GBP/USD Weekly Forecast: Recovery time? Robust UK retail sales, dovish Fed, may send sterling up

- GBP/USD has been retreating amid dollar strength and concerns about the US economy.

- UK retail sales, Fed minutes, and coronavirus developments are eyed.

- Mid-August's daily chart is painting a mixed picture.

- The FX Poll is pointing to cable holding up in the short-term before a rise afterward.

Diverging disease curves across the Atlantic can explain part of cable's slide, yet other factors such as rising US yields and worries about Britain's furlough scheme were also in play. Is the pendulum about to swing in the other direction? UK retail sales, the Fed's minutes, and coronavirus are in focus.

This week in GBP/USD:

The UK's unemployment rate remained at 3.9% in June – a remarkably low level, courtesy of the government's successful furlough scheme. The program that keeps workers attached to their employees – while paying them most of their salaries – is set to expire in October.

Rishi Sunak, Chancellor of the Exchequer, stated that the scheme is unsustainable and that many people will lose their jobs. His dire words took the sting out of sterling's gains. July's rapid 94,400 increase in jobless claims also weighed.

Relatively good news came out of Gross Domestic Product figures for the second quarter. The British economy shrank by a historic 20.4% in the three months ending in June – yet that beat estimates. Moreover, June's increase of 8.7% has shown that reopening is boosting the economy.

Further moves depend on beating coronavirus. Russia's announcement of registering the world's first COVID-19 vaccine was met with skepticism but serves to redouble efforts to defeat the disease.

UK coronavirus cases continue moving higher, while they are showing tentative signs of falling in the US. Nevertheless, America's situation remains far worse.

Source: FT

These initial signs of improvement in the US may have contributed to politicians' lack of urgency in providing more relief to the US economy. Republicans and Democrats remain at loggerheads with time passing by and millions of unemployed Americans receiving a cut to their benefits.

President Donald Trump signed an executive order decreeing a top-up of $300/week to those out of work – half of the previous payment – and that money is yet to be distributed. Lower fiscal spending pushed bonds yields higher and safe-haven flows boosted the greenback.

In politics, Democratic challenger Joe Biden chose Senator Kamala Harris as his running mate, a decision in line with most analysts' expectations. Harris is considered a pragmatist and elevating her status seemed to have no substantial market implications. Trump

Sino-American tensions have remained elevated yet the focus shifted from Hong Kong – Britain's former colony – to Taiwan. China upped the ante, sending a fighter jet closer to the island while America's Health Secretary Alex Azar was in Taipei. However, markets focused on the trade deal and talks around it, which seemed satisfactory.

Overall, the dollar gained ground.

UK events: Retail sales could be a bright spot

Coronavirus developments remain of high importance. Pound traders will want to see the disease remaining under control even if cases continue rising. Any new local lockdowns may weigh on sterling. Prime Minister Boris Johnson aims to reopen schools in September and any delay would also cause suffering. On the other hand, if infections fall, the pound has room to rise.

Investors have low expectations for any Brexit breakthrough. With the recent round of US-UK over, for now, that front will likely remain quiet as well.

The economic calendar kicks off with CPI figures on Tuesday. As in other places, inflation has dropped in the wake of COVID-19 and has liked remained depressed. Headline CPI stood at 0.6% yearly in June, and no substantial changes are likely in July.

Consumption has recovered faster than the broader economy – according to official retail sales figures for June and also independent measures from Barclaycard and the British Retail Consortium for July. Updated expenditure data is due out now with July's retail sales. Will the volume return to that seen last year? The option is remote, but cannot be ruled out, especially given the government's furlough scheme.

Markit's preliminary Purchasing Managers' Indexes for August are also set to show ongoing expansion – scores above 50. The large services sector is in the spotlight.

Here is the list of UK events from the FXStreet calendar:

US events: Fed minutes in focus

Is the US beginning to turn a corner against coronavirus? While the infections curve is clearly off the peak, deaths remain at an elevated level. A consistent drop in the seven-day rolling average is needed to confirm the trend and provide hope.

Vaccine news will also be of interest after Russia's announcement' propelled the global race to develop immunization into a higher gear. Hopes may boost the market and weigh on the greenback.

The Democratic National Convention kicks off in Milwaukee – and mostly online amid the disease. The party conferences usually boost the party holding them in the polls, but these have been stable of late, showing a solid lead for challenger Joe Biden.

Markets are more interested in what Congress does in Washington. Investors assume lawmakers will eventually strike a deal, but every day that passes without new relief is weighing on the economy. If officials settle for a small package, it would hurt the economy and also Trump's chances. A larger boost would boost the economy and the president's probability of holding onto power.

The highlight of the economic calendar is the Federal Reserve's meeting minutes from the July meeting. Back then, the Fed expressed concern about the recent downturn following the resurgence of coronavirus cases from mid-June. Will the minutes unveil even greater worries? Or will it convey a message of stability?

It is essential to note that the document is not a raw protocol of deliberations but a thoroughly edited publication – with officials considering a market response.

Apart from the Fed minutes, building permits are of interest, and weekly jobless claims statistics remain essential high-frequency figures. Initial claims are for the week ending August 14 – when Non-Farm Payrolls surveys are held.

Markit's preliminary August PMIs and Existing Home Sales have the last word of the week and are set to show stability.

Here the upcoming top US events this week:

GBP/USD Technical Analysis

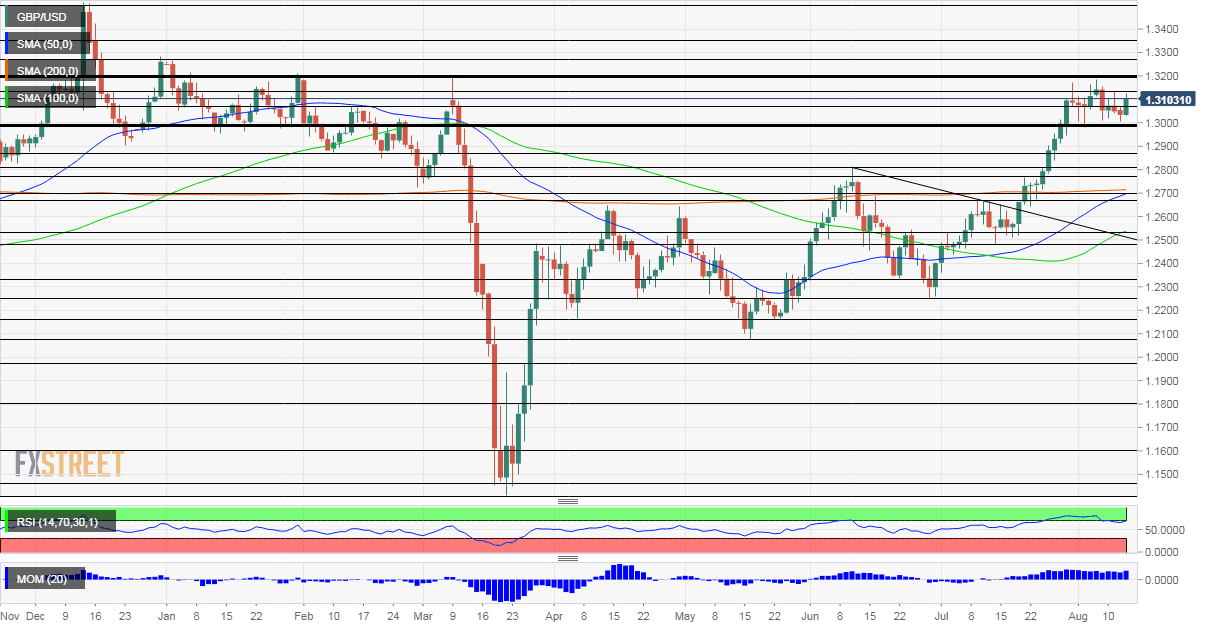

The Relative Strength Index on the daily chart is still flirting with 70 – moderately overbought. Momentum remains positive and GBP/USD is trading above the 50, 100, and 200-day Simple Averages. All in all, the picture is not 100% bullish.

Immediate levels to watch are 1.3060, which was a temporary cap in August – and also before the pandemic – and 1.3145, which was a temporary peak.

More significant resistance is at 1.32, a swing high before March's crash. Further up, 1.3270 was a high point in January, and it is followed by 1.3350 and 1.3510.

Strong support is at 1.2985, August's low. GBP/USD neared that level later in the month. Further down, the next level to watch is 1.2870, a support line from February. It is followed by 1.2815 and 1.2700 – the latter is where the 50-day SMA and the 200-day one converge.

GBP/USD Sentiment

The pendulum may now swing in favor of the pound, as the US economy slows down and upbeat UK retail sales may send sterling higher.

The FXStreet Forecast Poll is showing that experts expect stability in the upcoming week, followed by drops afterward. The long-term target has been upgraded while the expectations have remained stable for other timeframes.

Related Reads

Author

Yohay Elam

FXStreet

Yohay is in Forex since 2008 when he founded Forex Crunch, a blog crafted in his free time that turned into a fully-fledged currency website later sold to Finixio.