EUR/USD Weekly Forecast: Optimism should harm US Dollar demand

- Inflation in the Euro Zone put the European Central Bank between a rock and a hard place.

- The August United States Nonfarm Payrolls report pointed to the end of monetary tightening.

- EUR/USD partially lost its bearish momentum, but the risk skews to the downside.

The EUR/USD pair recovered some ground this week after falling in the previous six but remains at the lower end of its latest range, heading into the weekly close trading at around 1.0810.

Tensions were high throughout the first half of the week as market players awaited critical macroeconomic data for direction while keeping an eye on Chinese developments. The Asian country struggles to revive growth, with local macroeconomic data confirming the economic setback and putting pressure on the People’s Bank of China (PBoC) to take more aggressive measures.

Inflation dictates direction

Inflation and employment figures took centre stage these last few days, and there were no good news, particularly for the Euro Zone. Germany reported on Wednesday the preliminary estimate of the August Harmonized Index of Consumer Prices (HICP), which grew by 6.4% YoY and 0.4% MoM, higher than anticipated. Finally on Thursday, Eurostat announced that the EZ HICP rose 5.3% YoY in August, higher than the 5.1% expected by financial markets. The core annual inflation printed at 5.3%, as expected. Additionally, the HICP increased by 0.6% on a monthly basis, much higher than the expected decline of 0.1%.

That creates an unsolvable dilemma for the European Central Bank (ECB), which is trying to pause monetary tightening in light of the economic slowdown. Yet if they halt rate increases, inflation may well return to uncontrollable levels.

As per the US, the country released the July Personal Consumption Expenditures (PCE) Price Index, the Federal Reserve's (Fed) favorite inflation measure. As expected, the core PCE Price Index was up by 0.2% MoM and 4.2% YoY, although higher than the 4.1% posted in June. The readings had a limited impact on financial markets, as investors considered they were not enough to change the Fed’s current path. On a negative note, the Q2 Gross Domestic Product was downwardly revised to 2% from a previous estimate of 2.2% for the three months to June. The annual comparison came down from 2.4% to 2.1%. However, the numbers failed to trigger recession-related concerns.

Encouraging US employment data

The US also unveiled employment-related figures. The ADP Employment Change survey showed that the private sector added 187K new jobs in August, below the 195K expected or the previous 371K. Weekly unemployment rates printed at 228K, better than anticipated, while on Friday, the country released the August Nonfarm Payrolls (NFP) report. The headline reading resulted better than anticipated, with 187K new jobs added in the month, according to the US Bureau of Labor Statistics (BLS). Additionally, the Unemployment Rate rose to 3.8% from 3.5% in July, while the Labor Force Participation Rate improved to 62.8% from 62.6%. Finally, Average Hourly Earnings edged lower to 4.3% on a yearly basis from 4.4%, signaling easing inflationary pressures from the labor side.

The employment report boosted the mood ahead of the weekly close, as it pretty much confirmed the Fed could hold its fire in September, while odds for a rate hike in November decreased. The end of the tightening cycle is finally here.

Yields were down and stocks up, although equities lacked momentum enough to confirm a USD sell-off. The Dollar quickly trimmed NFP-inspired losses but held ground following a better-than-anticipated ISM Manufacturing PMI, which improved to 47.6 from the previous 46.4.

The upcoming week will feature some relevant reports. The US will release the August ISM Services PMI on Wednesday when the EU will unveil July Retail Sales. On Thursday, the Euro Zone will publish the final estimate of the Q2 GDP, while on Friday, Germany will release the final estimate of the August HICP.

EUR/USD technical outlook

The EUR/USD pair trades below the 23.6% Fibonacci retracement of the 1.1275/1.0765 slump at 1.0885, a level that EUR/USD was unable to overcome following the encouraging employment report. Mid-week, the pair topped at 1.0944, just below the 38.2% retracement of the mentioned slide at 1.0959.

Technical readings in the weekly chart turned neutral, although the upside seems limited. Indicators bounced from around their midlines, still lacking enough positive momentum to confirm another leg north. At the same time, a mildly bearish 20 Simple Moving Average (SMA) caps the upside, while the 100 SMA maintains its bearish slope below the current level.

The risk is skewed to the downside in the daily chart, as EUR/USD met sellers around a directionless 100 SMA, while the 20 SMA gains downward strength below it. Meanwhile, technical indicators remain directionless within negative levels, failing to provide clear directional clues.

Support can be found at 1.0800 and the 1.0765 August low. Beyond the latter, the long-term bearish case will likely accelerate. Sellers await around the 1.0930/40 price zone, while beyond it, investors will be looking for a test of the 1.1000 mark.

EUR/USD sentiment poll

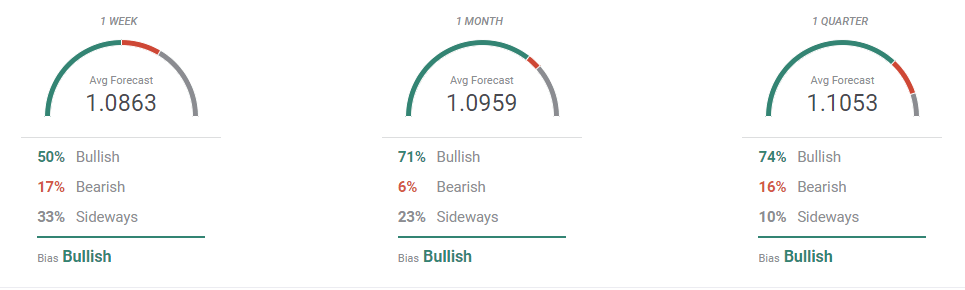

According to the FXStreet Forecast Poll, EUR/USD could recover in the upcoming weeks, given that the pair is seen at higher levels in all the time frames under study. For next week, the pair is seen averaging 1.0864, with 50% of the polled experts betting for higher levels. By the end of the quarter, the average target increases to 1.1053, with buyers up to 74%. A word of warning, bulls seem encouraged by optimism and not taking into account the broad Euro weakness. Advances could take place, but the Euro is not strong enough at the time being.

The Overview chart offers a neutral-to-bullish stance. The weekly moving average picked up, but the longer ones remain flat. In the weekly and monthly views, the pair is hardly seen below 1.0800, while in the quarterly perspective, the base of potential ranges is located at around 1.0600.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.