AUD/USD Weekly Forecast: Down but not beaten

- The Australian dollar fell alongside plummeting US indexes.

- The Reserve Bank of Australia will have a monetary policy meeting next week.

- AUD/USD retreated sharply from a multi-year high, but the bearish potential is limited.

The AUD/USD pair hit 0.8006 on Thursday, a fresh three-year high, but it was all downhill from there. Wall Street plummeted as US Treasury yields soared to one-year highs, dragging commodity-linked currencies lower. AUD/USD fell to 0.7730 on Friday, bouncing just modestly ahead of the weekly close.

The pair rallied as the American dollar maintained its sour tone while investors remained mostly optimistic about future economic developments. Meanwhile, US Treasury yields stormed higher but accelerated their advances after US Federal Reserve chief Jerome Powell testified on monetary policy before Congress.

Powell reiterated that the central bank will keep supporting the economy, remarking that the employment sector is still far from pre-pandemic levels. On inflation, he repeated that the central bank has no aims to act if inflation moves above the 2% target for a while. He also said that any change to the current ultra-loose monetary policy would be communicated in advance.

Stronger dollar, weaker gold

The greenback gathered momentum as stocks plunged, but it had to do with confidence about a US economic comeback rather than with a dismal market mood. Cheaper government bonds and higher yields gathered investor appetite.

Safe-haven gold also collapsed, with spot falling under $ 1,750.00 a troy ounce, reaching its lowest reading since June 2020, adding pressure on the aussie.

Australia had not much to report on the macroeconomic front. The country published the Q4 Wage Price Index at the beginning of the day, which rose by 0.6% QoQ and 1.4% YoY, beating the market expectations but still well below average and near record lows. Q4 Private Capital Expenditure resulted at 3%, much better than the previous -3% and largely above the 0% expected.

In the US, Durable Goods Orders surged 3.4% in January, much better than the 1.1% expected, while Initial Jobless Claims shrank to 730K in the week ended February 19. The country’s Q4 GDP was upwardly revised to 4.1% as expected.

Busy days ahead

The week will start with China and Australia publishing February Manufacturing PMIs figures, while Canberra will also unveil February TD Securities Inflation. The Reserve Bank of Australia will announce its latest decision on monetary policy on Tuesday, while the country will publish Services PMIs on Wednesday. Australia will also publish Q4 Gross Domestic Product, foreseen at -1.8% and the final reading of January Retail Sales.

The US will also publish its official ISM PMIs next week, while Markit will release the final versions of its own indexes. The focus will shift to US employment-related data mid-week, as the US will publish Wednesday the ADP survey. The report is expected to show that the private sector added 125K in February, after gaining 174K in the previous month. On Thursday, the country will publish February Challenger Job Cuts, Initial Jobless Claims for the week ended February 26, and Q4 Unit Labor Cost and Nonfarm Productivity. Finally, on Friday, the US will publish the February Nonfarm Payroll report. At the time being, the market expects a 110K increase in job creation and an unemployment rate of 6.4%.

AUD/USD technical outlook

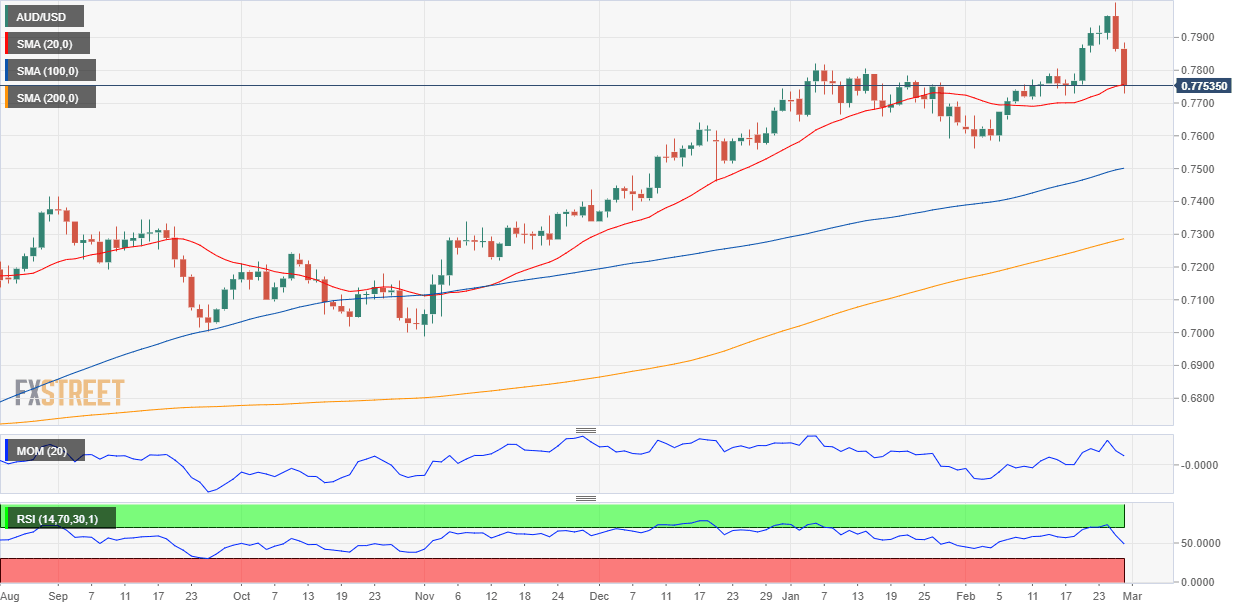

The AUD/USD pair trades around 0.7770, and the weekly chart shows that it holds on to the higher ground with a limited bearish scope. The pair trades above all of its moving averages, with the 20 SMA advancing above the larger ones. Technical indicators turned lower but are far from signaling a bearish continuation ahead, as the RSI is barely retreating from overbought readings.

In the daily chart, the risk of a bearish extension is higher. The pair is challenging a mildly bullish 20 SMA, while technical indicators retreated from overbought readings towards their midlines, maintaining their downward strength.

A steeper decline could be expected on a break below 0.7710, the immediate support level. The next relevant level is 0.7640, en route to 0.7563, the February low. The most relevant resistance level is 0.7820, as if the pair manages to run beyond it, it has room to extend its advance towards the 0.8000 threshold.

AUD/USD sentiment poll

According to the FXStreet Forecast Poll, the AUD/USD pair is poised to extend its current decline, but not for much. The sentiment indicator shows that bears are a majority in the three time-frame under study, although, on average, the pair is seen holding around the 0.7700 figure. The first test of the psychological 0.8000 threshold may have exacerbated the downbeat sentiment.

The Overview chart shows that higher highs are still possible, but most polled experts seem comfortable with the current price level, as most possible targets accumulate around it. The weekly and monthly moving averages turned marginally lower, but the quarterly one maintains its neutral stance.

Related Forecasts:

EUR/USD Weekly Forecast: Dollar surfing yields’ wave

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.