EUR/USD Price Forecast: Gains look limited by 1.1570

- EUR/USD came under renewed downside pressure and flirted with 1.1300.

- The US Dollar regained traction on the back of easing jitters around US-China crisis.

- Advanced PMIs in the US and the euro area came in mixed in April.

The euro came under further pressure on Wednesday, with EUR/USD suffering the continuation of the upside momentum in the US Dollar (USD) and slipping back to the boundaries of the 1.1300 contention zone.

Indeed, a broad rebound in the US Dollar, buoyed by improving risk sentiment, alleviated tariff concerns and mitigated fears surrounding the Trump-Powell conflict helped drag the pair lower, while lifting the Dollar Index (DXY) to weekly highs around 99.80.

Tariff volatility lingers

While the broader scenario surrounding tariffs remained unchanged, market participants saw their sentiment improve after the White House hinted at some potential reduction in tariffs on Chinese goods.

The above came as a continuation of US Treasury Secretary comments on Tuesday, who signalled a potential de-escalation in the US-China trade dispute.

Policy crosscurrents: Fed holds, ECB cuts

The Federal Reserve (Fed) kept rates steady at 4.25%–4.50%, with Chair Jerome Powell stressing the primacy of inflation control, even as rising tariffs risk stagflation. Powell reiterated that future policy moves will hinge on data, highlighting the Fed’s balancing act amid growing political and economic headwinds.

Across the Atlantic, the European Central Bank (ECB) delivered a widely expected 25bp rate cut to 2.25%, dropped the term “restrictive” from its policy language, and maintained a data-dependent stance—prompting markets to price in a potential follow-up move in June.

Trump vs. Powell: Truce?

Contributing to the upbeat mood among market participants, President Trump said he is not planning on firing Fed’s Chief Jerome Powell. Trump’s comments indeed soothed renewed fears surrounding the independence of the central bank.

Speculative flows build

CFTC data shows euro bullish bets climbing, with net long positions reaching 69.3K contracts—the highest since September 2024. Commercial hedgers, meanwhile, deepened their shorts to nearly 118K contracts, as open interest surged past 708K—its strongest reading in over a month.

Technical landscape

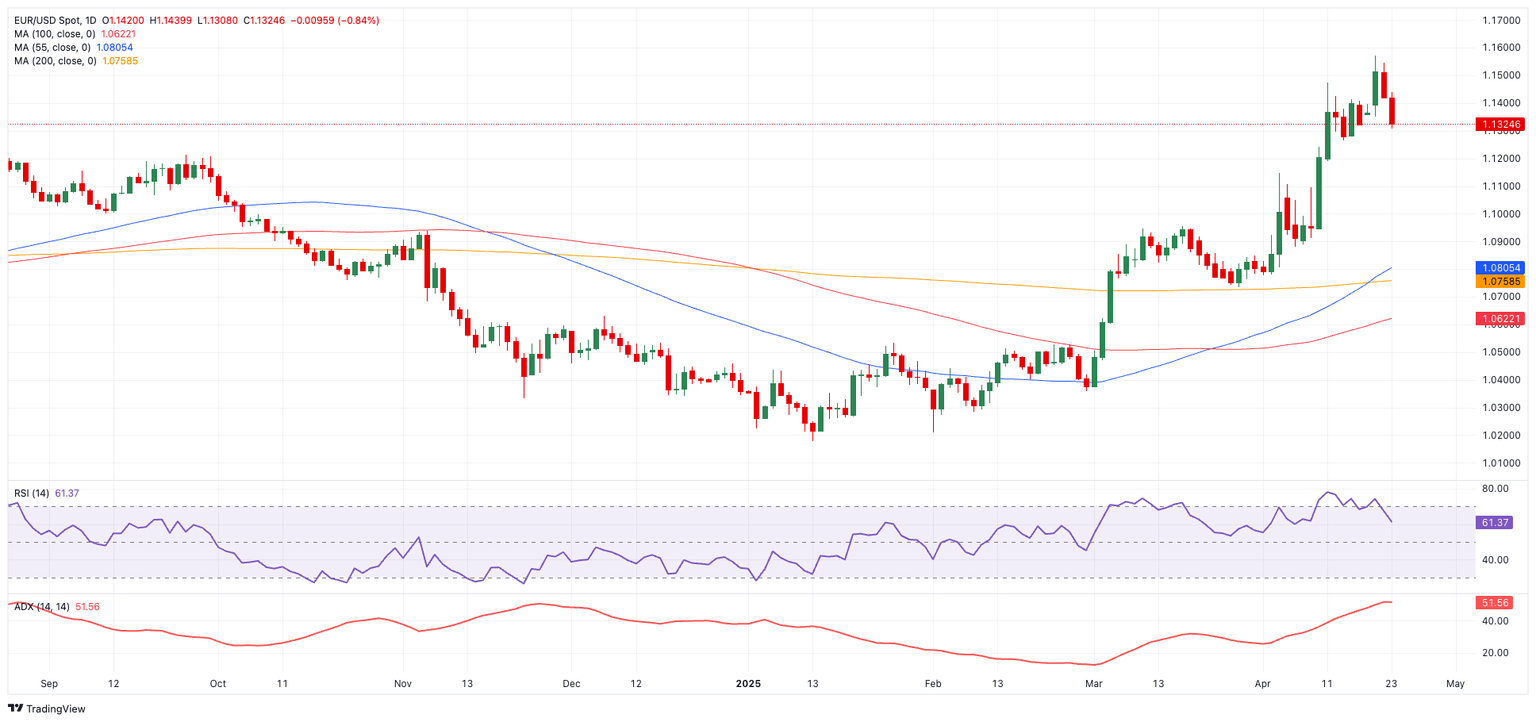

EUR/USD faces immediate resistance at the 2025 high of 1.1572, followed by the 1.1600 milestone, and the October 2021 top at 1.1692.

On the flip side, initial support lies at the 200-day SMA (1.0764), with further downside cushioning near the weekly low at 1.0732. (March 27)

Momentum readings remain constructive: The Relative Strength Index (RSI) has cooled around the 62 region, while a robust Average Directional Index (ADX) reading above 51 signals a strong underlying trend.

EUR/USD daily chart

Outlook: Volatility ahead

With US trade policy and central bank divergences still top of mind, EUR/USD is poised for further volatility. Until clearer guidance emerges from the Fed and ECB, or a breakthrough on tariffs, the pair is likely to remain hostage to headline risk.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.