EUR/USD Forecast: Time to sell? Yellen's inflation and embrace set to outweigh NFP boost

- EUR/USD has been in retreat from Friday's NFP-induced levels.

- US Treasury Secretary Yellen's embrace of higher inflation is supporting the dollar.

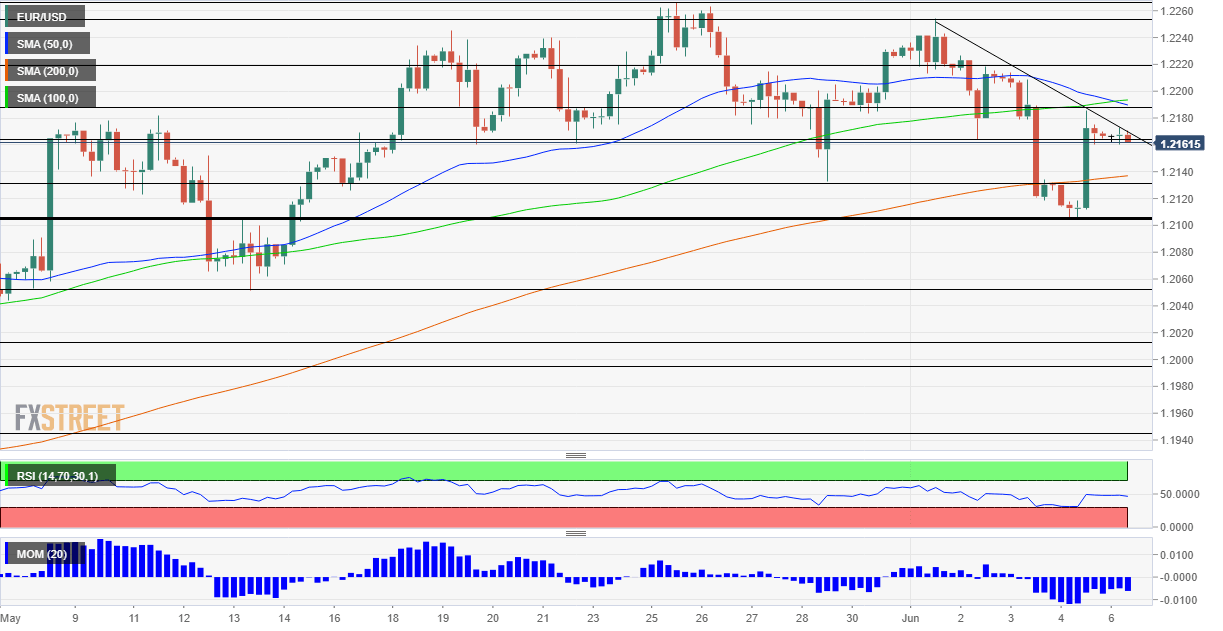

- Monday's four-hour chart is showing downtrend resistance looms over the pair.

Higher rates would a "plus" for the US – these comments by Treasury Secretary Janet Yellen are already supporting the dollar. More may be in store. Yellen has clout due to her current and also former job as Chair of the Federal Reserve. It is no the first time that she provided remarks related to her former job, but she apologized for any misunderstanding after her previous comments. She is not doing so now.

Higher borrowing costs in response to more robust inflation support the greenback and counter the blow that the currency received from Friday's Nonfarm Payrolls. The American economy gained only 559,000 jobs in May, below 664,000 expected and on top of a disappointing increase in April.

That sent the dollar down ahead of the weekend and allowed EUR/USD to jump from near 1.21 to above 1.2150. However, that NFP also contained a silver lining – earnings rose by 0.7%, more than projected – and most importantly, signaling an increase in prices down the line. When workers have more money in their pockets, the consumer more.

See NFP Quick Analysis: Dollar buying opportunity? Two reasons why dollar downing is likely temporary

US Consumer Price Index figures for May are due out only on Thursday, but Yellen's comments help refocus the conversation. Another event due that day is the European Central Bank's rate decision.

The Frankfurt-based institution will likely maintain its policy unchanged as the old continent emerges from the coronavirus crisis after stumbling through the winter. Business sentiment figures have been upbeat and Monday's release of the Sentix Investor Confidence will likely support that view.

However, hopes for a vaccine-led recovery are already priced into the euro.

All in all, EUR/USD may come under additional pressure – at a minimum, correcting some of Friday's gains.

EUR/USD Technical Analysis

Euro/dollar is capped by a downtrend resistance line that was formed in early June and dropped under the 50 and 100 simple moving averages on the four-hour chart. With downside momentum also pressuring the pair, bears are in the lead.

Some support awaits at 1.2130, a swing low from late May, followed by 1.2105, a clear separator of ranges that is the current monthly low. The next levels to watch are 1.2055 and 1.2015.

Some resistance is at 1.2185, Friday's peak, followed by 1.220 and 1.2155, which held EUR/USD down in the past week.

EUR/USD Weekly Forecast: Pressure of Fed after disappointing NFP, eyes on ECB

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Yohay Elam

FXStreet

Yohay is in Forex since 2008 when he founded Forex Crunch, a blog crafted in his free time that turned into a fully-fledged currency website later sold to Finixio.