Chart of the Week: CHF crosses in focus

- CHF crosses make for compelling chart studies ahead of the open.

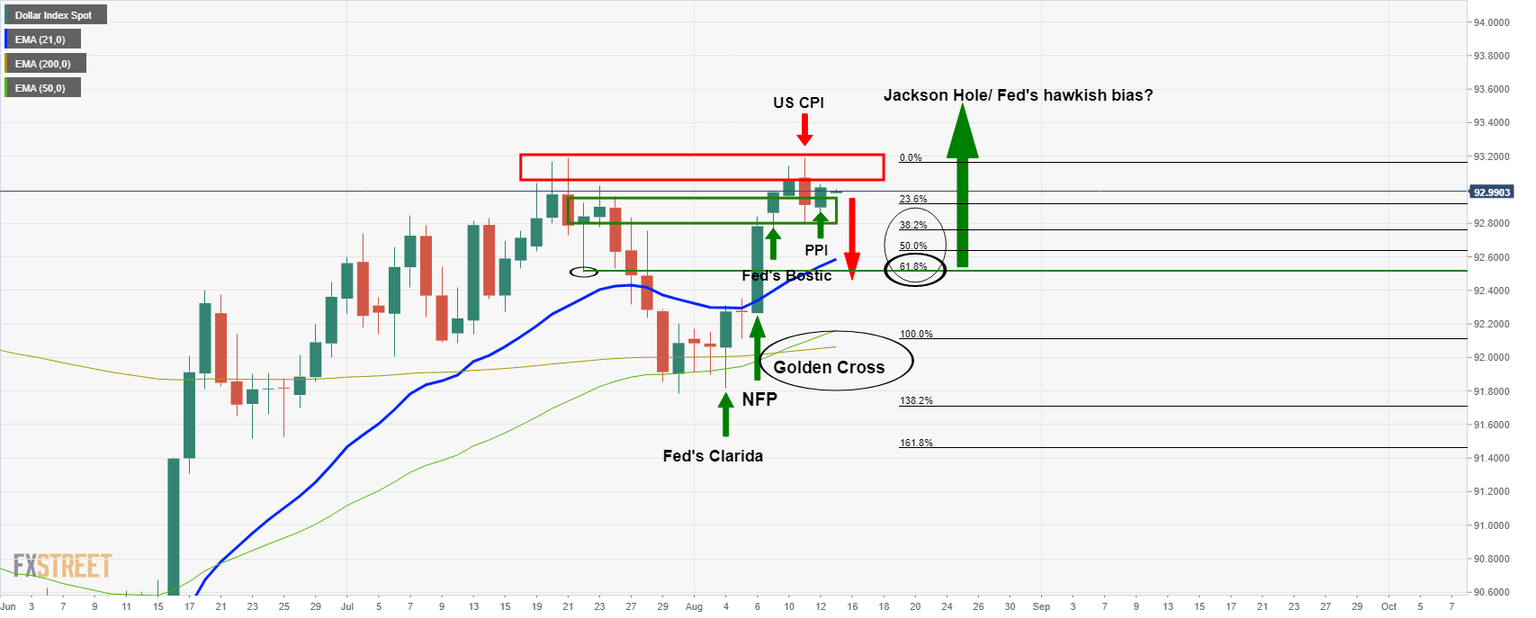

- US dollar has corrected a 61.8% Fibo in DXY and there are bullish prospects for the days and weeks ahead.

The Swiss franc is in focus for the open with some interesting market structures across the crosses.

The following analysis illustrates a bearish bias for the franc across the US dollar, pound, yen and Australian dollar from a daily time frame.

First of all, much will depend on the trajectory of the US dollar which has recently corrected in a fashion anticipated in prior analysis, here: US dollar teases reversal traders, Golden Cross underpins.

As illustrated, above and below between the prior analysis and live market analysis, the US dollar has completed a 61.8% Fibonacci retracement and considering the M-formation and golden cross, there is now a bullish outlook for the open.

This would be expected to result in a bullish outcome for USD/CHF:

USD/CHF daily chart

This paints prospects of a bullish reverse head and shoulders on the daily chart.

CHF/JPY daily chart

For CHF/JPY, the M-formation is compelling for a restest of the neckline and an ABCD correction could be a development in the days ahead:

However, 119.80/00 may prove to be too strong of a resistance which leaves prospects of an offered swissy across alternative crosses as follows:

GBP/CHF daily chart

The price has dropped to old resistance that would be expected to act as support which leaves a bullish outlook for days ahead in GBP/CHF.

AUD/CHF daily chart

Meanwhile, there are prospects of a reverse head & shoulders developing in AUD/CHF for the days ahead:

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.

-637646562162906970.png&w=1536&q=95)

-637646549608820429.png&w=1536&q=95)

-637646553391053518.png&w=1536&q=95)

-637646557283459355.png&w=1536&q=95)