AUD/USD Weekly Forecast: The tide turns on fears of another economic setback

- RBA’s Deputy Governor Debelle painted a gloomy picture of the Australian economy.

- US first-tier data takes center stage this week, but relevant figures are also coming from China.

- AUD/USD at a brink of turning bearish in the long-term.

King Dollar won the battle in the last full trading week of September, with AUD/USD plummeting and nearing the 0.7000 threshold. Several factors combined to put the greenback back in its throne this week, including a speech from RBA’s Deputy Governor Guy Debelle.

Speculative interest runs to safety these days as the coronavirus pandemic keeps taking its toll in global economic growth. Data across the globe was tepid, while the number of new daily cases is on the rise, particularly in Europe, but also hitting hard the south hemisphere.

Australian recovery not a rapid bounce but more of a slow grind

RBA Deputy Governor Debelle took due note in his speech at the beginning of the week, referring to “a historic decline in output in the Australian and global economy.” Australian GDP contracted by 7.0% in the second quarter of the year, the largest economic turnaround since the 1930s. Among other things, Debelle said that “most indicators of activity and the labour market troughed in early May. Since then we have seen a recovery in a number of these indicators, though there has been substantial variation across the country.” Finally, he said that the recovery had not been a rapid bounce but more of a slow grind. In this scenario, the central bank is studying additional tools to support the economy.

Across the Pacific, things are not much better. The US Congress remains incapable of agreeing on a coronavirus aid-package. Democrats and Republicans decided by the end of the week to resume formal talks on the matter, but it seems unlikely they could come up with a deal before the elections.

Another factor weighing on the Aussie is gold. The bright metal plummeted to $1,851.63 a troy ounce amid central banks’ on-hold stance. Without any additional stimulus measures, things are not that bright for the metal.

Tepid macroeconomic readings confirm the struggle

Australian data released these days was mixed, but clearly confirming RBA Deputy’s suspicion. The preliminary estimates of the Commonwealth Bank PMIs showed that business activity expanded in September, against an expected backdrop. August Retail Sales, however, fell 4.2% according to a preliminary release. Also, the country’s Trade Balance posted a surplus of 4294M against 4607M in the previous month.

The American currency holds on to gains heading into the weekend despite mixed US data released at the end of the week, as US Durable Goods Orders were up a measly 0.4% in August, missing expectations of 1.0%. Still, Nondefense Capital Goods Orders ex Aircraft jumped 1.8%. Earlier in the week, Markit reported that business activity remained in expansion territory, but advancing at a lower-than-expected pace.

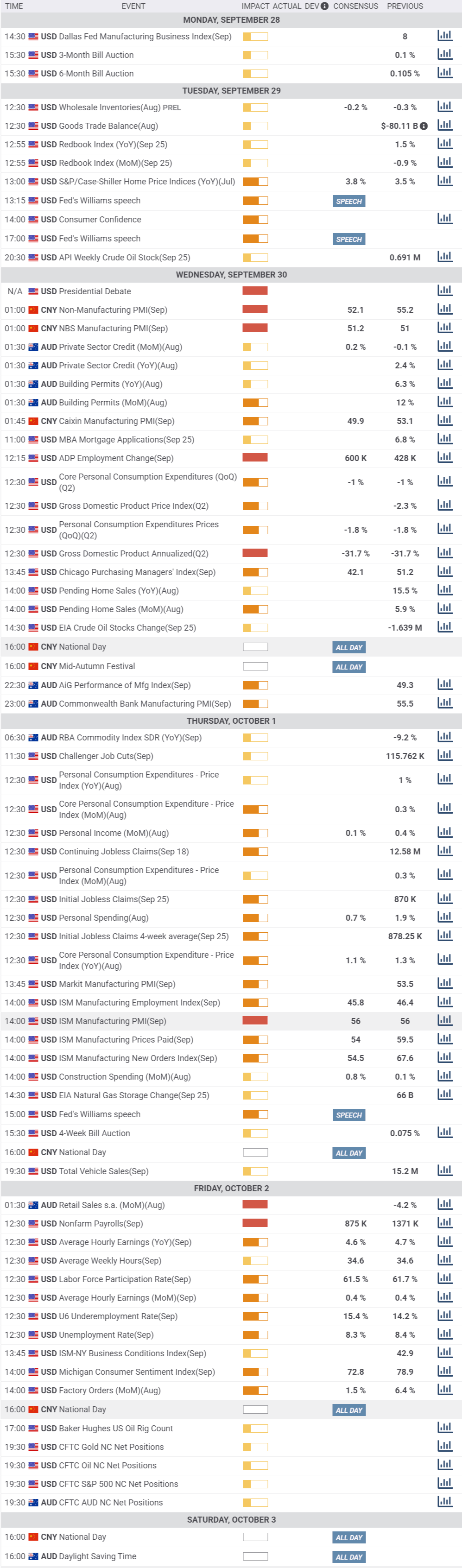

Things will be more interesting in the data front next week, as a new month starts. Australia will publish housing-related data and the official AIG Performance of Manufacturing Index for September, alongside the final reading of August Retail Sales. China will have its saying too, as the country will unveil the official NBS Manufacturing and Non-Manufacturing PMIs for September next Wednesday.

As for the US, there are two first-tier events that would catch investors’ eye, the presidential debate that will take place on Wednesday and the Nonfarm Payroll report, scheduled as usual for Friday.

Regarding the presidential debate, Trump and Biden will confront on the economy, coronavirus, riots and the Supreme Court, among other things. As for employment data, the US is expected to have added 875K new jobs in September, while the unemployment rate is seen ticking down to 8.3% from the current 8.4%. Average hourly earnings are seen up by 0.4% MoM. Ahead of this event, the US will also publish the official ISM Manufacturing PMI, foreseen at 56 in September.

AUD/USD technical outlook

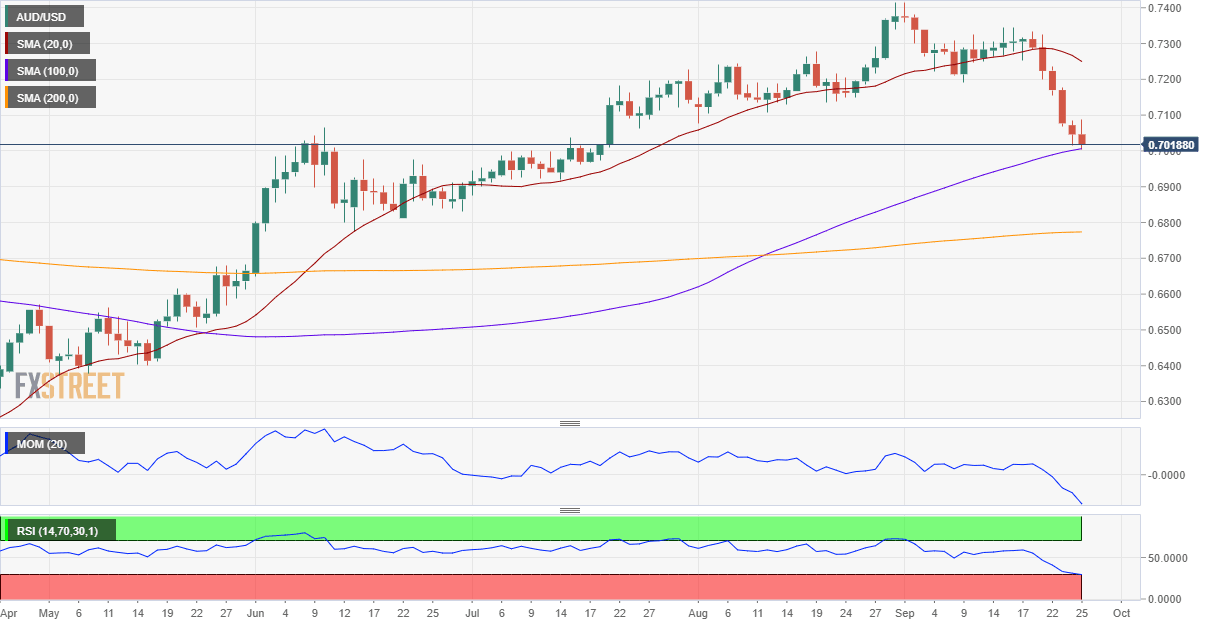

The AUD/USD pair has not only lost its bullish potential, but it’s at a brink of entering a long-term bearish path. The weekly chart shows that the pair is barely resting above a bullish 20 SMA, which remains above the 100 SMA. However, the pair has fallen well below the 200 SMA, which provided dynamic support in the last few weeks. Technical indicators in the meantime, head sharply lower, still above their midlines, although by little.

The daily chart shows that the pair has fallen for six days in a row, with no signs of bearish exhaustion. The pair is now below a bearish 20 DMA and a few pips above the 100 DMA, which maintains a mildly bullish slope. The Momentum indicator is stable within negative levels, while the RSI indicator is hovering around 30.

The 0.7000 level is the immediate support, followed by 0.6920. A break below this last exposes a robust static support area at around 0.6840. Resistances, on the other hand, come at 0.7100 and 0.7170. Anyway, the pair would need to recover beyond 0.7250 to shrug off the negative bias.

AUD/USD sentiment poll

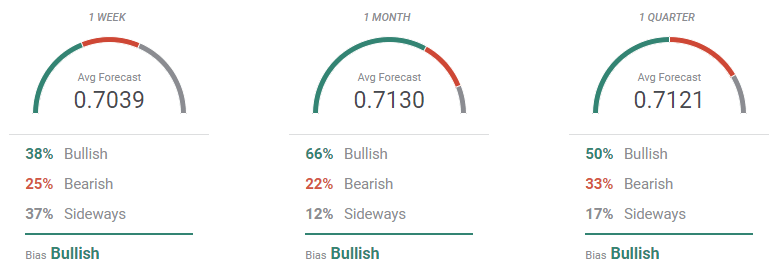

The FXStreet Forecast Poll shows that the bullish sentiment persists around AUD/USD and that it firms up as time goes by. Bulls are a majority in the three timeframes under study, although weekly basis they account just for the 38% of the polled experts. They rise to 66% in the monthly view, with the pair seen at 0.7130 on average and holding nearby throughout the next weeks.

The bearish momentum remains strong in the short-term, as the Overview chart shows that the weekly moving average turned sharply lower, with the larger accumulation of targets just below 0.70. The moving averages are flat in the monthly and quarterly perspectives, although there’s an increased number of bears pointing towards the 0.6700 area in the quarterly view.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.