GBP/USD Weekly Outlook: Pound Sterling looks north ahead of UK employment, inflation test

- The Pound Sterling recaptured 1.2600 versus the US Dollar amid sustained upside.

- GBP/USD braces for a busy economic docket on both sides of the Atlantic.

- The pair broke the consolidative range to the upside on the daily chart.

The Pound Sterling (GBP) extended the recovery from 14-month troughs against the US Dollar (USD) as the GBP/USD pair reclaimed the 1.2500 threshold.

Pound Sterling capitalized on USD downfall

The primary catalyst behind the GBP/USD pair’s ongoing upswing was the sustained correction in the US Dollar across its major currency rivals. US President Donald Trump’s reciprocal tariffs plan and dovish US Federal Reserve (Fed) expectations exerted downside pressure on the Greenback, even though Fed Chairman, Jerome Powell, stuck to his hawkish rhetoric in his Congressional testimonies.

The market sentiment remained in a sweet spot almost throughout the week, courtesy of prospects of a Russia-Ukraine peace deal and the delay in implementing Trump’s reciprocal tariffs. Trump has entrusted Commerce Secretary, Howard Lutnick, to prepare a roadmap for charging reciprocal tariffs on every country that imposes duties on US imports.

Additionally, increased bets that the Fed will maintain its easing trajectory this year offered some relief to the markets.

Following a hot January US Consumer Price Index (CPI) data, the Producer Price Index (PPI) also surprised markets to the upside. However, the index's monthly components cooled, reinforcing dovish expectations around the Fed’s rate cut prospects.

The annual headline CPI increased 3% in January, up from 2.9% the previous month. The core inflation unexpectedly rose to 3.3% over the year in January versus December’s 3.2% growth. Meanwhile, the PPI increased by 3.5% over the year in January, compared with December’s 3.3% growth and the forecast of 3.2%.

Reuters reported, “Following the PPI data, US rate futures priced in 31 basis points (bps) of easing this year, compared with 27 bps late on Wednesday, according to LSEG calculations. The next rate reduction is expected either at the October or December meeting.”

On Friday, the US Census Bureau reported that Retail Sales declined by 0.9% on a monthly basis in January. This reading came in worse than the market expectation for a decline of 0.1% and made it difficult for the USD to find demand. In turn, GBP/USD climbed above 1.2600.

The Pound Sterling also received support from cautious remarks from Bank of England (BoE) policymakers. BoE Chief Economist, Huw Pill, told Reuters on Thursday that he “urges caution on interest rate cuts.” BoE official Megan Greene said on Wednesday “I believe it is appropriate to maintain a cautious and gradual approach to removing monetary restrictiveness.”

Week ahead: UK inflation and US PMI data to stand out

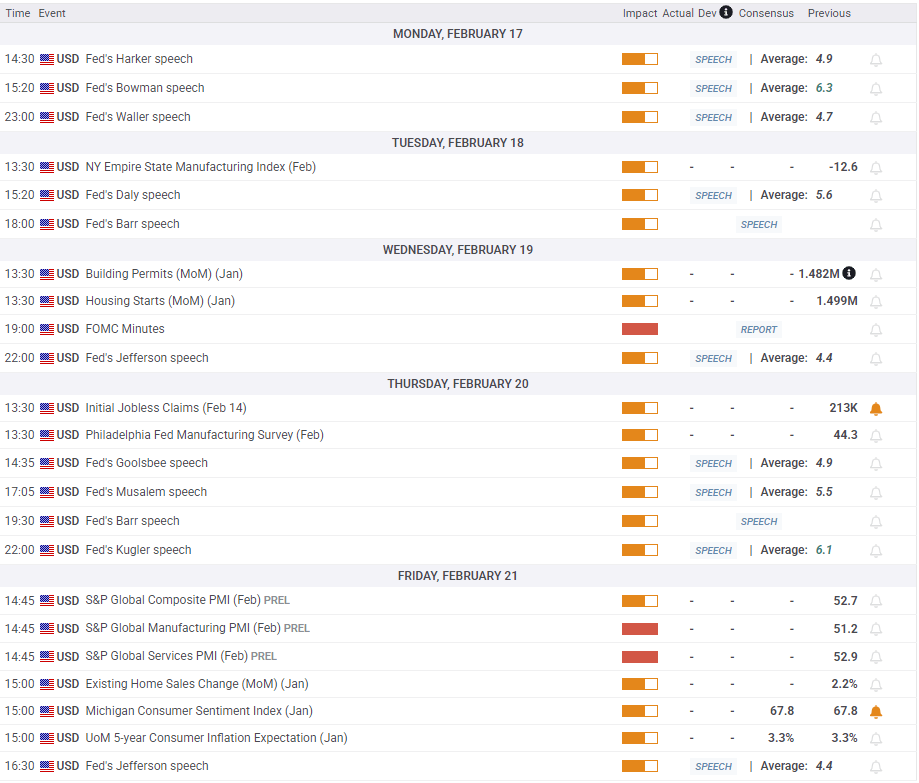

It’s a holiday-shortened week as US markets are closed on Monday in observance of Presidents’ Day. There are no significant events from the UK on Monday either.

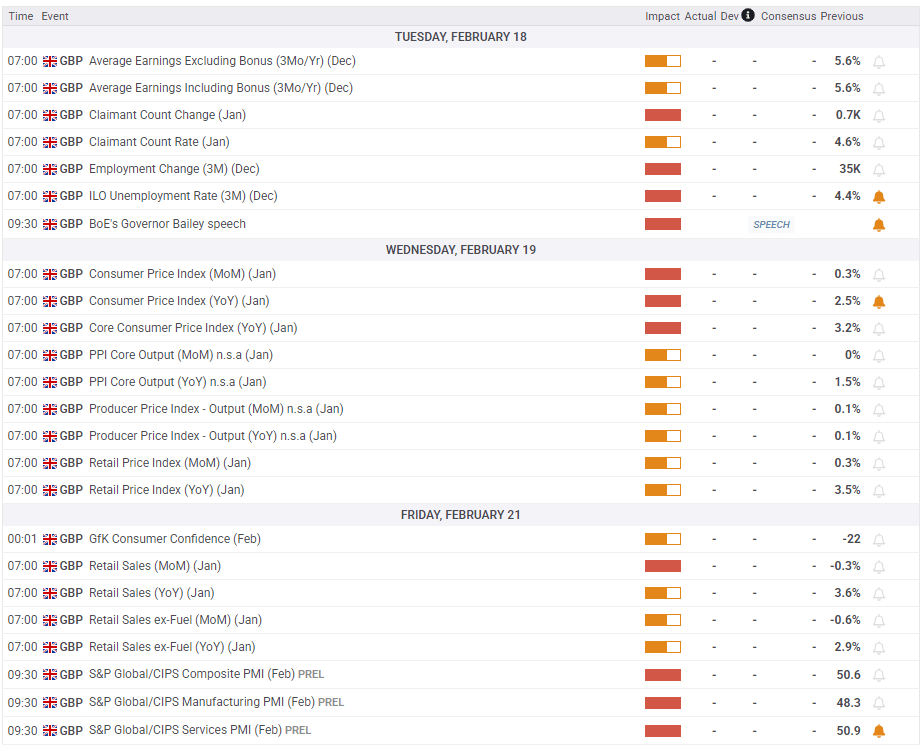

On Tuesday, Pound Sterling traders will look forward to BoE Governor Andrew Bailey’s fireside chat on fostering openness in financial markets and the role of central banks.

Any hints on the Bank’s policy outlook could trigger a big reaction in the British Pound.

Ahead of Bailey’s appearance, the UK labor market data will be closely scrutinized for fresh policy cues.

Attention then turns toward Wednesday's January UK CPI report, followed by the Minutes of the Fed’s January policy meeting.

Thursday will feature the usual weekly Jobless Claims data from the US, while the CBI Industrial Order Expectations data will likely entertain traders earlier that day.

The S&P Global preliminary business PMI data from the US and the UK will make up for a busy calendar on Friday. The UK Retail Sales data will also add to the data-busy day.

Besides the economic data releases, traders will continue closely following fresh developments on Trump’s tariff plans and speeches from Fed policymakers during the week.

GBP/USD: Technical Outlook

The daily chart shows that GBP/USD broke its consolidative phase to the upside after closing Thursday above the 50-day Simple Moving Average (SMA) at 1.2465.

The 14-day Relative Strength Index (RSI) holds firmly above the midline, currently near 64, suggesting more room for gains.

The immediate resistance is at the December 30 high of 1.2608. A sustained break above it will expose the 1.2650 psychological level.

Further up, buyers will aim for the 100-day SMA at 1.2675 and the 200-day SMA at 1.2788.

If Pound Sterling sellers jump in at higher levels, the 50-day SMA resistance-turned-support at 1.2465 will be challenged at first.

The 21-day SMA at 1.2420 will be the next downside target, below which doors will reopen to test the rising trendline support at 1.2332.

Deeper declines could challenge bullish commitments at the February 3 low of 1.2249.

Pound Sterling FAQs

The Pound Sterling (GBP) is the oldest currency in the world (886 AD) and the official currency of the United Kingdom. It is the fourth most traded unit for foreign exchange (FX) in the world, accounting for 12% of all transactions, averaging $630 billion a day, according to 2022 data. Its key trading pairs are GBP/USD, also known as ‘Cable’, which accounts for 11% of FX, GBP/JPY, or the ‘Dragon’ as it is known by traders (3%), and EUR/GBP (2%). The Pound Sterling is issued by the Bank of England (BoE).

The single most important factor influencing the value of the Pound Sterling is monetary policy decided by the Bank of England. The BoE bases its decisions on whether it has achieved its primary goal of “price stability” – a steady inflation rate of around 2%. Its primary tool for achieving this is the adjustment of interest rates. When inflation is too high, the BoE will try to rein it in by raising interest rates, making it more expensive for people and businesses to access credit. This is generally positive for GBP, as higher interest rates make the UK a more attractive place for global investors to park their money. When inflation falls too low it is a sign economic growth is slowing. In this scenario, the BoE will consider lowering interest rates to cheapen credit so businesses will borrow more to invest in growth-generating projects.

Data releases gauge the health of the economy and can impact the value of the Pound Sterling. Indicators such as GDP, Manufacturing and Services PMIs, and employment can all influence the direction of the GBP. A strong economy is good for Sterling. Not only does it attract more foreign investment but it may encourage the BoE to put up interest rates, which will directly strengthen GBP. Otherwise, if economic data is weak, the Pound Sterling is likely to fall.

Another significant data release for the Pound Sterling is the Trade Balance. This indicator measures the difference between what a country earns from its exports and what it spends on imports over a given period. If a country produces highly sought-after exports, its currency will benefit purely from the extra demand created from foreign buyers seeking to purchase these goods. Therefore, a positive net Trade Balance strengthens a currency and vice versa for a negative balance.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.