GBP/USD Forecast: Perky pound has three reasons to rise taking a peek at highest since 2018

- GBP/USD has been edging higher amid hopes of an accelerated UK vaccination campaign.

- The Bank of England is edging closer to a rate hike, and the Governor could add fuel to the fire.

- A drop in US inflation expectations could hit the dollar.

- Tuesday's four-hour chart is pointing to additional rises.

First a false break, then the real thing? GBP/USD has surpassed the previous 2021 peak of 1.4240, taking a peek at the highest since 2018, reaching 1.4250 before falling back to range. While the failure to hold onto the highs may embolden bears, cable has three reasons to rise.

1) Shots in arms

Britain has already reached 59% of its population with at least one COVID-19 jab and roughly 38% with two shots. In response to the spread of the worrying B.1.167.2 variant first identified in India, authorities are ramping up the campaign, aiming to vaccinate 75% of the population by the end of the month.

The fresh inoculation drive is accompanied by a dose of good news from Bolton, the epicenter of the recent breakout, which has seen a drop in cases. The biggest question for Brits and markets is if "Freedom Day" – the full reopening planned for June 21 – remains in play. These recent developments raise the chances of returning to normal.

2) BOE bullishness

Bank of England member Gertjan Vlieghe hinted that the "Old Lady" could raise interest rates as soon as early 2022. His words surprised markets and pushed the pound higher, yet he is only one of nine members on the bank's Monetary Policy Committee. The most important one of them, BOE Governor Andrew Bailey, speaks on Tuesday.

Will Bailey boost the bulls? The UK economy is looking stronger, with falling unemployment and rising prices. Any hint toward the exits – ahead of the bank's decision later this month – could support the pound.

3) US cooldown?

The main dollar driver has been fear of rising inflation in the US. These concerns grew on Friday with the publication of the Core Personal Consumption Expenditure (Core PCE) – the Federal Reserve's preferred gauge of inflation – which hit 3.1% in April. Apart from beating estimates, the indicator is also well above the Fed's 2% target.

Have price pressures remained elevated also in May? The ISM Manufacturing Purchasing Managers' Index for May may provide some hints. Its "Prices Paid" component hit the highest on record in April and could fall, strengthening the Fed's stance that inflation is only transitory.

ISM Manufacturing PMI Preview: NFP Hint? Inflation component to steal the show, rock the dollar

Randal Quarles and Lael Brainard, two governors at the Federal Reserve, are slated to speak later in the day and they may add to cooling down the dollar.

All in all, there is room for the pound to rise and the dollar to fall.

GBP/USD Technical Analysis

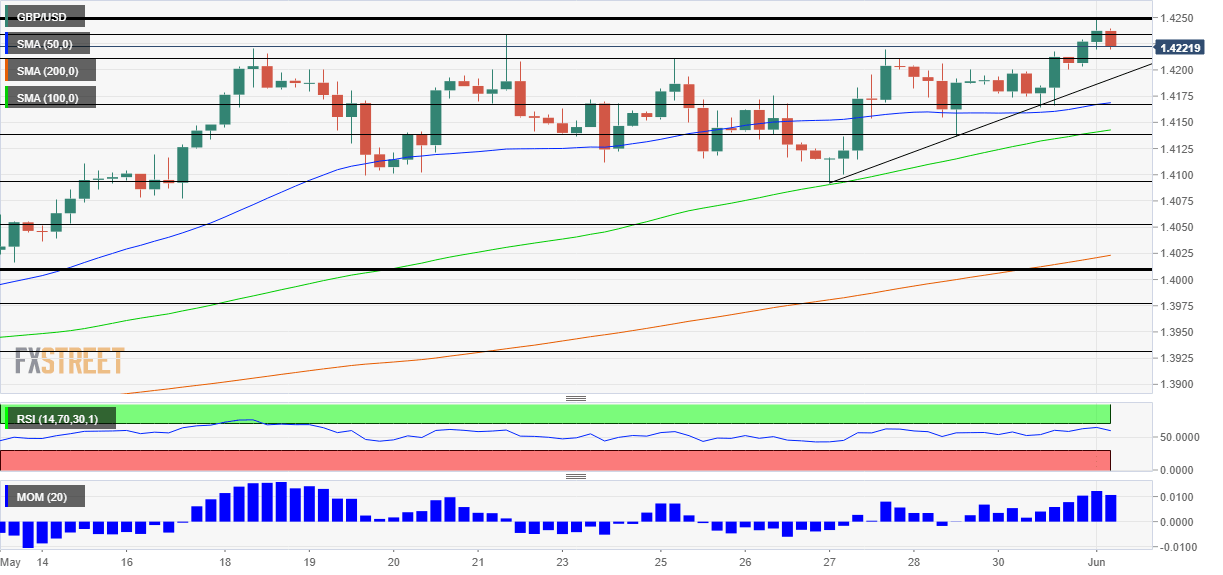

The four-hour chart is showing that cable is trading in an uptrend, setting higher lows. Moreover, momentum is to the upside and the pair is trading above the 50, 100 and 200 simple moving averages, bullish signs.

The first hurdle is 1.4250, which is the fresh 2021 peak and the highest in three years. It is followed by 1.4345 and 1.4365, levels last recorded in 2018.

Some support is at 1.4220, a swing high on the way up. Further down, 1.4170 and 1.4135 await GBP/USD.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Yohay Elam

FXStreet

Yohay is in Forex since 2008 when he founded Forex Crunch, a blog crafted in his free time that turned into a fully-fledged currency website later sold to Finixio.