US Durable Goods Orders December Preview: Have job losses tipped over the consumer market?

- Durable Goods Orders expected to be on par in December at 0.9% from 1%.

- Nondefense Capital Goods are forecast to be unchanged at 0.5%.

- Retail Sales present a cautionary view, -1.4% in November, -0.7% in December.

- Initial Jobless Claims and Nonfarm Payrolls have worsened since October.

- Markets are unlikely to be moved having seen the weak December Retail Sales figures.

Americans pulled back on spending at the end of last year as layoffs accelerated and job losses returned. The slowdown in the labor market is predicted to be temporary as the economy pulls away from the pandemic in the next two quarters but consumers turned caution nonetheless, Retail Sales unexpectedly fell in November and December.

Durable Goods are consumer and business purchases that are designed to last three years or more in normal use. The tend to be optional, a new car, computer or display counter rather than food, gasoline or raw materials.

Have consumers decided to wait on their desires until the future is more secure?

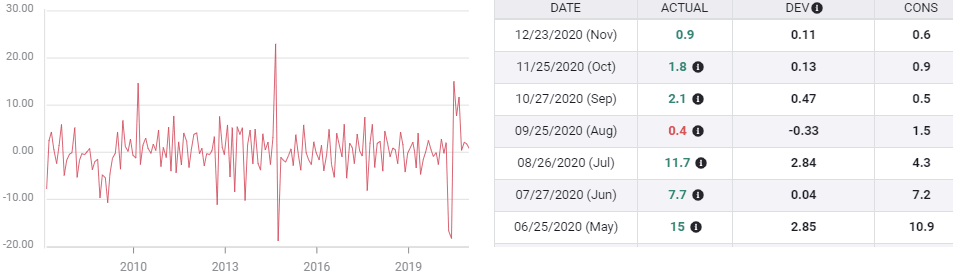

Analysts polled by Reuters do not seem to think so. Durable Goods Orders are forecast to rise 0.9% in December after gaining a revised 1% in November. Orders ex-Transportation are projected to rise 0.5% following 0.4% prior. Nondefense Capital Goods Orders, the business investment proxy, are forecast to be unchanged at 0.5%.

Durable Goods

US labor market

The labor market began to deteriorate in the final two months of the year, largely under the impact of a stringent lockdown in California, the largest state economy, and partial closures in New York and elsewhere.

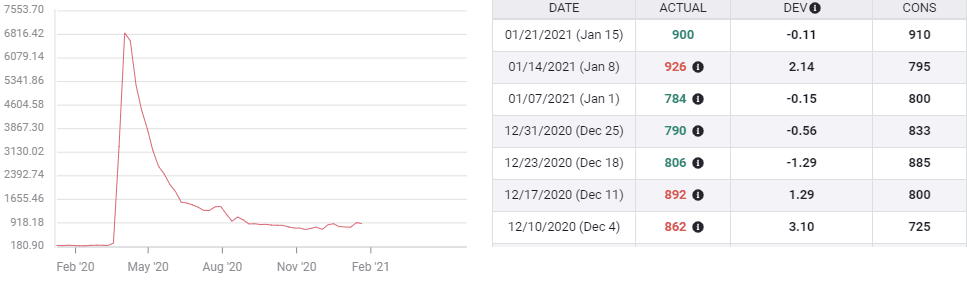

Initial Jobless claims in the first and last weeks of November were 711,000 and 716,000, the lowest of the pandemic. But the two middle weeks averaged 767,500, giving the month a run of 740,500. Even with weekly totals for half the month increasing sharply, November was still the seventh straight month of improvement and the average was 58,000 lower than October.

Initial Jobless Claims

Claims had similar brief increases in July and in August that were not precursors to a general rise in layoffs or a drop in hiring. At the end of November the direction of the labor market was still undecided.

That trend was determined in the first week of December when claims rose to 862,000 followed by 892,000, which was the highest seven-day total in two-and-a-half months. December's average jumped to 837,500, the highest in 12 weeks.

Nonfarm Payrolls reflected the deterioration in job markets. Payrolls dropped to 336,000 in November from an average of 660,500 in September and October.

In December the market lost 140,000 positions, the first negative month since April and a reversal on the 71,000 forecast.

Claims have continued at a much higher pace in January averaging 870,000 for the three weeks through January 15 and are projected to be 878,000 on January 22 due on Thursday.

With layoffs continuing at a higher level in January than December, the current 68,000 estimate for this month's payrolls, to be issued on February 5, seems optimistic.

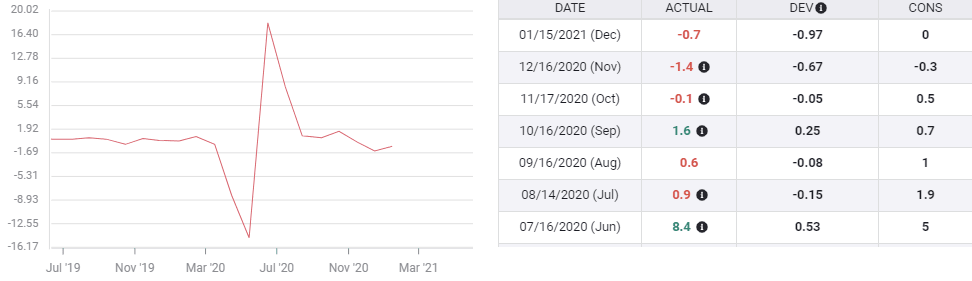

Retail Sales

Consumer spending has also mirrored the declining fortunes of the job market.

From July to September sales rose an average of 1.03% per month. In October sales dipped to -0.1%. In the November and December holiday shopping months sales fell 1.4% and 0.7% respectively.

Retail Sales

Control Group Sales averaged 0.5% from July to September. They fell 0.1% in October, 1.1% in November and 1.9% in December.

Conclusion

The relatively optimistic assessments for Durable Goods have low odds of being fulfilled. Individuals and families can logically opt to wait for a secure recovery before buying that new bicycle or boat.

Business investment in the Nondefense category, may hold up as it is spending for execution in several months when a much better economic environment is anticipated.

For the markets Durable Goods Orders are old news, restating the information from Retail Sales for specific and smaller categories. No development is going to convince traders that the revival started in December.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Joseph Trevisani

FXStreet

Joseph Trevisani began his thirty-year career in the financial markets at Credit Suisse in New York and Singapore where he worked for 12 years as an interbank currency trader and trading desk manager.