EUR/USD Weekly Forecast: Buyers cautiously returning with Fed in focus

- Tepid US growth was partially overshadowed by encouraging employment data and trade tensions relief.

- The European Central Bank maintained its dovish stance despite modest economic progress.

- EUR/USD seems to have completed its bearish corrective slide and may soon resume its bullish run.

The EUR/USD pair stayed under mild selling pressure for the second consecutive week, but settled on Friday at around 1.1350, pretty much unchanged from the opening. Investors are still wary about the US Dollar (USD) given the White House's tariffs policy potential effects on the local economy.

Additionally, United States (US) data released in the last few days indicated a slowing performance throughout the first quarter of the year, also a result of trade-war concerns. On the contrary, European Union (EU) macroeconomic figures were unimpressive but painted a better picture.

As the week comes to an end, investors shift the focus to global trade developments and the upcoming Federal Reserve (Fed) monetary policy announcement.

European data and the European Central Bank

The EU released the April Economic Sentiment Indicator, which contracted to 93.6 from 95.00 in March. Additionally, the Union released the preliminary estimate of the Q1 Gross Domestic Product (GDP), indicating the economy grew by 1.2% on a yearly basis and by 0.4% in the quarter, beating expectations of 1.0% and 0.2%, respectively. Finally, the Harmonized Index of Consumer Prices (HICP) rose by more than anticipated in April, according to preliminary estimates, up 2.2% year-on-year (YoY) vs the 2.1% expected.

Meanwhile, Germany released March Retail Sales, down on a monthly basis by 0.2%, better than the -0.4% anticipated by market players. The German Q1 (GDP) showed the economy grew 0.2% in the quarter, according to preliminary estimates. The figure matched expectations, while improving from the Q4 2024 reading of -0.2%. Inflation in the country, as measured by the HICP, increased by 2.2% year-on-year (YoY), down from the previous 2.3% but above the 2.1% expected.

Tepid EU data kept the door open for additional rate cuts. European Central Bank (ECB) officials delivered dovish messages, supporting the case for another 25 basis points (bps) rate cut when they meet in June.

Among others, ECB policymaker Olli Rehn stated on Monday that the central bank may need to lower interest rates below the neutral level to support the economy, given materializing downside risks. He even called for larger interest rate cuts. Also, ECB Philip Lane noted he would not pre-commit to any path and said the growth forecast would see only a moderate markdown.

A fragile economy and persistent trade tensions leave no room for anything other than further cuts.

US economy shrinks, employment fails ahead of Fed

Unimpressive US data limited USD advances despite the de-escalation of global trade tensions.

Consumer Confidence, as measured by CB, fell to 86 in April, its lowest since October 2021. Also, the preliminary estimate of the US Q1 Gross Domestic Product (GDP) also missed expectations, as the economy contracted at an annualized pace of 0.3% against the anticipated 0.4% expansion, and sharply down from the previous 2.4%. The April ISM Manufacturing Purchasing Managers’ Index (PMI), on the contrary, posted 48.7, down from the 49 posted in March, but better than the 48 expected.

Inflation in the US, as measured by the change in the Personal Consumption Expenditures (PCE) Price Index, edged lower to 2.3% on a yearly basis in March from 2.5% in February. The figure missed expectations of 2.2%. The core annual PCE Price Index rose 2.6%, down from the 3% increase reported in February and in line with analysts' estimates.

Employment-related figures were tepid, although the April Nonfarm Payrolls (NFP) report brought a positive surprise ahead of the weekly close.

Earlier in the week, the US released the April ADP Employment Change report, which showed that the private sector added measly 62K new job positions, much worse than the 108K expected, while below the previous 147K. Also the number of job openings in the country on the last business day of March stood at 7.19 million, as reported in the Job Openings and Labor Turnover Survey (JOLTS), easing from the previous 7.48 million openings (revised from 7.56 million) reported in February and below the market expectation of 7.5 million. Finally, Initial Jobless Claims for the week ended April 26 rose by 241K, worse than the 224K anticipated and the previous weekly figure of 223K.

On Friday, the NFP showed the country added 177K new job positions in April, surpassing the expected 130K and not far from the 185K posted in March. The Unemployment Rate held steady at 4.2% as expected, while annual wage inflation, as measured by the change in the Average Hourly Earnings, held steady at 3.8%, below the 3.9% expected.

Federal Reserve taking centre stage

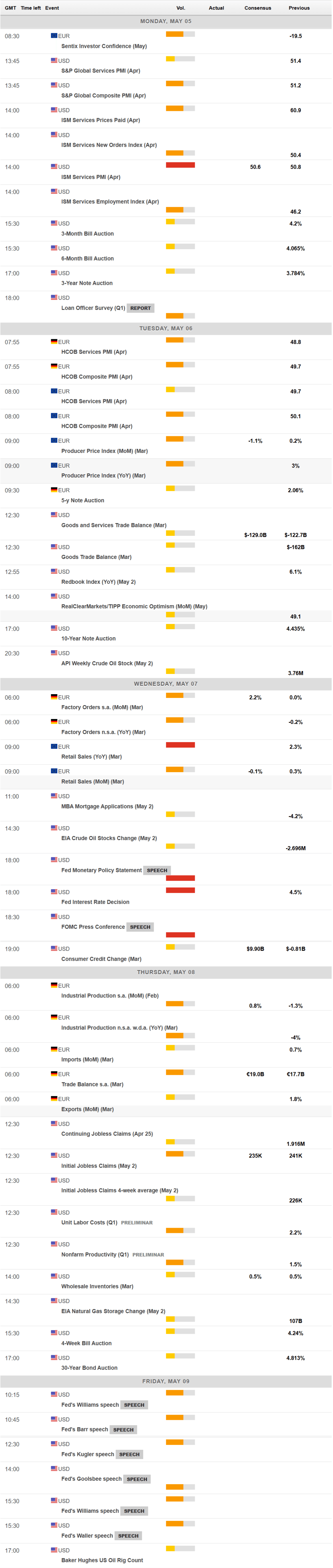

The macroeconomic calendar has little relevant to offer in the upcoming days. The US will release the April Services PMI, foreseen at 50.6, down from the March reading of 50.8. As for the EU, the focus will be on Germany Factory Orders, seen increasing by 2.2% in March, and EU Retail Sales for the same period.

The Fed will gather all the attention, announcing the monetary policy decision on Wednesday. Fed officials are widely anticipated to keep the benchmark interest rate on hold this time, floating between 4.25% and 4.50%. Uncertainty related to trade tensions translates into potentially higher inflation coupled with a slowdown in economic activity, forcing policymakers to stay put ahead of a clearer picture emerges.

Chairman Jerome Powell is expected to repeat the need to wait and see, with the focus on progress towards the 2% inflation goal. Questions about his relationship with President Donald Trump within the press conference are likely, yet Powell will likely dodge those as usual.

Trump trade war developments

In the meantime, global trade tensions continue, impacting the market’s mood. Headlines were mostly discouraging throughout the first half of the week, as headlines coming from China indicated no negotiations were underway. As days went by, back and forth between Washington and Beijing continued, with both sides waiting for the opposite one to take the first step, something that has not yet happened.

Still, comments from Trump pointing to ongoing negotiations with other major trade counterparts brought some relief to financial markets. On Thursday, US President Trump noted progress on talks with some Asian countries, including India and Japan. Regarding China, Trump stated that there’s a “very good” chance of making a deal with China, yet added that any deal with Beijing has to be in US terms. Meanwhile, a Beijing-backed outlet reported that United States officials have contacted their Chinese counterparts for talks.

Finally, White House trade advisor Peter Navarro down-talked data, saying, “I got to say just one thing about today’s news, that’s the best negative print I have ever seen in my life,” while saying he likes “where we’re at now.”

The mood improved ahead of the weekly close thanks to the optimism related to such headlines.

EUR/USD technical outlook

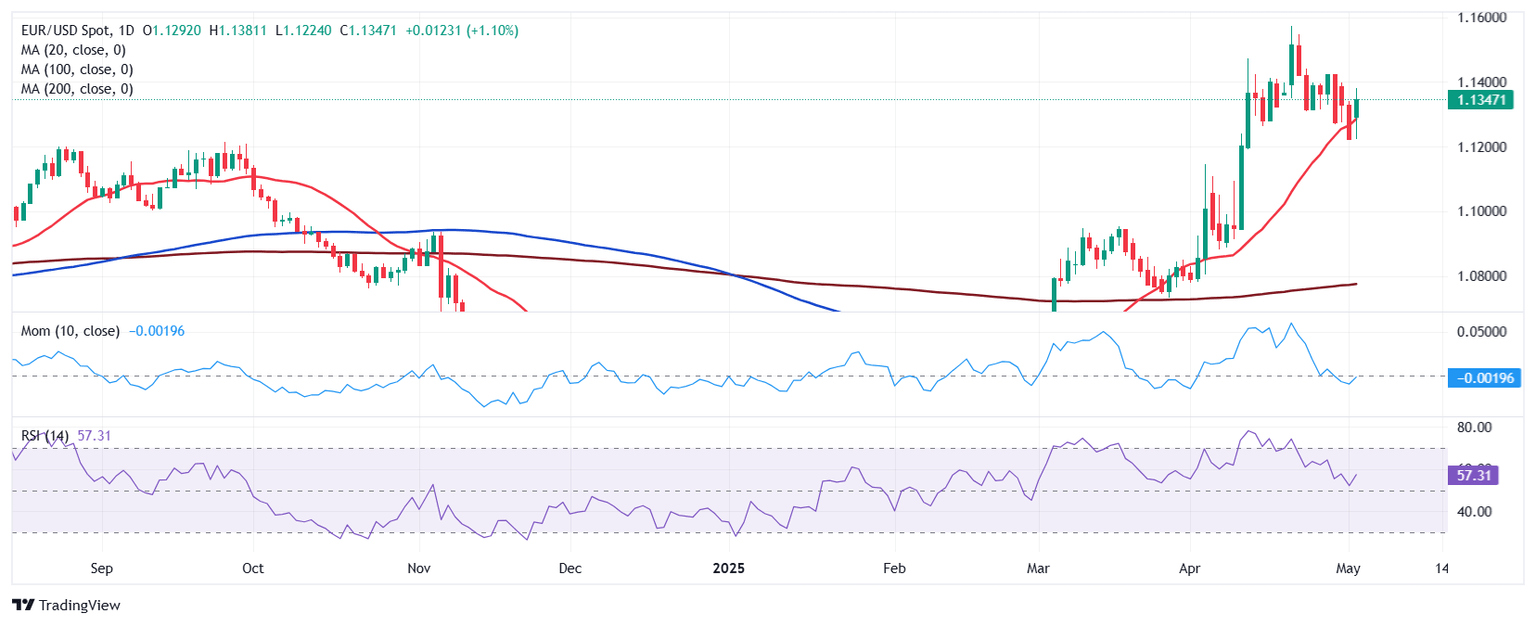

The weekly chart for the EUR/USD pair shows extreme conditions continue to recede, while the bearish potential seems well-limited. Technical indicators retreated from their recent highs, but remain within overbought territory, with the Relative Strength Index (RSI) indicator consolidating around 70. At the same time, the pair develops above all its moving averages, with a bullish 20 Simple Moving Average (SMA) extending its advance below the 100 and 200 SMAs. The longer one stands at around 1.0830, which is too far away to be considered a relevant support, yet at the same time, it reflects EUR/USD bullish momentum.

The daily chart shows EUR/USD bounced from a bullish 20 SMA currently at around 1.1300. The 100 and 200 SMAs grind north over 500 pips below the current level, in line with the dominant bullish strength. Finally, technical indicators are stuck around their midlines, barely bouncing while losing the bearish strength from the previous sessions. Overall, it seems the downward correction is complete and EUR/USD may soon resume its upward strength.

Immediate resistance can be found at around 1.1400, followed by the 1.1470 region, ahead of the yearly peak at 1.1573. A clear break below the latter should see EUR/USD extending gains well beyond the 1.1600 mark. Support, on the other hand, comes at around 1.1300, followed by the 1.1260 price zone. A break below the latter could open the door for a decline towards the 1.1160/70 price zone.

Economic Indicator

Fed Interest Rate Decision

The Federal Reserve (Fed) deliberates on monetary policy and makes a decision on interest rates at eight pre-scheduled meetings per year. It has two mandates: to keep inflation at 2%, and to maintain full employment. Its main tool for achieving this is by setting interest rates – both at which it lends to banks and banks lend to each other. If it decides to hike rates, the US Dollar (USD) tends to strengthen as it attracts more foreign capital inflows. If it cuts rates, it tends to weaken the USD as capital drains out to countries offering higher returns. If rates are left unchanged, attention turns to the tone of the Federal Open Market Committee (FOMC) statement, and whether it is hawkish (expectant of higher future interest rates), or dovish (expectant of lower future rates).

Read more.Next release: Wed May 07, 2025 18:00

Frequency: Irregular

Consensus: -

Previous: 4.5%

Source: Federal Reserve

US-China Trade War FAQs

Generally speaking, a trade war is an economic conflict between two or more countries due to extreme protectionism on one end. It implies the creation of trade barriers, such as tariffs, which result in counter-barriers, escalating import costs, and hence the cost of living.

An economic conflict between the United States (US) and China began early in 2018, when President Donald Trump set trade barriers on China, claiming unfair commercial practices and intellectual property theft from the Asian giant. China took retaliatory action, imposing tariffs on multiple US goods, such as automobiles and soybeans. Tensions escalated until the two countries signed the US-China Phase One trade deal in January 2020. The agreement required structural reforms and other changes to China’s economic and trade regime and pretended to restore stability and trust between the two nations. However, the Coronavirus pandemic took the focus out of the conflict. Yet, it is worth mentioning that President Joe Biden, who took office after Trump, kept tariffs in place and even added some additional levies.

The return of Donald Trump to the White House as the 47th US President has sparked a fresh wave of tensions between the two countries. During the 2024 election campaign, Trump pledged to impose 60% tariffs on China once he returned to office, which he did on January 20, 2025. With Trump back, the US-China trade war is meant to resume where it was left, with tit-for-tat policies affecting the global economic landscape amid disruptions in global supply chains, resulting in a reduction in spending, particularly investment, and directly feeding into the Consumer Price Index inflation.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.