EUR/USD Forecast: Bulls waiting for an excuse to resume buying

EUR/USD Current Price: 1.1301

- Easing concerns about global growth and riots in the US kept the dollar pressured.

- Wall Street remained in the green reflecting the prevalent optimism.

- EUR/USD held above the 23.6% retracement of the latest daily run.

The EUR/USD pair is closing this first day of the week, little changed around the 1.1300 level. European data released this Monday weighed only modestly on the shared currency, despite it missed the market’s expectations. Germany published April Industrial Production, which fell in the month by 17.9%. When compared to a year earlier, it collapsed by 25.3%, much worse than the previous -11.3%. The EU June Sentix Investor Confidence improved from -41.8 to -24.8, slightly worse than expected.

Concerns related to global growth and protests in the US cooled down, with financial markets stable. European equities spent most of the day in the red, ending it around their opening levels. US indexes, on the other hand, maintained the green throughout the day, capping dollar gains.

Focus this week is on the US Federal Reserve decision next Wednesday, although policymakers may hold their bullets this time, as things seem to be slowly improving. Ahead of the event, Germany will release this Tuesday its April Trade Balance, while the EU will publish the final version of Q1 GDP, foreseen unchanged at -3.8%. The US will publish minor figures,

EUR/USD short-term technical outlook

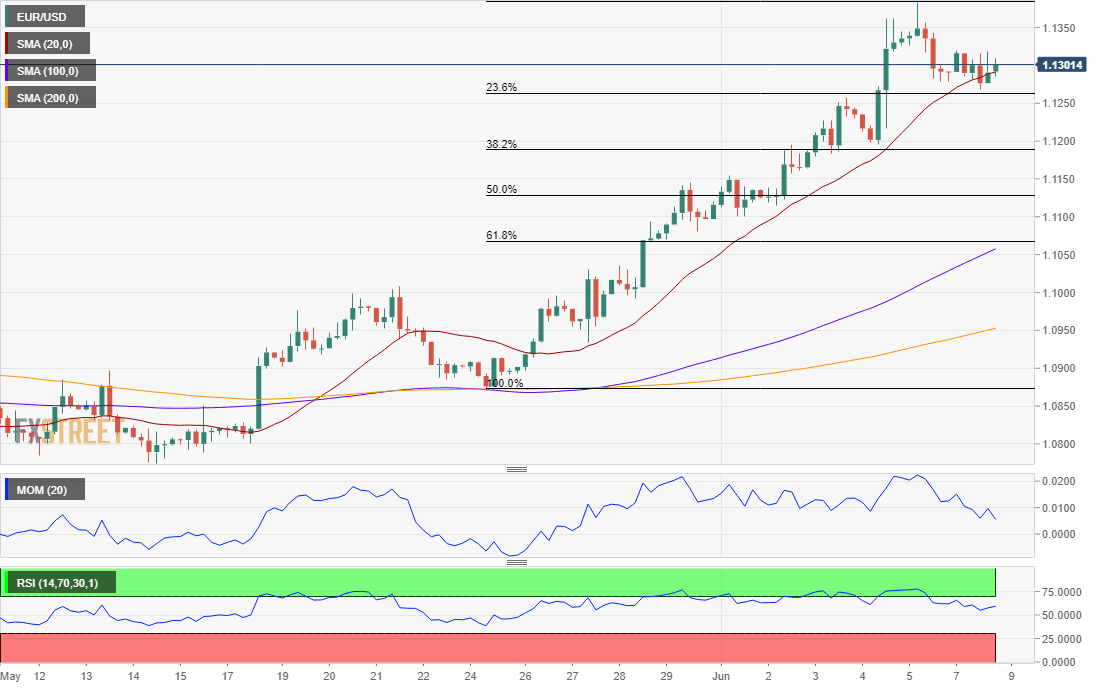

The EUR/USD pair bottomed for the day at 1.1267, a few pips above the 23.6% retracement of its latest bullish run at 1.1260. The 38.2% retracement of the same rally comes at 1.1185, which means that it’s unlikely that bulls could give up as long as the pair holds above this last. In the 4-hour chart, the pair is developing above a bullish 20 SMA, while technical indicators are now flat well above their midlines, after correcting extreme overbought conditions. The pair would likely resume its advance once above 1.1315, the immediate resistance.

Support levels: 1.1260 1.1220 1.1185

Resistance levels: 1.1315 1.1370 1.1410

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.