EUR/USD Price Forecast: Once 1.1600 is cleared, the focus shifts to 1.1800

- EUR/USD traded in an inconclusive fashion below the 1.1600 hurdle on Tuesday.

- The US Dollar could not sustain an earlier move past the 99.00 barrier.

- President Trump said there are a few candidates to replace Chair Powell.

The Euro (EUR) improved modestly on Tuesday, quickly setting aside the poor start to the week vs. the US Dollar (USD). That said, EUR/USD hovered near the 1.1600 region without clear direction, looking to reignite the strong upside impulse observed in the wake of the release of the US jobs report on Friday.

Trade pact breathes life into the US Dollar

In Washington, the newly inked US–European Union trade framework handed the Greenback fresh impetus in past days. Under the agreement, most European exports to the United States now face a 15% tariff—up from 10% in April but below the 30% threat first mooted. Key sectors such as aerospace, semiconductors, chemicals and select agricultural goods won tariff reprieves, while steel and aluminium remain taxed at 50%.

In return, Europe has pledged to purchase $750 billion of American energy, boost defence procurement from US firms and channel over $600 billion into direct investment stateside.

Not everyone in Europe cheered. German Chancellor Friedrich Merz warned that higher US levies would strain already fragile industrial output, and French President Emmanuel Macron called the deal “a dark day” for the Continent—reflecting growing unease about its long-term costs.

US jobs data cools Dollar’s rally—and tips the scale toward rate cuts

Friday’s US Department of Labor (DOL) report showed the economy added just 74K jobs in July, adding to a sharp downward revision from the previous month’s readings—and enough to mull further interest-rate relief at the Federal Reserve (Fed).

That undercut prior optimism from robust Automatic Data Processing (ADP) private payroll figures and stronger-than-expected Q2 GDP, while the latest Personal Consumption Expenditures (PCE) inflation gauge ticked up only slightly in June.

Central banks stand pat

Policymakers on both sides of the Atlantic held fire last month.

At the Federal Reserve, Chair Jerome Powell maintained a cautious stance, even as Governors Christopher Waller and Michelle Bowman registered dissenting votes—underscoring uncertainty over the timing of any rate cuts.

In Europe, European Central Bank (ECB) President Christine Lagarde described euro-area growth as “solid, if not a little better,” but markets have pushed back expectations for rate reductions from autumn to spring 2026.

Speculators retreat from Euro longs

Data from the Commodity Futures Trading Commission (CFTC) through July 29 show speculators scaling back their bullish bets on the EUR. Net long positions fell to about 123.3K contracts—the lowest in three weeks—while institutional net shorts eased to around 175.8K contracts. Additionally, open interest declined for the first time in six weeks to roughly 828.6K contracts.

Technical levels to watch

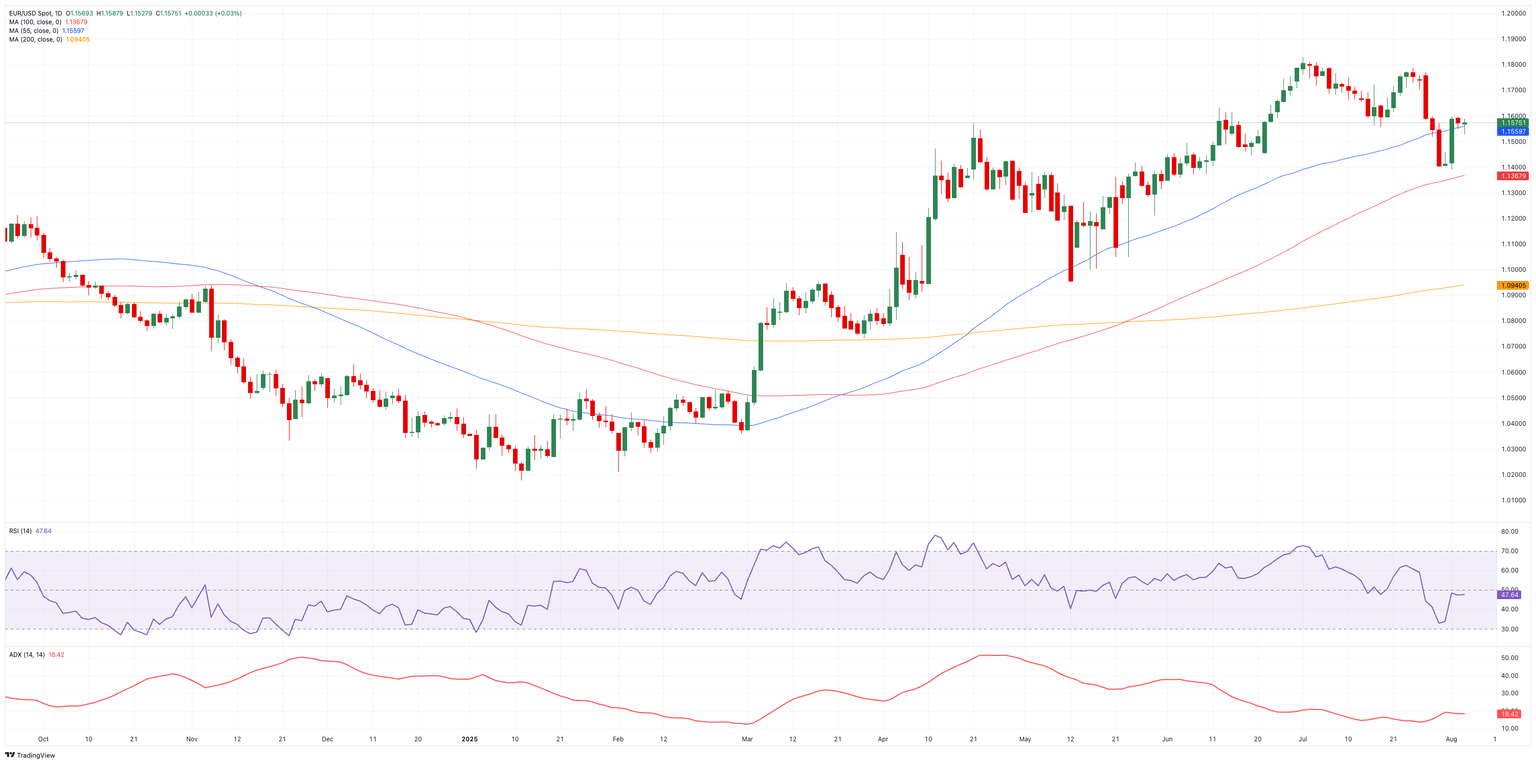

The first resistance sits at the weekly high of 1.1788 (July 24), seconded by the 2025 ceiling of 1.1830 (July 1). Beyond that, traders will eye the September 2021 top at 1.1909 (September 3), and, ultimately, the psychological 1.2000 level.

On the other hand, immediate support comes from the August valley of 1.1391 (August 1), ahead of the transitory 100-day simple moving average (SMA) at 1.1375, with the weekly trough at 1.1210 (May 29) lying just beneath.

As for momentum, the Relative Strength Index (RSI) hovers just below 48—suggesting there’s still room for a pullback—while the Average Directional Index (ADX) around 21 points to a trend that hasn’t yet found firm footing.

Outlook: Dollar dynamics to dictate direction

Absent a dovish surprise from the Federal Reserve or a thaw in transatlantic trade tensions, EUR/USD is likely to grind within its recent range. Traders will be watching US Dollar strength for cues—and bracing for the next catalyst to spark a clear directional move.

Euro FAQs

The Euro is the currency for the 19 European Union countries that belong to the Eurozone. It is the second most heavily traded currency in the world behind the US Dollar. In 2022, it accounted for 31% of all foreign exchange transactions, with an average daily turnover of over $2.2 trillion a day. EUR/USD is the most heavily traded currency pair in the world, accounting for an estimated 30% off all transactions, followed by EUR/JPY (4%), EUR/GBP (3%) and EUR/AUD (2%).

The European Central Bank (ECB) in Frankfurt, Germany, is the reserve bank for the Eurozone. The ECB sets interest rates and manages monetary policy. The ECB’s primary mandate is to maintain price stability, which means either controlling inflation or stimulating growth. Its primary tool is the raising or lowering of interest rates. Relatively high interest rates – or the expectation of higher rates – will usually benefit the Euro and vice versa. The ECB Governing Council makes monetary policy decisions at meetings held eight times a year. Decisions are made by heads of the Eurozone national banks and six permanent members, including the President of the ECB, Christine Lagarde.

Eurozone inflation data, measured by the Harmonized Index of Consumer Prices (HICP), is an important econometric for the Euro. If inflation rises more than expected, especially if above the ECB’s 2% target, it obliges the ECB to raise interest rates to bring it back under control. Relatively high interest rates compared to its counterparts will usually benefit the Euro, as it makes the region more attractive as a place for global investors to park their money.

Data releases gauge the health of the economy and can impact on the Euro. Indicators such as GDP, Manufacturing and Services PMIs, employment, and consumer sentiment surveys can all influence the direction of the single currency. A strong economy is good for the Euro. Not only does it attract more foreign investment but it may encourage the ECB to put up interest rates, which will directly strengthen the Euro. Otherwise, if economic data is weak, the Euro is likely to fall. Economic data for the four largest economies in the euro area (Germany, France, Italy and Spain) are especially significant, as they account for 75% of the Eurozone’s economy.

Another significant data release for the Euro is the Trade Balance. This indicator measures the difference between what a country earns from its exports and what it spends on imports over a given period. If a country produces highly sought after exports then its currency will gain in value purely from the extra demand created from foreign buyers seeking to purchase these goods. Therefore, a positive net Trade Balance strengthens a currency and vice versa for a negative balance.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.