EUR/USD Forecast: ECB hits euro ahead of the Fed, bears eye break below 1.21

- EUR/USD has been falling after an ECB hinted at lowering the euro.

- The Federal Reserve's decision is set to rock markets later in the day.

- Wednesday's four-hour chart is pointing to further falls for the pair.

Klaas Knot has been hitting the common currency – the mostly unknown member of the European Central Bank has said that his institution has the tools to counter the appreciation of the euro. The Dutch ECB member has gone further than his boss, President Christine Lagarde, and also said that the Frankfurt-based institution could cut interest rates. He tied any future policy moves to the bank's single mandate – inflation.

Knot's comments come one day after the media reported that the ECB is investigating the impact of the US Federal Reserve's policies on the exchange rate – and the latter's effect on price development. Will the Fed indeed send the dollar down and complicate the ECB's task?

The world's most powerful central bank convenes later in the day and is set to leave its bond-buying scheme unchanged amid speculation about its next moves. Jerome Powell, Chairman of the Federal Reserve, will likely reject any calls to taper down the bond-buying scheme amid ongoing hardship. Help from the Fed may be needed to fund government debt if President Joe Biden is successful in passing most of his ambitious $1.9 trillion fiscal stimulus deal.

The recent exuberance in several stocks – namely Gamestop – may change Powell's mind. Reporters will likely quiz the Fed Chair about market exuberance and also about upbeat prospects about the economy in the latter half of 2021 – especially as the US is ramping up vaccine production and deployment.

See:

- Fed Preview: Fearing market froth or boosting Biden's stimulus? Three scenarios

- US Federal Reserve Preview: Neither an optimist nor a pessimist be

Ahead of the Fed, US Durable Goods Orders are set to show a slower increase in investment in December. See US Durable Goods Orders December Preview: Have job losses tipped over the consumer market?

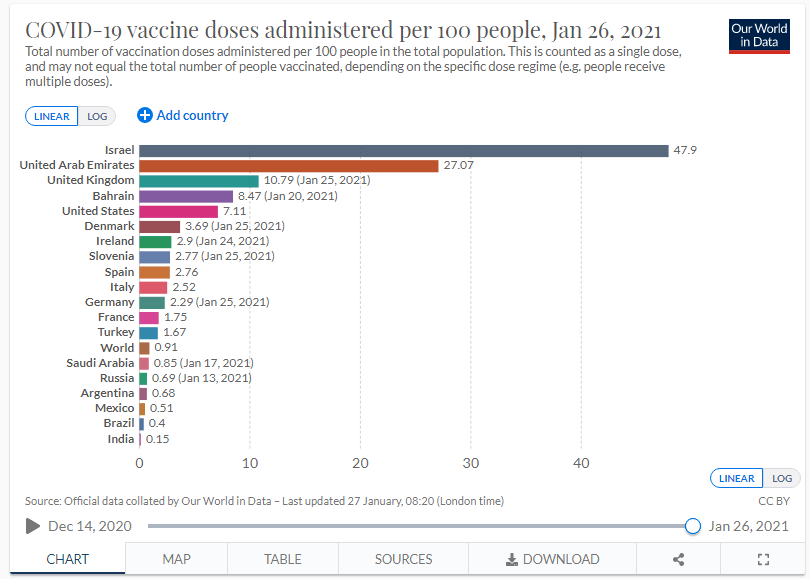

On the other side of the pond, immunization is advancing at a snail's pace – with pharmaceuticals and governments blaming each other for the delay. AstraZeneca and Brussels are at loggerheads over the delay even before the EU regulator approved the British firm's jabs. A final seal is due on Friday.

Source: OurWorldInData

Italy continues grappling with its political issues in the middle of the covid crisis. Prime Minister Giuseppe Conte is trying to form a new government one day after tendering his resignation.

Overall, clouds are darkening over the euro while things look rosier in the US. All eyes are now on the Fed.

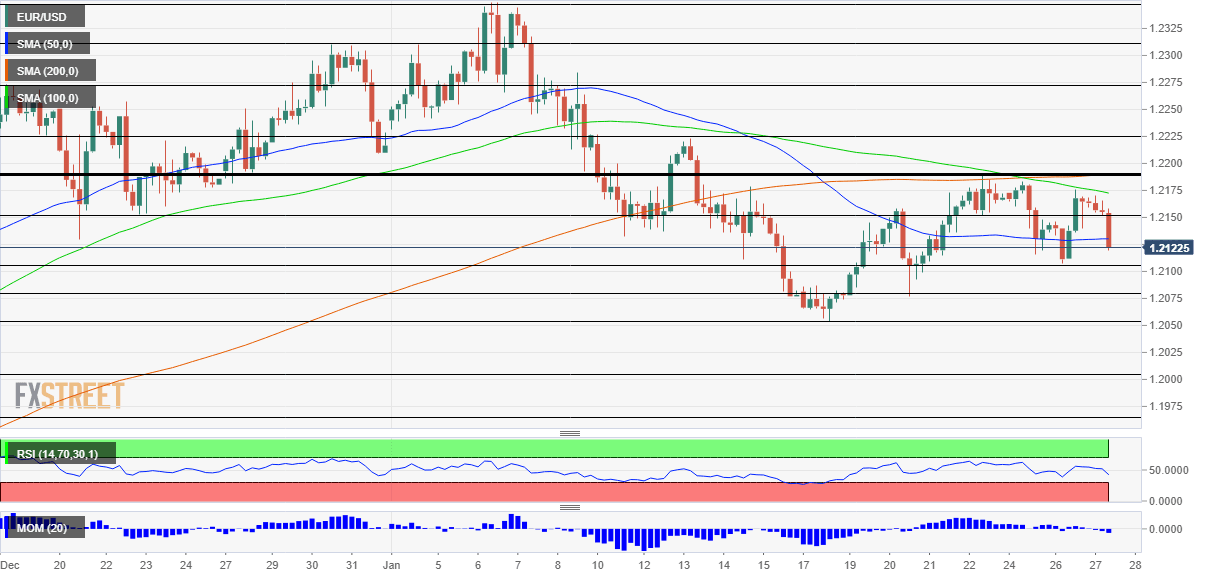

EUR/USD Technical Analysis

Euro/dollar has dropped below the 50 Simple Moving Average on the four-hour chart and momentum is to the downside. The pair also trades below the 100 and 200 SMAs.

Critical support is at 1.21, the weekly low and also a psychologically significant level. The next levels to watch are 1.2050 and 1.2075, both stepping stones on the way up. Further below, 1.20 and 1.1960 are eyed.

Resistance awaits at 1.2150, a separator of ranges last week, and then by the all-important 1.2190 cap – last week's peak and where the 200 SMA hits the price.

EUR/USD Price Forecast 2021: Euro-dollar long-term bullish breakout points to 1.2750

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Yohay Elam

FXStreet

Yohay is in Forex since 2008 when he founded Forex Crunch, a blog crafted in his free time that turned into a fully-fledged currency website later sold to Finixio.