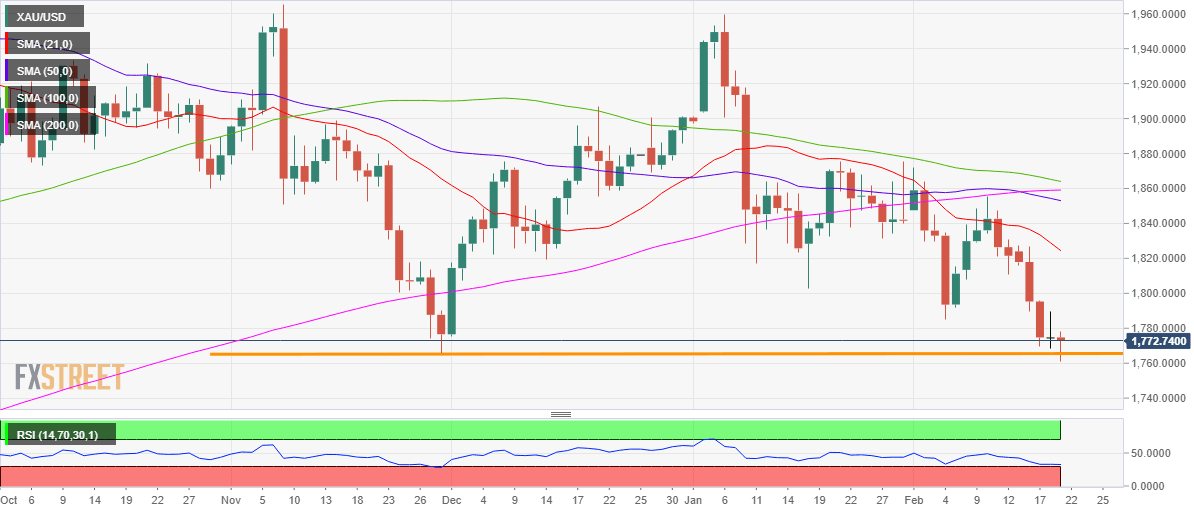

As observed in the daily chart, the gold price is at the brink of announcing a massive sell-off should sellers find acceptance below the November 30 low of $1765 on a daily closing basis.

Stops could be triggered on a sustained move below the latter, exposing the June 2020 lows around $1720.

The 14-day Relative Strength Index (RSI) lies just above the oversold territory, suggesting that there is room for further downside. Therefore, the bears could extend the sell-off fuelled by the confirmation of the death cross formation on Tuesday.

However, if the bulls manage to defend the crucial support, allowing the price to settle above that level, a corrective pullback towards the January low of $1803 cannot be ruled out.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.