Eastern Europe 30 years on

Around 1990 the East Block of Communist countries collapsed and the transition to capitalism began. Up to that time the industrial sectors in the Eastern Block traded almost exclusively among themselves and there were minimal manufactured exports to the West. Most foreign currency was earned from commodities exports plus some armaments exports particularly to the Middle East. Also, a number of countries had small foreign tourism sectors.

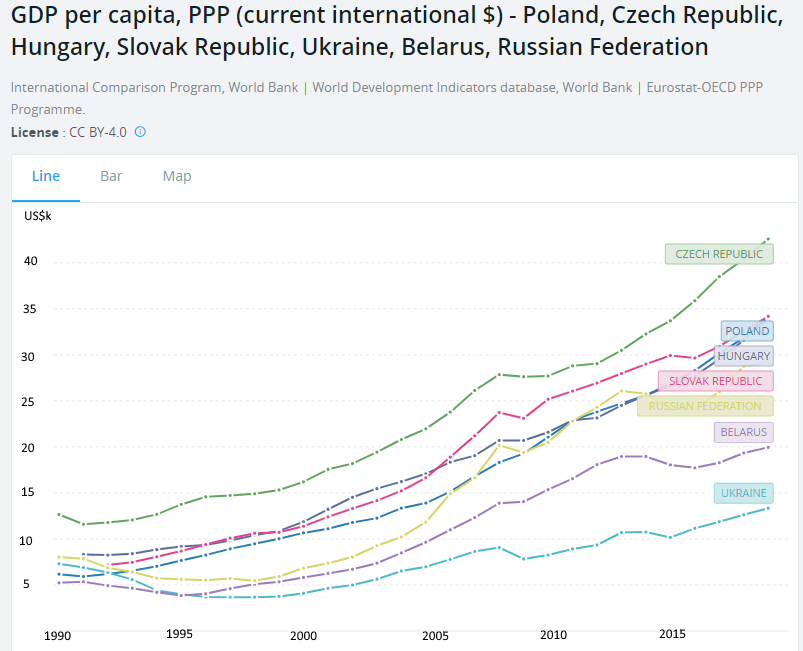

After 1990 the question arose as to how to reconvert the industrial sectors in the East Block to be able to survive and thrive in a market environment. In most countries, e.g. Poland, Czech Republic, Hungary etc., this was achieved by maintaining the currencies cheap such that the cost of labour was only a small fraction of the cost in the West. This created a natural barrier to the penetration of Western manufactures of consumer goods and allowed the manufacturing sectors the space to find their feet in the new environment. Generally this has been successful such that several decades on most of these countries are members of the EU and are achieving modest if unspectacular economic growth with an insertion in the EU markets based on lower costs.

A notable exception was the former East Germany. In this case the West German authorities had a choice to make; they could have allowed East German industry to evolve along the lines of its East Block neighbours and would have meant that in economic terms the newly unified Germany would have functioned as two states or the could have pursued full economic and political unification. In the event they chose the latter option presumably because they felt that the two-state option carried too many political risks.

Upon unification the former East Germany adopted the Deutsche Mark and its citizens acquired the same rights as the citizens of the former West Germany. This meant that companies operating in the East immediately started to bill and pay their wages in DMs. This cut them off from their former trading partners in the East who could not afford their prices and forced almost all of them into bankruptcy. A holding company (the Treuhandanstalt) was set up to take over the failing enterprises and find a buyer for them but in the end only a small share of the industry in the former East survived and some 2.5 million industrial workers out of 3.2million were laid off.

There followed massive transfers from the West to the East which continue to this day and in spite of numerous incentives for companies to locate manufacturing in the Eastern provinces it seems unlikely that they will achieve the manufacturing density of the West in the foreseeable future. It is notable that the South Koreans, who studied the costs of German Unification closely, have concluded that when or if their turn to unify arrives they will allow North Korea to function as a separate economy rather than immediate economic unification.

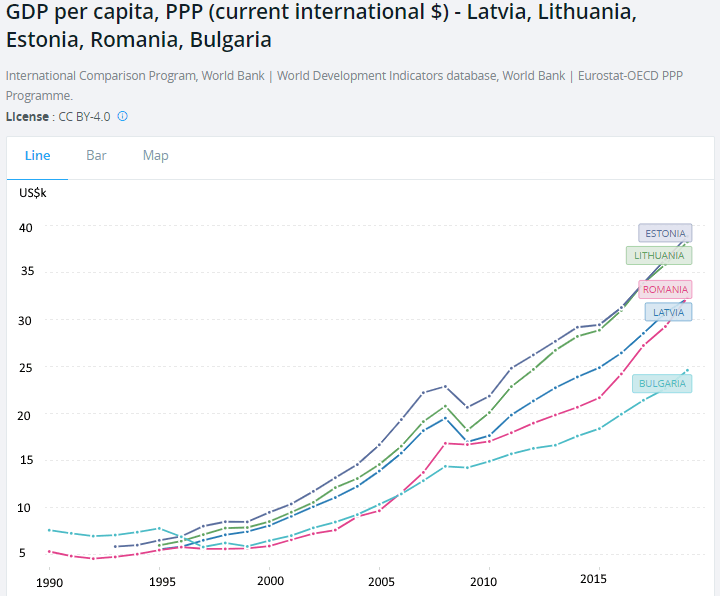

Further East involved the breakup of the Soviet Union into fifteen successor states. The Baltic countries, Latvia, Lituania and Estonia have joined the EU and their trajectory is similar to other EU member states from the former East Block. In Central Asia most of the new states are now participants in China’s Belt & Road initiative such that their economic destinies are now more intertwined with China than with Russia.

The trio of Russia, Belarus and Ukraine have in common that they are linguistically quite similar and none of the three have joined the European Union. Economically Russia has outperformed the other two due mostly to exports of oil and gas and other commodities.

Author

Paul Dixon

Latin Report

Paul Dixon’s focus is economics from a long term perspective.