Chinese wholesale Gold demand sets January record

Chinese gold demand kicked off 2024 with a bang.

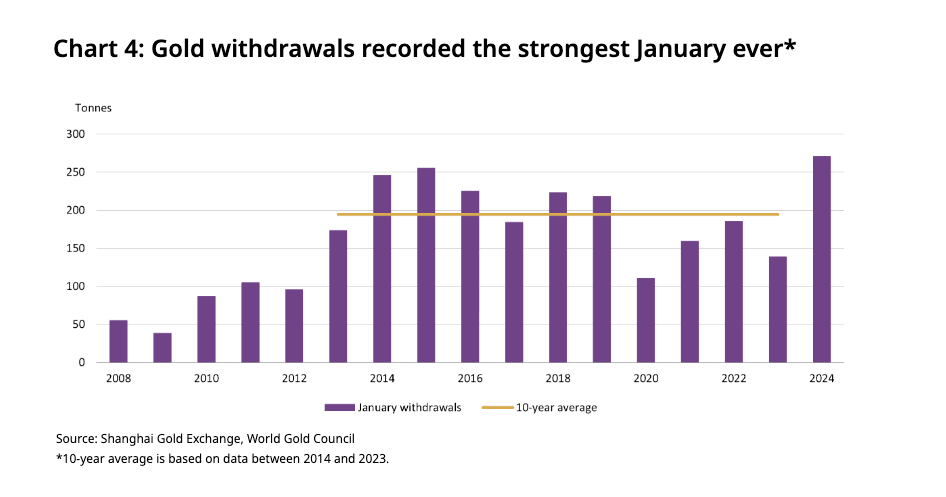

Wholesale gold demand set a record in January. Meanwhile, assets under management by Chinese gold ETFs reached an all-time high.

China ranks as the world’s top gold consumer, and Chinese demand has a significant impact on the global gold market.

Gold withdrawals from the Shanghai Gold Exchange (SGE) hit 271 tons in January, the highest level on record. It was a 95 percent increase compared to a tepid 2023 and a 65 percent increase month-on-month.

Withdraws from the SGE represent wholesale gold demand in China.

January is typically a strong month for gold demand in China with retailers restocking ahead of the Chinese New Year.

According to the World Gold Council, the high level of gold withdraws from the SGE “reflected its positive outlook on gold demand around the CNY holiday.”

As local assets including equities and properties saw weak performances, the strong RMB gold price performances in recent months attracted investors who sought safe-haven assets. And this led to continued popularity of gold bars and coins, resulting in manufacturer and commercial banks’ vibrant replenishment for the CNY holiday.

Gold also got a boost from the sale of “Year of the Dragon” themed jewelry. It is often considered auspicious and has helped support broader Chinese jewelry sales.

While the price of gold in dollar terms fell in January, in yuan (RMB) terms, it remained steady due to RMB weakness. Gold’s performance in the Chinese currency lagged behind global stocks, according to the World Gold Council, but it outperformed Chinese equities and commodities.

This should remind local investors of the benefit of diversifying their portfolios with gold, which has low correlations with Chinese assets.

Gold charted a 17 percent increase in yuan terms in 2023 and ranked as the second best-performing asset class in China.

Strong gold demand drove the price premium higher in China last month. It averaged $47 per ounce (2.2 percent), a $9 per month-on-month increase. That is to say, Chinese investors paid an average of $47 over the average international benchmark spot price and this was an average of $9 per month increase.

Due to strong demand coupled with a stable gold price, assets under management by Chinese-based gold ETFs rose by $113 million to $4 billion in January. An all-time high.

Inflows of gold into China-based funds totaled 1.6 tons in January, bringing the total to 63 tons.

Safe-haven demand drove investors into gold as Chinese equities sagged for the seventh straight month and the yuan weakened.

Gold ETFs are funds traded on the market like stocks that are backed by physical gold held by the issuer. In effect, investors can take advantage of the price movements in gold without buying, selling, or storing physical metal. Since the purchase is nothing but a number in a computer, investors can quickly convert their holdings into stocks or cash whenever they want, even multiple times on the same day. Many speculative investors appreciate the liquidity of trading ETFs.

ETFs can make up part of a good investment strategy, but they aren’t a substitute for owning physical gold either in your personal possession or held in a trusted, secure storage facility.

To receive free commentary and analysis on the gold and silver markets, click here to be added to the Money Metals news service.

Author

Mike Maharrey

Money Metals Exchange

Mike Maharrey is a journalist and market analyst for MoneyMetals.com with over a decade of experience in precious metals. He holds a BS in accounting from the University of Kentucky and a BA in journalism from the University of South Florida.