EUR/USD downtrend targeting 1.0340 monthly support

Overview

A complete top down analysis of the EURUSD.

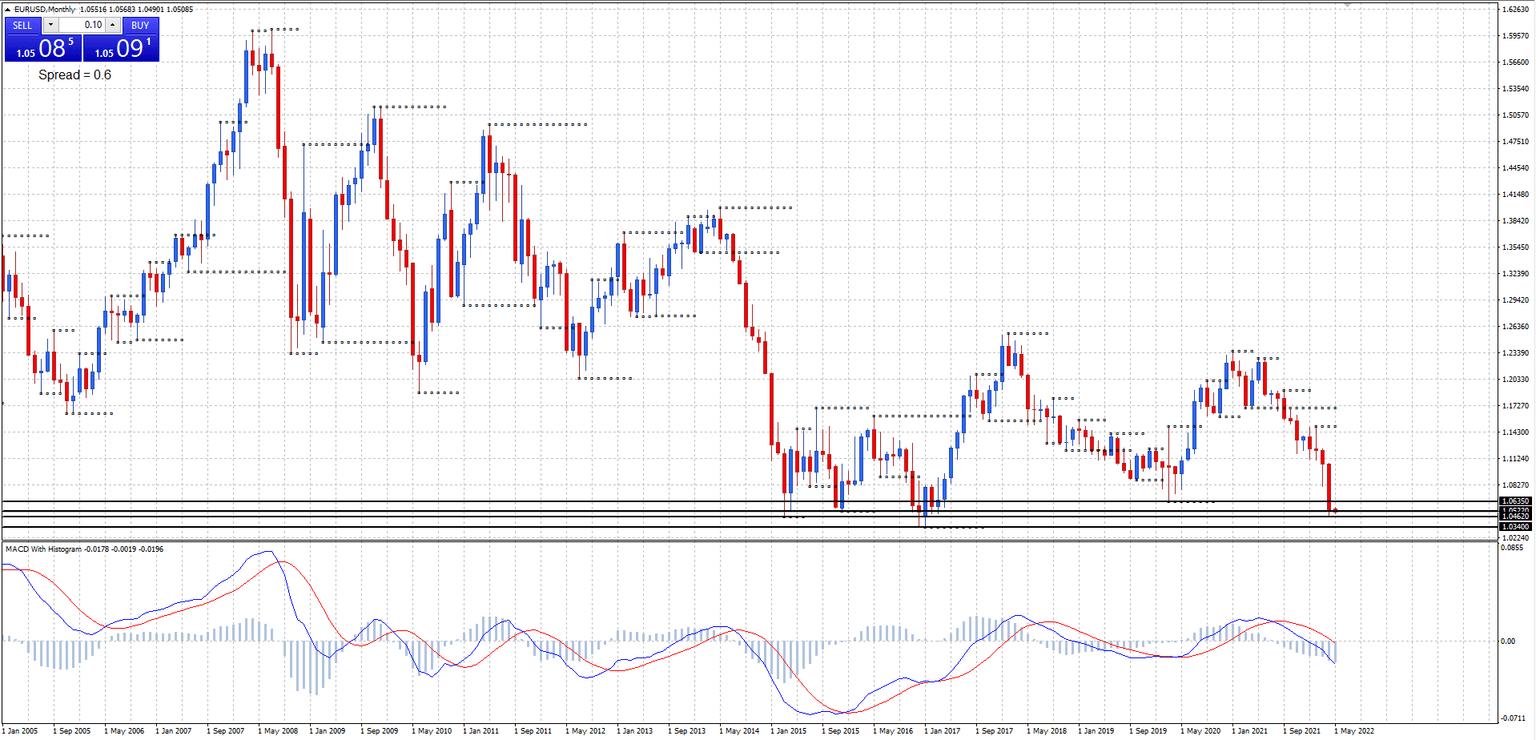

EUR/USD monthly

Monthly support at 1.0522, 1.0462, and 1.0340, resistance at 1.0635.

Monthly chart is in a downtrend targeting the 1.0340 major monthly support level.

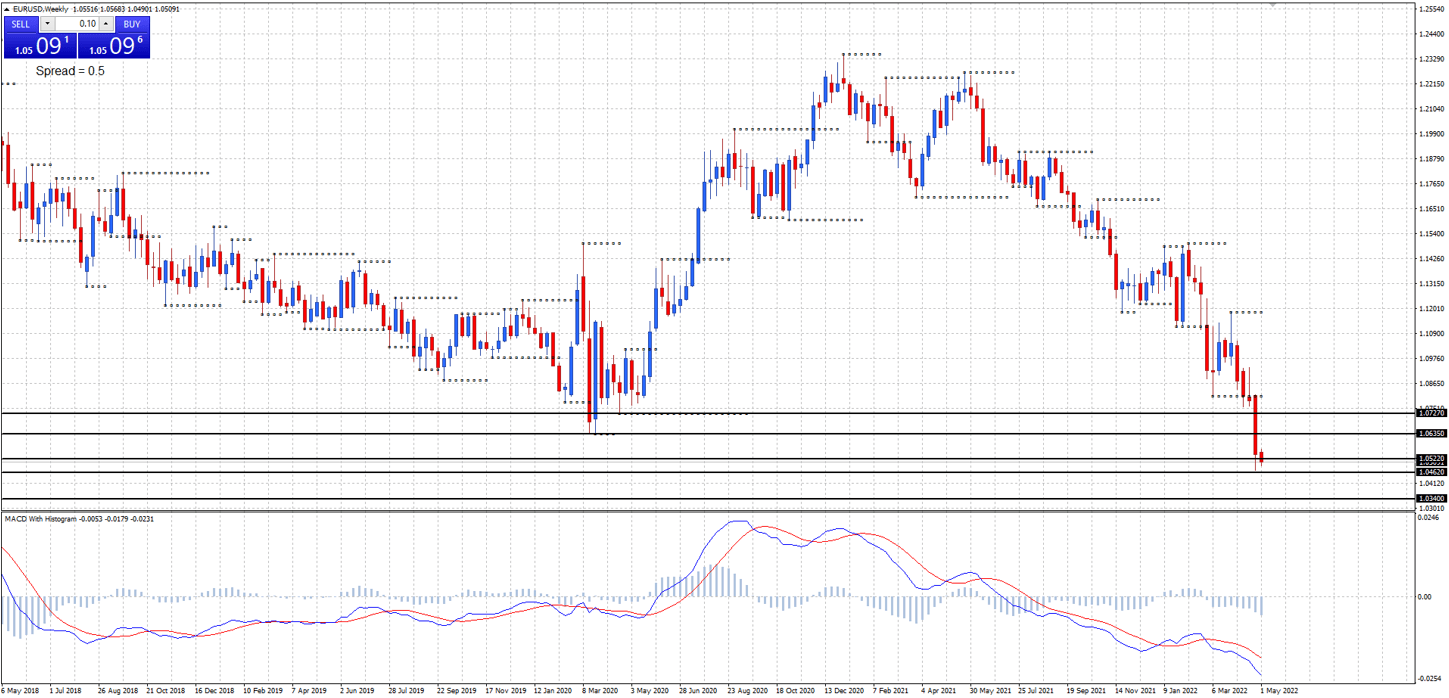

EUR/USD weekly

Weekly support at 1.0522, resistance at 1.0727.

Weekly chart is in a downtrend. Price continues to decline and is trading in the 1.0522 to 1.0340 monthly support area.

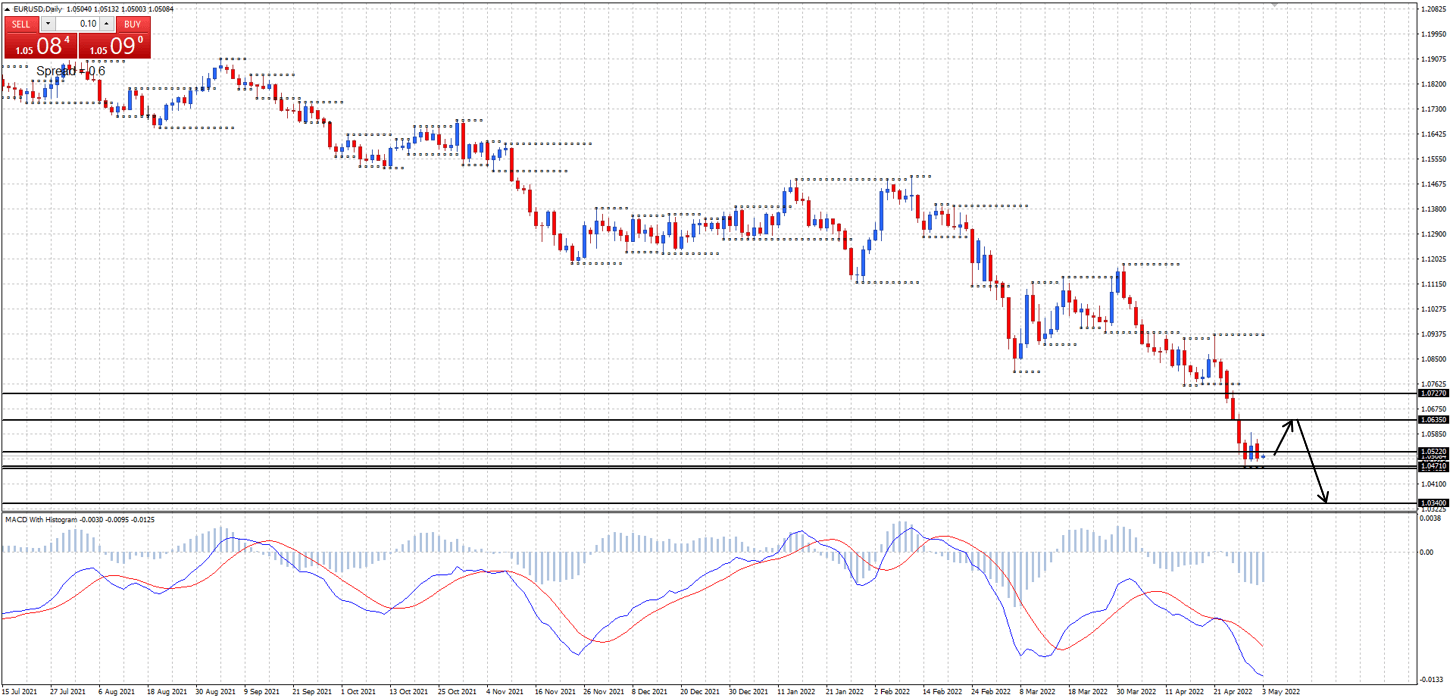

EUR/USD daily

Daily support at 1.0471, resistance at 1.0635.

Daily chart is in a downtrend. Price may be overextended in the short term.

Looking for price to rally back to the 1.0635 monthly resistance level before the next decline targeting the 1.0340 monthly support level.

Author

Duncan Cooper

ACY Securities

Duncan Cooper is a full-time trader and mentor. He has been actively trading the financial markets for more than 15 years and has traded stocks, options, futures, and the Forex Market since 2005.