EUR/USD Price Forecast: Consolidation continues, bulls hold the grip

EUR/USD Current price: 1.1397

- Sentiment related to US tariffs keeps leading financial boards ahead of first-tier data.

- US Consumer Confidence is expected to have fallen further in April.

- EUR/USD consolidates around 1.1400, additional gains in the docket.

The EUR/USD pair peaked at 1.1425 late on Tuesday, easing afterwards towards the current 1.1380 price zone. In the absence of relevant data and ahead of first-tier releases, financial markets swing at the rhythm of sentiment, the latter directly linked to United States (US) tariffs’ headlines.

The latest on the matter came from Treasury Secretary Scott Bessent, who said on Monday that the White House is in contact with China but added that it’s up to Beijing to take the first step in de-escalation.

News reporting progress in negotiations between the US and trading partners brought some relief to financial markets and helped the US Dollar (USD) trim part of its recent losses.

Data-wise, the Eurozone (EU) released April Consumer Confidence, which remained steady at -16.7. The Economic Sentiment Indicator for the same month eased from 95 in March to 93.6, missing expectations of 94.5.

The American session will bring the JOLTS Job Openings report and CB Consumer Confidence, foreseen contracting further in April to 87.7 from the previous 92.9

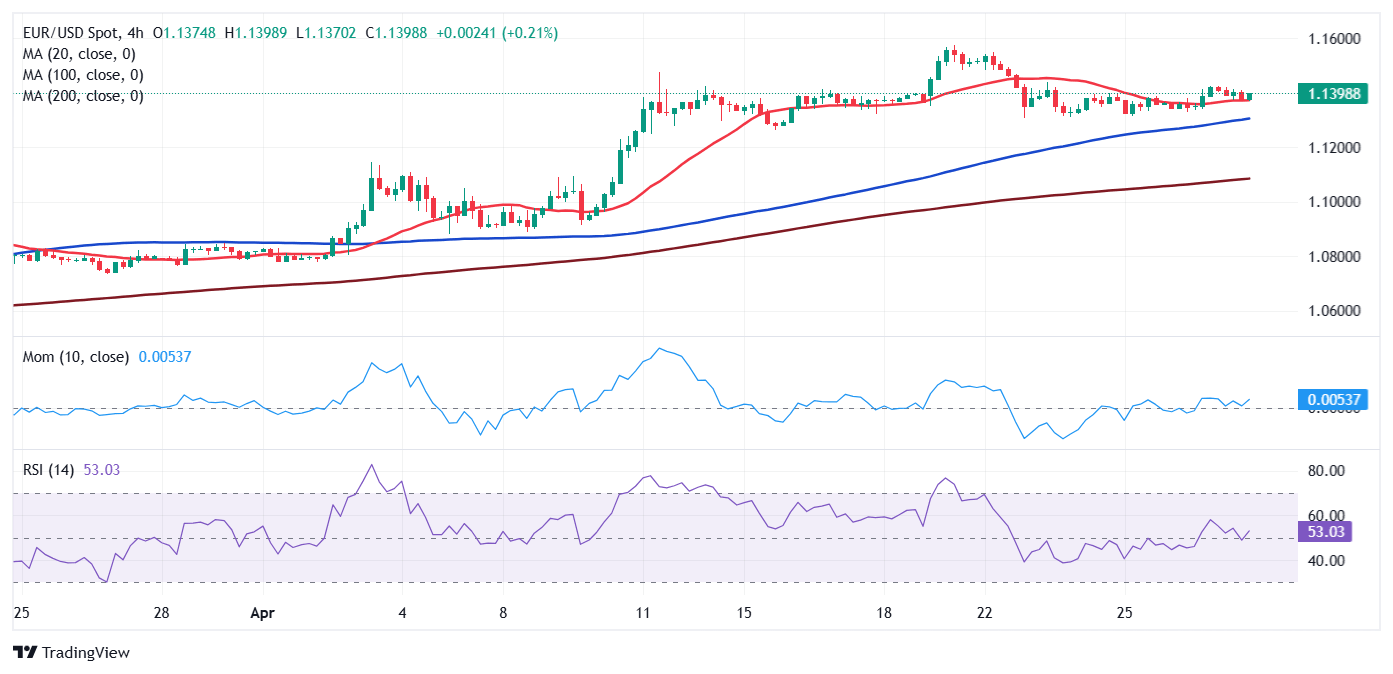

EUR/USD short-term technical outlook

The daily chart for the EUR/USD pair shows it’s losing some of its upward strength, but holding on to higher ground. Technical indicators turned marginally lower, but remain well above their midlines and without clear downward strength. At the same time, the pair keeps developing above all its moving averages, with the 20 Simple Moving Average (SMA) accelerating north far above the 100 and 200 SMAs, and currently at 1.1240.

The near-term picture is bullish, although there’s an evident lack of momentum. EUR/USD finds intraday support around a mildly bullish 20 SMA, while the longer moving averages advance below it. At the same time, technical indicators grind higher, yet barely move above their midlines. Overall, it seems that buyers will keep waiting before making up their minds.

Support levels: 1.1330 1.1285 1.1240

Resistance levels: 1.1425 1.1470 1.1510

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.