The weekender: When the market hits the bell lap and still finds another gear

Finds another gear

The market entered the final bend of the year like a tired marathoner who suddenly hears the crowd again. What appeared as cautious AI exhaustion to start the week then turned into a late-inning surge. The last full, fully staffed trading week delivered a rare trifecta: record option expiry, record volume, and record precious-metal prices, all colliding during triple-witching hour when hedges are stripped, models reset, and positioning is laid bare. Over 26 billion shares changed hands, roughly 50% above the 12-month average, as an estimated $7.1 trillion in notional open interest expired. This was not quiet year-end drift. This was the plumbing being stress-tested in real time.

Beneath the noise, the macro tape quietly softened in a way markets tend to like. Inflation continues to cool without collapsing demand outright. November core CPI slipped to 2.63% from just over 3% in September, reinforcing the idea that the disinflationary impulse is intact. Tariff effects are fading, shelter inflation is rolling over, and wage pressure is no longer accelerating. In market language, this is the kind of data that widens the Fed’s corridor rather than narrowing it. It doesn’t force action tomorrow, but it gives policymakers optionality for 2026.

At the same time, the growth engine is clearly losing torque. Regional Fed surveys turned south in a hurry. The Philly Fed dropped deeper into contraction territory, while the Empire survey reversed sharply from exuberance to mild pessimism. Consumer sentiment followed suit. The Michigan index slipped again, affordability angst resurfaced, and short-term inflation expectations nudged higher. Households feel squeezed even as headline inflation improves, a classic late-cycle tension that markets recognize instinctively. When both businesses and consumers start to sound cautious while inflation eases, the policy conversation naturally shifts from restraint to insurance.

Equities read that tea leaf quickly. After wobbling earlier in the week on renewed hand-wringing over AI capex excess and the limits of Fed easing, dip buyers stepped back in. The S&P 500 erased its weekly losses and finished higher, the Nasdaq outperformed, and megacap tech reclaimed its footing. Nvidia led the charge, Oracle jumped sharply, and suddenly the AI narrative looked less like a cracked engine and more like one that had briefly flooded. This was not blind exuberance; it was positioning recalibrating to a world where growth slows but liquidity remains supportive.

Rates told a similar story with more nuance. Treasuries logged their first weekly gain since late November before stalling on Friday, with the 10-year ending near 4.15%. The market continues to price two rate cuts in 2026, even as policymakers resist locking that in publicly. Overseas, Japan’s bond market delivered its own signal flare. Ten-year JGB yields pushed to their highest level since 1999, the yen weakened, and uncertainty lingered around the Bank of Japan’s policy trajectory despite a widely expected hike. For gold traders, this mattered. Rising long-end Japanese yields have correlated closely with gold prices this year, pointing to a global term-premium story as debt balloons.

And gold responded accordingly. In a rate-cutting environment where the economy is slowing, and the prospect of additional rate cuts looms, stocks and real stores of value can thrive simultaneously. This is the sweet spot where even a lump of coal in the Christmas stocking can turn into something shinier. Gold did exactly that, closing above $4,325, as the market priced a world of lower real rates, fragile confidence, and policymakers inclined to cushion rather than clamp down.

By the closing bell, the scoreboard told the story. The S&P 500 gained just under one percent, the Nasdaq 100 climbed more than one, Bitcoin added around three, and small caps lagged as they often do when liquidity favors scale and balance-sheet strength. The Nasdaq managed to claw into the green for the year’s final full week, with the S&P hovering nearby, while the rotation into defensiveness remained incomplete.

If traders were wondering whether the fabled Santa Claus rally would ever show up, this may have been its arrival. The market doesn’t feel euphoric, but it no longer feels cornered. Inflation is behaving, growth is cooling, liquidity is still ample, and positioning has been reset by one of the heaviest option expiries on record. That combination doesn’t guarantee smooth sailing, but it does explain why, even at the end of a long year, the market found just enough oxygen to sprint the final lap.

The Fed is still reading the instruments through fog

This week’s labour and inflation prints looked, at first glance, like a clean green light for the next leg of Fed easing. Payroll growth is fading, unemployment is drifting higher, inflation is cooling, and the surface-level narrative writes itself. But markets do not trade headlines alone. They trade signal quality, timing risk, and the credibility of the instruments on the dashboard. And right now, several of those gauges aren’t accurately signalling.

Start with the labor market, where the headline story says slowdown, but the plumbing tells a more complicated tale. Payrolls rose by 64k in November, following a sharp October drop and a run of soft or outright negative prints earlier in the year. Strip out the noise, however, and the private sector picture looks less alarming. Private payrolls added 69k, an improvement on October and broadly in line with most of the past six months. This is not a labor market falling down an elevator shaft. It is one that has slowed to a crawl and is now inching forward again, barely, but still moving.

The catch is that the data itself is under dispute. Chair Powell openly suggested that payroll figures may be overstated by roughly 60k, pointing squarely at the BLS birth-death model, which tries to infer firm creation and destruction with a lag. That model is set to be revised with the January data, meaning today’s employment picture may be revised materially after the fact. In market terms, we are trading provisional prints with an asterisk attached. The most honest conclusion is that payroll growth has likely stalled, but confirmation is still several weeks away.

Unemployment, meanwhile, has made a more decisive move. The jobless rate jumped to 4.6%, the highest since 2021 and above every Fed participant’s estimate of the natural rate. That matters. Not because 4.6% is catastrophic, but because of how quickly the labor market has loosened from previously tight conditions. If unemployment holds here into December and January, recession alarms based on the Sahm Rule will start flashing again. That rule misfired once already in 2024, but it still captured a genuine cooling impulse that helped push the Fed into a surprise 50bp cut. The labour market appears to be slipping another rung down the ladder.

Yet even here, the Fed has reason to hesitate. October data were missing entirely, survey response rates were unusually low, and methodological adjustments inflated statistical error bands. The establishment survey was extended to gather more responses, while the household survey struggled. In plain language, the Fed knows the unemployment rate is rising, but it does not yet trust the exact slope of the move. Policymakers are unlikely to bet aggressively on a single noisy three-month window.

Inflation tells a similarly supportive but imperfect story. Headline and core CPI rose a benign 0.2% over the two-month period since September, with three-, six-, and twelve-month trends all running below 3% and cooling. Core goods prices show little sign of tariff pressure. Core services, long the stubborn holdout, are finally easing as rent dynamics turn. On the surface, this looks like the soft landing textbook page the Fed has been trying to write for two years.

Then come the footnotes. Rent inflation printed at levels that are almost too good to be true. Primary rent barely moved, the weakest reading in more than a decade. Owners’ equivalent rent also slowed sharply. These figures arrived alongside unusually high rates of data imputation, where missing local prices are replaced with broader regional averages. More than a third of CPI inputs were imputed in November, down from an emergency-level 40% during the shutdown, but still far above the historical norm near 10%. When that much of the data is estimated rather than observed, confidence matters as much as direction.

Complicating matters further, CPI is not the Fed’s target. PCE is. And the PCE data pipeline is effectively frozen. October and November releases have been postponed, leaving policymakers without their preferred inflation compass just as rates have entered what they describe as a plausible neutral zone. Some CPI components feed into PCE, but the Fed is still navigating without a full map.

Put it all together, and the policy picture looks less like a clear runway and more like a late-night instrument landing. The descent is underway. The airspeed is manageable. But visibility is limited, and no one is eager to touch down too fast. The data argue for further rate cuts, but not for urgency. This is why skipping January and aiming for a mid-March move still makes sense. The Fed can afford to wait for cleaner labor averages, revised payroll models, and updated PCE inflation before pulling the next lever.

Markets, for their part, understand this dynamic well. They are pricing easing, but not panic. This is not the start of an emergency cycle. It is the careful unwinding of restriction in an economy that is cooling, not cracking. The Fed is not slamming the brakes, but it is also not flooring the accelerator. It is feeling its way forward, one data release at a time, in a cockpit where several gauges are still recalibrating.

Chart of the week

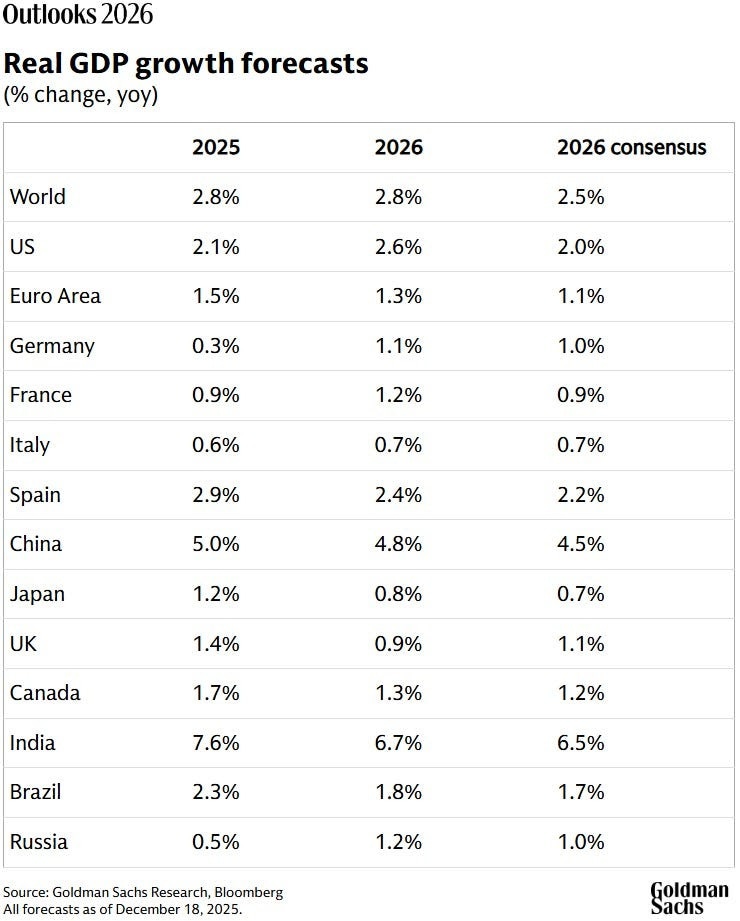

The outlook for the global economy in 2026

Goldman Sachs Research forecasts the global economy will generate “sturdy” growth in 2026. In fact, our economists’ forecasts for most major countries are at or above consensus estimates.

“As has typically been the case since the pandemic, we are most optimistic (relative to consensus) in the US,” writes Jan Hatzius, chief economist and head of Goldman Sachs Research, in the team’s report titled “Macro Outlook 2026: Sturdy Growth, Stagnant Jobs, Stable Prices.”

The US is expected to substantially outperform consensus economist forecasts because of tax cuts, easier financial conditions, and a reduced drag on the economy from tariffs. As a result of tax cuts, for example, consumers will receive around an extra $100 billion (0.4% of annual disposable income) in tax refunds in the first half of next year.

The narrative for China’s economy is much more mixed, Hatzius writes. GDP is forecast to expand 4.8% as strong exports outweigh sluggish domestic demand.

China’s ability to produce increasingly higher quality goods at lower prices remains unmatched, he writes. The world’s second-largest economy has demonstrated that it has the capability to deter high tariffs on its exports, as seen in the trade negotiations with the US. “All this suggests that the Chinese manufacturing sector should continue to grow robustly,” Hatzius writes.

At the same time, large parts of China’s domestic economy remain weak. Although the largest drag from the property downturn on GDP growth has probably already taken place (property sales are down 60% and property starts are down 80% from the peak), our economists estimate that the sector will produce a 1.5 percentage point drag on GDP growth next year.

Author

Stephen Innes

SPI Asset Management

With more than 25 years of experience, Stephen has a deep-seated knowledge of G10 and Asian currency markets as well as precious metal and oil markets.