EUR/USD Weekly Forecast: Central banks, inflation and growth to rock financial boards

- The Federal Reserve and the European Central Bank will announce their monetary policy decisions next week.

- The United States will publish the Q2 Gross Domestic Product and an inflation update.

- EUR/USD approaches the edge of the bullish cliff, central banks to make it or break it.

The EUR/USD pair trimmed part of its United States (US) inflation-related gains, and after peaking at 1.1275, it fell towards the 1.1100 region, trading barely above the latter as the week ends.

US Dollar corrects extreme oversold conditions

Speculative interest failed to push the US Dollar further lower, despite several attempts to do so throughout the first half of the week, to finally give up on Thursday. The US Dollar recovered with little supporting such a rally. An immediate catalyst for the USD strength was a better-than-anticipated weekly employment report, as Initial Jobless Claims rose by 228K in the week ended July 14, beating expectations and signaling the labor market remains tight. Stops got triggered, and the Greenback extended its rally throughout the day, holding ground on Friday.

US data released in the past few days was tepid, to say the least. Beyond upbeat employment figures, the country published June Retail Sales, which rose a modest 0.2% MoM. Industrial Production in the same period decreased by 0.5%, while Capacity Utilization was up 78.9%. Housing-related numbers missed the market expectations, while the Philadelphia Fed Manufacturing Survey printed at -13.5 in July, worse than the -10 anticipated.

Across the pond, the Eurozone confirmed that the Harmonized Index of Consumer Prices (HICP) rose by 5.5% in June. However, the core annual reading was upwardly revised from 5.4% to 5.5%. Additionally, the German Producer Price Index (PPI) rose by 0.1% YoY in June, higher than anticipated.

In general, financial markets remained optimistic. US stock indexes rallied to fresh multi-month highs, with the Dow Jones Industrial Average (DJIA) and the S&P 500 retaining gains at the end of the week and the Nasdaq Composite trading flat. Government bond yields found their footing by the end of the week, with the US Treasury yield curve still inverted.

Central Banks take the spotlight

The Federal Reserve (Fed) and the European Central Bank (ECB) will have monetary policy meetings and announce their decisions next week. The Fed is widely anticipated to hike rates by 25 basis points (bps), although market participants will be looking for signs of whether another rate hike afterwards remains on the table. The ECB is expected to follow the same path, with market participants also expecting at least one more hike in September.

On the one hand, US inflation has decreased sufficiently to allow policymakers to end the tightening cycle, but persistent tight labor conditions pose a risk to inflation. Therefore, the American central bank is reluctant to announce an end to the current monetary policy.

On the other, European price pressures remain too elevated, while local policymakers expect it to stay high for an extended period of time. Their counterweight is a recession and/or a financial crisis.

In fact, global central banks are moving within a thin line and have to maintain a delicate balance to tame inflation without triggering economic chaos. That remains the main reason why every word or hint is intensely scrutinized and quickly priced in.

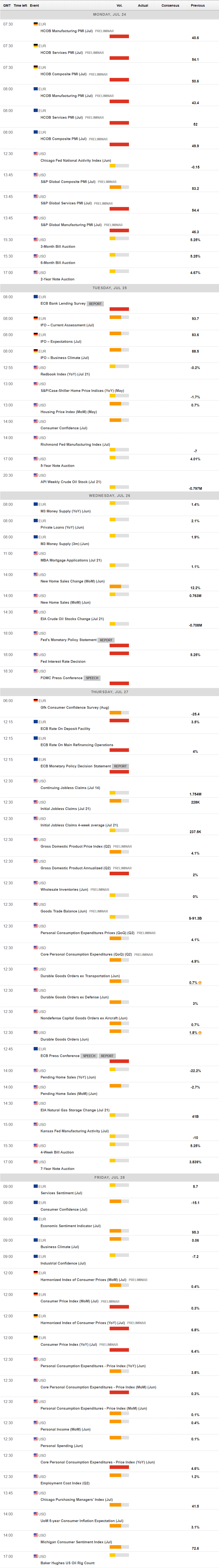

Beyond central banks’ announcements, there will be a couple of relevant macroeconomic figures out. S&P Global will release the preliminary estimates of the July PMIs. Also, the United States will publish the preliminary estimate of the second quarter Gross Domestic Product (GDP) and the June Personal Consumption Expenditures (PCE) Price Index, the Fed’s favorite inflation measure. Finally, Germany will unveil the preliminary estimate of its July Harmonized Index of Consumer Prices (HICP), previously at 6.4% YoY.

EUR/USD technical outlook

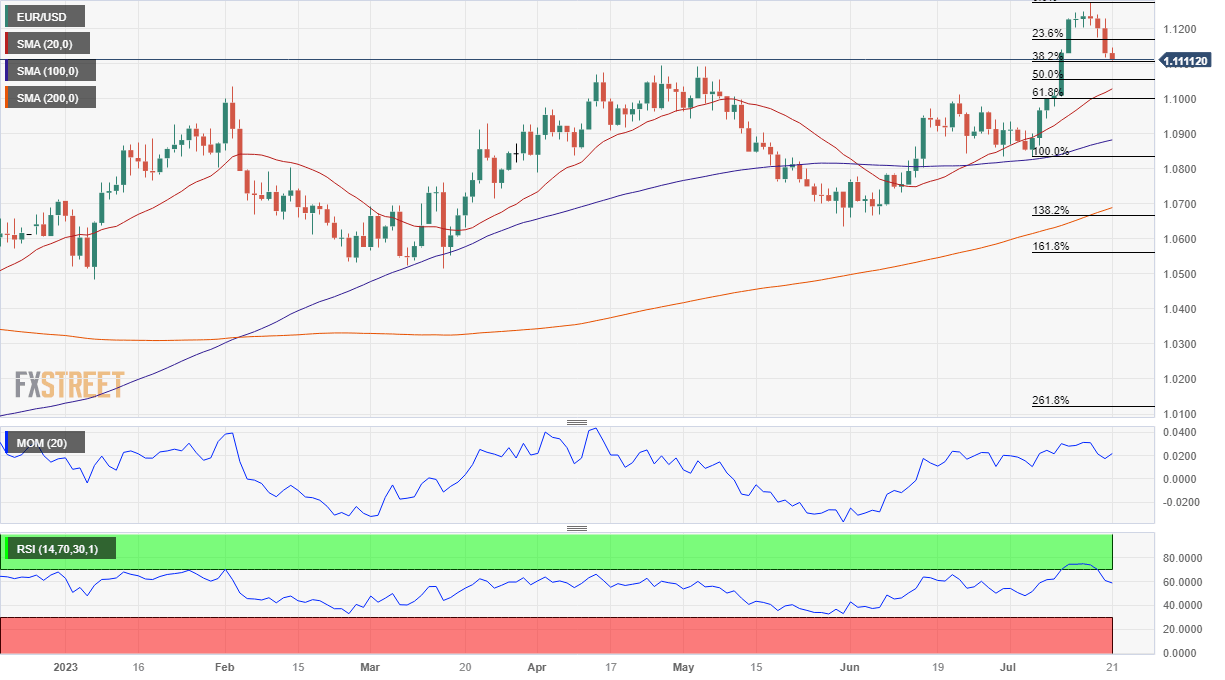

Generally speaking, and on the back of the previous weekly slide, the latest EUR/USD slump seems corrective. The pair trades a few pips above the 38.2% Fibonacci retracement of its 1.0833/1.1275 rally at 1.1105, while the next Fibonacci support comes at 1.1053.

From a technical point of view, the weekly chart shows that the pair was unable to hold ground above a directionless 200 SMA, currently standing at 1.1190. At the same time, the 20 SMA offers a firmly bullish slope well below the current level while above the 100 SMA, somehow suggesting bulls have not yet given up. Finally, technical indicators turned lower. The Momentum indicator is currently approaching its 100 level from above, yet the Relative Strength Index (RSI) indicator barely pulled back from overbought levels, limiting the chances of a steeper decline.

On a daily basis, the risk of a steeper decline seems limited. EUR/USD develops far above bullish moving averages, with the 20 SMA above the longer ones and at 1.1027. At the same time, technical indicators have turned flat well into positive ground after correcting extreme conditions, suggesting sellers are not willing to push it further down. Still, the pair closed in the red for a fourth consecutive day while posting lower lows and lower highs.

A more relevant support level comes at 1.1000, as the 61.8% retracement of the aforementioned rally converges with the psychological threshold. The level stands as a potential bearish target in the case of a bearish breakout following central banks’ decisions. Once below the level, the slide could continue towards the 1.0890/1.0920 price zone, as bulls will likely retreat.

To the upside, investors will become more confident about a sudden recovery above 1.1200, although the pair needs to stabilize beyond 1.1250 to continue advancing, with 1.1400 then in sight.

EUR/USD sentiment poll

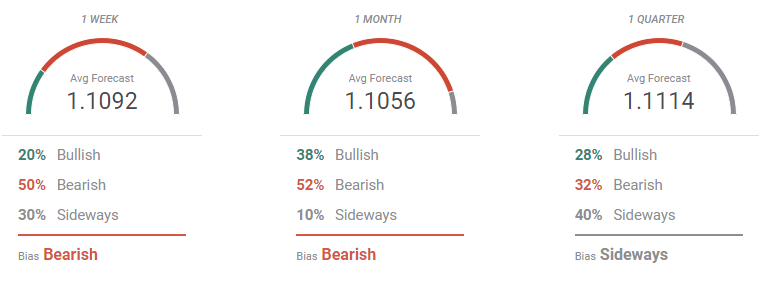

The FXStreet Forecast Poll suggest the decline will continue in the near term. EUR/USD is seen on average below the 1.1100 level in the weekly and monthly views, although above the threshold in the quarterly perspective. Bear account for 50% and 52%, respectively in the nearest views, while decreasing to 32% in the longer term.

The Overview chart confirms the ongoing corrective decline, as the weekly moving average has turned sharply lower, although bets below 1.1000 are inexistent. The monthly and quarterly moving averages maintain their bullish slopes, in line with an upcoming recovery. Finally, the potential range in the monthly view goes from 1.0600 to 1.1400, with most targets accumulating between 1.0800 and 1.1100. The range is lifted in the quarterly perspective, as most targets accumulate above the 1.1000 threshold.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.