Euro breaks out lower after weak EU GDP data

The euro broke-out lower after the relatively weak economic data from Europe. According to the Eurostat, the bloc’s GDP declined by 0.7% in the fourth quarter. This was a sharper contraction than what analysts were expecting. On an annualised basis, the economy contracted by -5.1 %, lower than the previous contraction of -4.3%. In Italy, the economy weakened by 6.6% while in Portugal, it dropped by 5.4%. These numbers came a day after Markit released positive manufacturing PMI data. The services PMIs that will come out tomorrow are expected to be relatively weak.

The Australian dollar declined today after the relatively dovish interest rate decision by the RBA. As expected, the bank decided to leave interest rates unchanged at 0.1%. It also decided to boost its quantitative easing program by another A$100 billion. The goal of the QE is to lower government borrowing. It also maintained its term lending program that helps to lower interest rates by companies and households. Analysts believe that the bank will not shift its main interest rate to the negative zone. The pair will react to the Australian AIG construction index, services PMIs, and building approvals tomorrow.

Global stocks rebounded today as traders continued to focus on activities by day traders in chat rooms. Some of the top companies favoured by these traders have experienced mixed returns this week. GameStop shares dropped by more than 30.77% yesterday and are also down by 22% in the premarket. AMC shares have declined by 21% in premarket while Nokia shares have fallen by more than 1%. Meanwhile, futures tied to the Dow Jones, S&P 500, and Nasdaq 100 indices have risen by more than 0.8%.

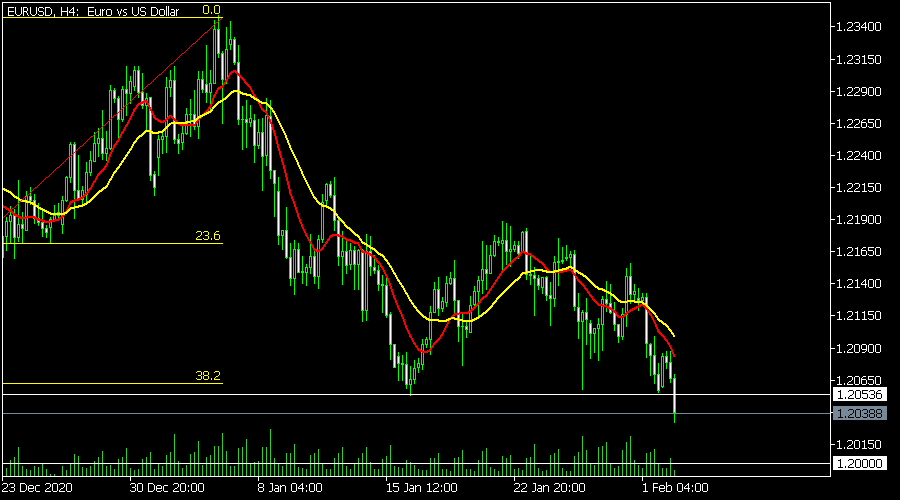

EUR/USD

The EUR/USD pair dropped to an intraday low of 1.2036, which was the lowest level since November last year. The price managed to drop below the important support level and the previous YTD low of 1.2053. Also, it has moved below the previous bearish consolidation pattern and the 38.2% Fibonacci retracement level. Therefore, the pair will likely continue falling as bears target the next support at 1.2000.

AUD/USD

The AUD/USD pair dropped to an intraday low of 0.7610, which was slightly above last week’s low of 0.7590. On the four-hour chart, the price moved below the 25-day and 15-day exponential moving averages. It has also crossed the 23.6% Fibonacci retracement level. Also, the histogram and line of the MACD have moved below the neutral line. Therefore, the pair will likely continue falling as bears target the next support at 0.7550.

USD/CHF

The USD/CHF pair continued rising today after it broke-out yesterday. On the four-hour chart, it has moved substantially above the neckline of the inverse head and shoulders pattern. It is also along the upper line of the Bollinger Bands while the MACD has moved above the neutral line. Therefore, the pair will likely continue rising as bulls target the next resistance at 0.9050.

Author

OctaFx Analyst Team

OctaFX

OctaFX is a market-leading forex broker, providing personalised forex brokerage services to customers in over 100 countries worldwide.