EUR/USD Forecast: Extra gains now look at 1.1000

- EUR/USD resumed its upward bias and rose to the 1.0960 zone.

- Renewed selling pressure kept the US Dollar subdued.

- Bets for an ECB rate cut in June remained on the rise.

The consistent appetite for the risk-associated universe put the US Dollar (USD) under extra downward pressure, allowing further breathing room for EUR/USD on Wednesday.

That said, spot rose to three-day highs in the 1.0960/65 band against the backdrop of a weaker Greenback, which in turn prompted the USD Index (DXY) to resume the downtrend south of the 103.00 support, leaving behind at the same time its post-US CPI advance.

The pair’s resurgence was accompanied by another positive performance in US yields across different maturity periods, mirroring the movement observed in German 10-year bund yields, which climbed further and approached 2.40%.

Considering the broader macroeconomic landscape, both the Federal Reserve (Fed) and the European Central Bank (ECB) are anticipated to initiate their easing cycles early in the summer, likely in June. However, the pace of subsequent interest rate cuts may vary, potentially distinguishing the strategies of both central banks. Nonetheless, the ECB is unlikely to significantly lag behind the Fed.

According to the FedWatch Tool provided by CME Group, the probability of a rate cut in June has increased to approximately 60%.

On the ECB front, Board member Villeroy suggested a potential rate cut in spring, stating the Governing Council will maintain vigilance until the 2% inflation target is reached. His colleague Kazaks warned of significant uncertainty and that a decision on rates will be made in upcoming meetings, highlighting the need to avoid excessive postponement of the rate reduction.

In conclusion, the relatively sluggish fundamentals of the euro area, juxtaposed with the resilient US economy, reinforce the anticipation of a stronger Dollar in the medium term, particularly as both the ECB and the Fed potentially introduce their easing measures almost simultaneously. In such a scenario, EUR/USD could undergo a more substantial correction, initially targeting its YTD low around 1.0700 before potentially revisiting the lows observed in late October 2023 or early November in the 1.0500 region.

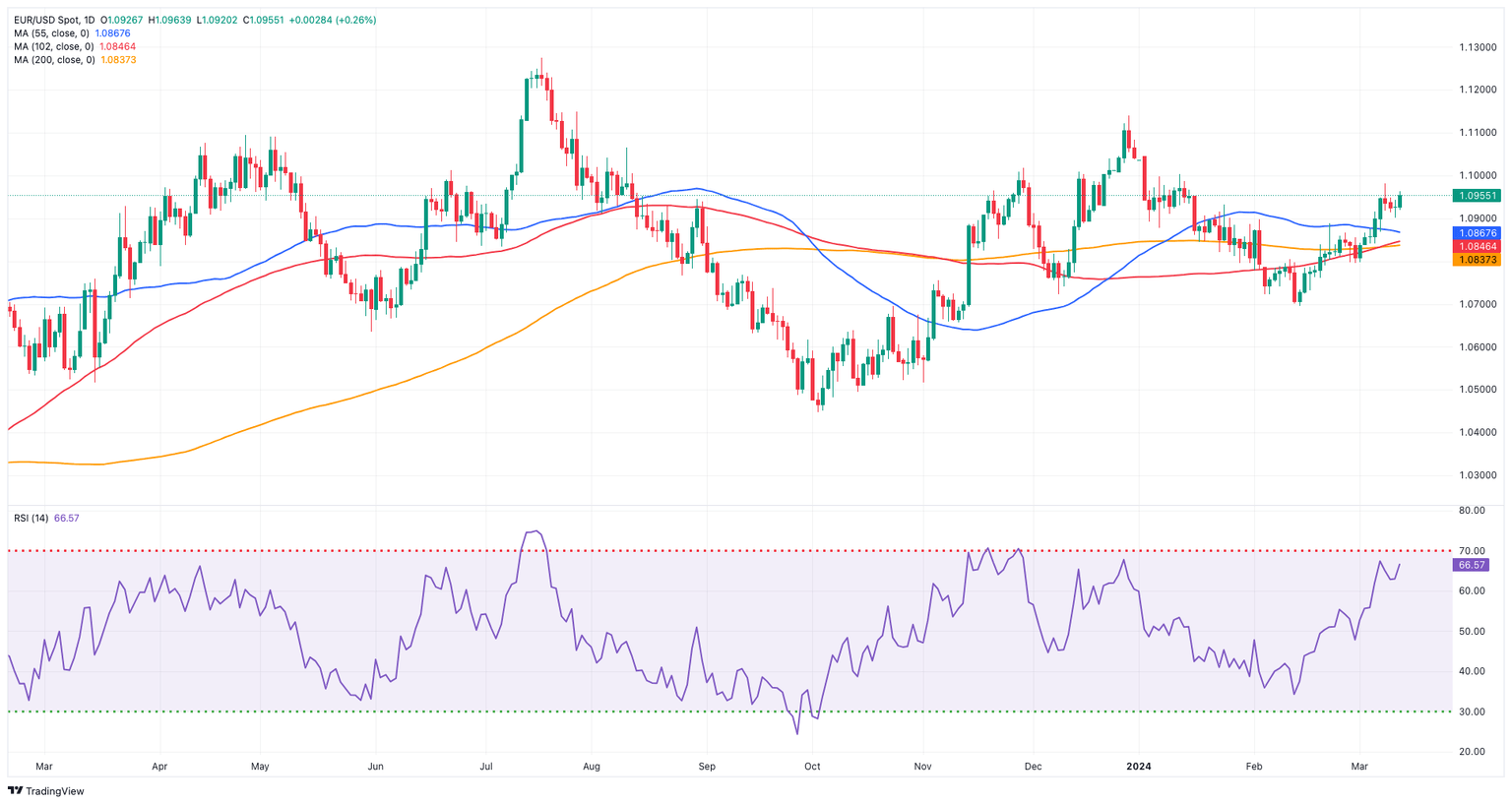

EUR/USD daily chart

EUR/USD short-term technical outlook

The breakthrough of the March peak of 1.0981 (March 8) may prompt EUR/USD to challenge the weekly high of 1.0998 (January 11), which reinforces the psychological barrier of 1.1000 and comes ahead of the December 2023 top of 1.1139 (December 28).

On the downside, if the pair falls below the 200-day SMA at 1.0836, it might reach its 2024 low of 1.0694 (February 14). The November 2023 low of 1.0516 (November 1) is next, followed by the weekly low of 1.0495 (October 13, 2023), the 2023 low of 1.0448 (October 3), and the round level of 1.0400.

Meanwhile, the EUR/USD remains above its 200-day Simple Moving Average (SMA) of 1.0835, suggesting additional advances remain in the pipeline in the very near term.

Looking at the 4-hour chart, it appears that the pair has resumed its gradual advance for the time being. That said, the next upward obstacle seems to be 1.0981, followed by 1.0998. The initial level of support is 1.0902 ahead of 1.0867, with the 200-SMA at 1.0836 followed by 1.0761. The Moving Average Convergence Divergence (MACD) remained positive, and the Relative Strength Index (RSI) rose to the boundaries of 65.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.