S&P 500 vs Gold: The reality check you need

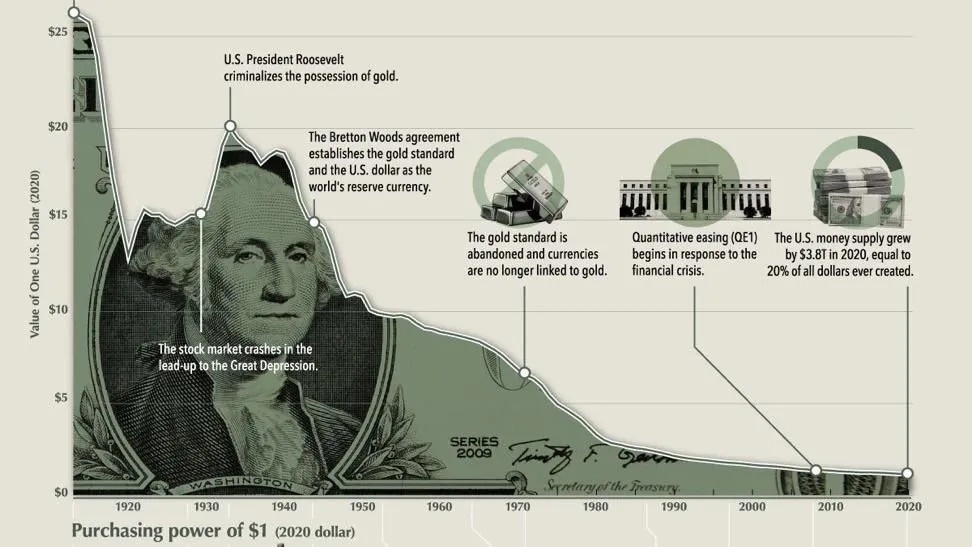

Most investors measure performance in dollars. That’s a mistake. Because the dollar is losing value every year.

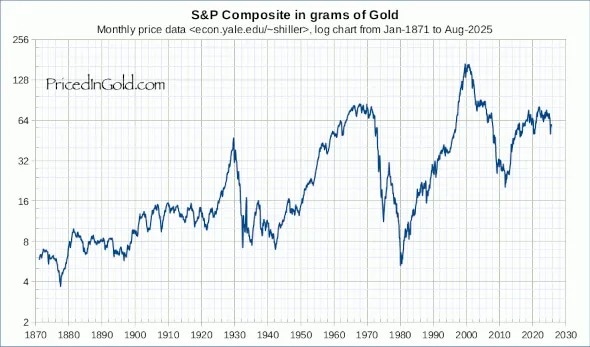

I used to feel satisfied tracking double-digit returns in my stock portfolio. Then I converted every gain into ounces of gold. Suddenly, I understood the broader market hadn’t moved in nearly two decades. It changed how I viewed money, but also how I viewed risk.

Gold has quietly delivered steady gains while stocks have stagnated in real terms.

- Gold CAGR since 1971: 8.9%

- S&P 500 CAGR since 1971: 8.1%

- Since 2006 the S&P 500 priced in gold is flat

- Year-to-date, gold is outpacing stocks

- Housing priced in gold also is almost unchanged over 20 years.

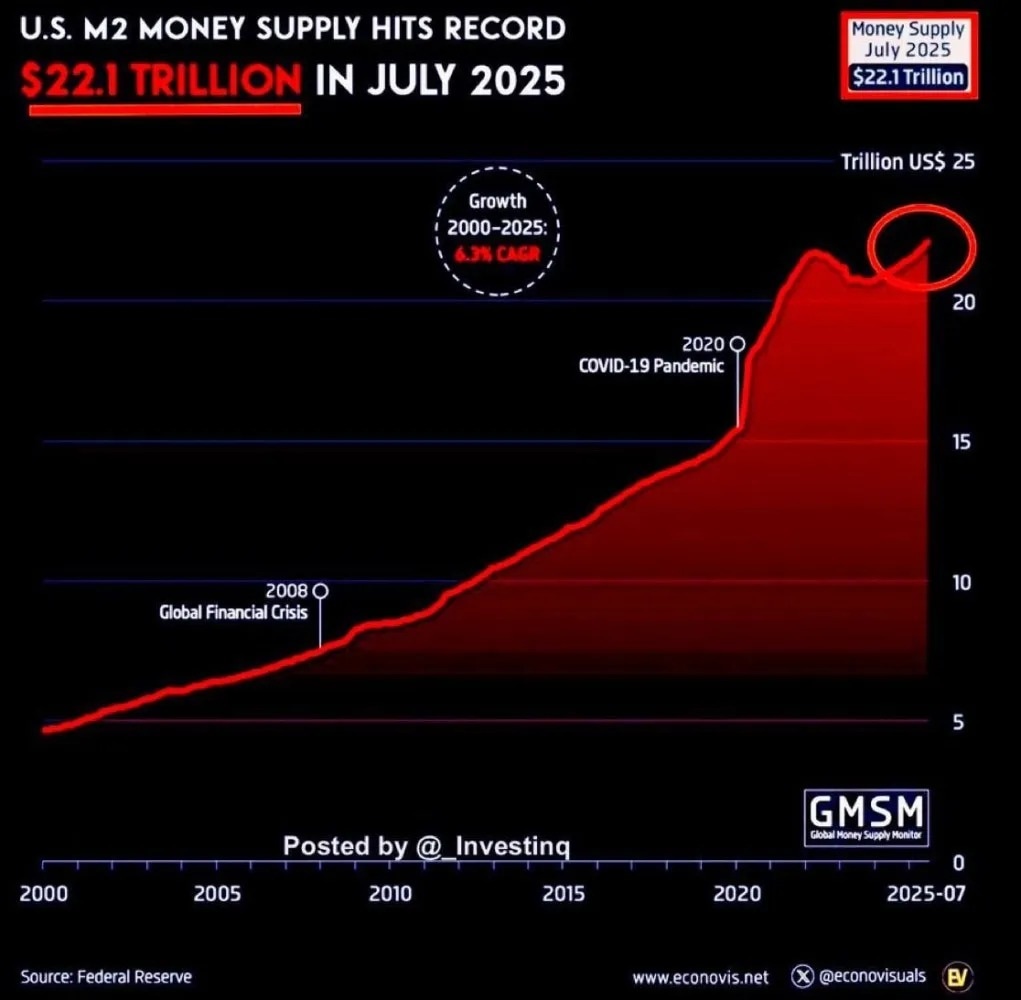

The underlying driver is the same: steady money supply growth averaging 5% annually, accelerated during COVID. Risk-on assets like stocks and risk-off assets like gold now hit all-time highs simultaneously. This is stagflationary and alone a major cause for concern but the point for today is that out of the two, only gold preserves real value.

- Spot gold has surpassed $4,200/oz - +10,000% since the Nixon Shock in 1971

- Ultra-low ‘real’ rates and massive asset bubbles coincide with declining fiat confidence

- Historical S&P 500-to-gold ratio peaks signaled major economic turning points (1929, 1971, 2000)

- Central banks continue stockpiling gold at record pace

- Retail investors remain heavily exposed to stocks priced in a debasing currency

This isn’t just about inflation, it’s about a slow erosion of fiat trust.

Gold shows the real purchasing power of money, unlike stocks or bonds priced in dollars. The smartest investors are thinking beyond percentages, focusing on long-term preservation of wealth in real terms.

What can you do in practical terms?

- Track assets in ounces, not dollars

- Use gold as a core hedge against currency debasement

- Avoid overexposure to paper assets tied to government promises

History repeats. The S&P 500-to-gold ratio has peaked three times before, each ushering in a decade-long market shift. Are you prepared for a fourth?

Author

Matt Oliver

Independent Analyst

Precious Metals Analyst managing proprietary trading accounts and a private investment portfolio. I use a blend of macroeconomics, fundamentals, value investing, technicals, and strict risk management.