EUR/USD Price Forecast: Firmer USD amid mounting trade concerns

EUR/USD Current price: 1.0316

- US President Donald Trump set to announce fresh tariffs on steel, aluminum.

- ECB President Christine Lagarde will testify before the European Parliament.

- EUR/USD at risk of retesting the January monthly low at 1.0177.

The US Dollar (USD) gapped higher at the opening for a second consecutive week, following comments from the United States (US) President Donald Trump. Trump said on Sunday that he would announce on Monday new 25% tariffs on all steel and aluminum imports into the US, adding he would announce reciprocal tariffs that would match levies from any other country on Tuesday or Wednesday.

The EUR/USD pair fell to an intraday low of 1.0317 during Asian trading hours amid a souring market mood, which also put pressure on local stock markets. Concerns eased after London’s opening, helping Asian indexes recover unevenly as European ones hold into the green. As a result, the EUR/USD pair filled the gap and hovers around the 1.0310 level ahead of the American opening.

Data-wise, the Eurozone released February Sentix Investor Confidence, which resulted at 48.6, missing expectations of 49.7 and below the downwardly revised January reading of 49.

European Central Bank (ECB) President Christine Lagarde is due to speak about the ECB Annual Report at the European Parliament during American trading hours, while the US calendar has nothing relevant to offer until Wednesday when the country will publish the January Consumer Price Index (CPI).

EUR/USD short-term technical outlook

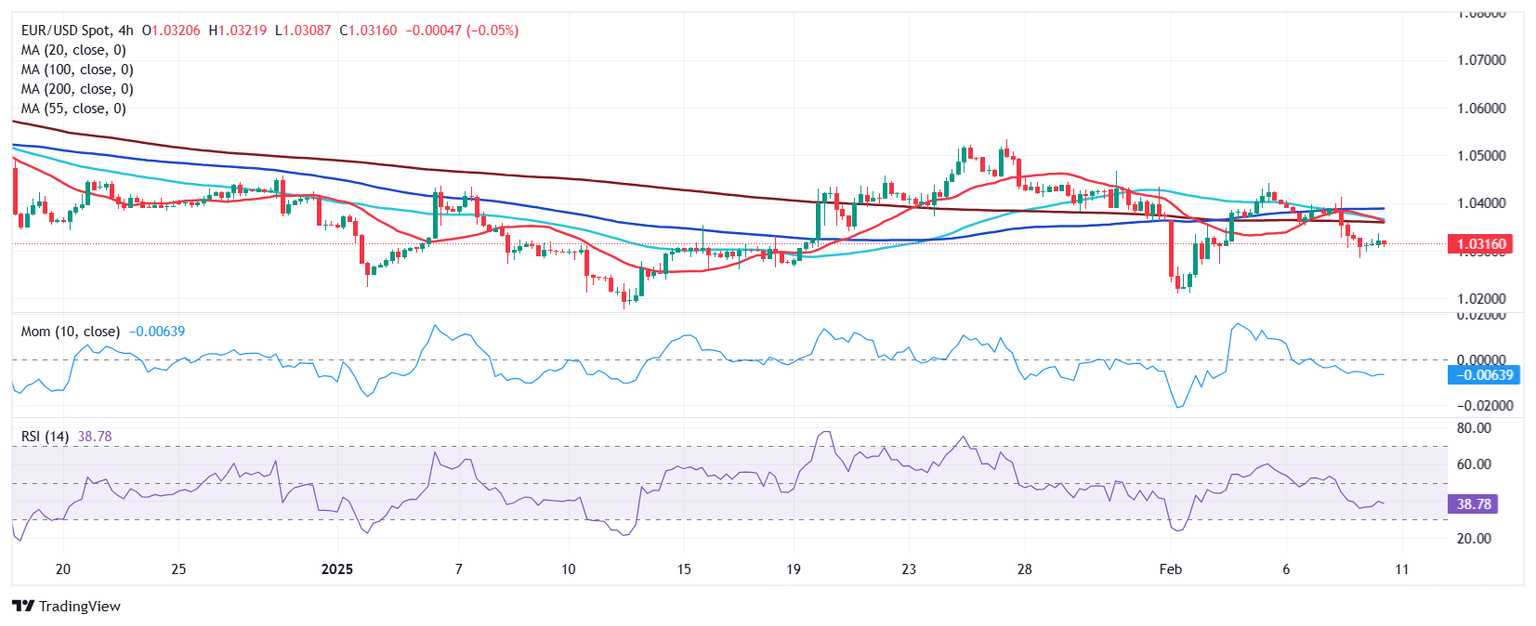

From a technical point of view, the daily chart for the EUR/USD pair shows it develops below Friday’s close, and the lower low opens the door for another leg south. Technical indicators maintain firm downward slopes within negative levels, in line with prevalent selling interest. Finally, the pair develops below all its moving averages, with the 100 and 200 Simple Moving Averages (SMAs) heading firmly south, far above the current level, while a flat 20 SMA provides dynamic resistance at 1.0380.

In the near term, and according to the 4-hour chart, the risk for EUR/USD skews to the downside. Technical indicators have turned flat well below their midlines after correcting oversold conditions, while the pair develops far below all its moving averages, which anyway are confined to a tight 50 pips range. A break below the intraday low should open the door for a retest of the January monthly low at 1.0177.

Support levels: 1.0275 1.0230 1.0180

Resistance levels: 1.0340 1.0385 1.0420

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.