AUD/USD Weekly Forecast: Bulls may finally give up some

- Australian macroeconomic data indicated economic progress at the end of 2020.

- US growth data and the Federal Reserve monetary policy decision in the spotlight.

- AUD/USD consolidating near multi-year highs, a corrective slide is foreseen below 0.7640.

The AUD/USD pair has made little progress this week, ending it around the 0.7700 figure as investors struggled to maintain the optimism alive. Upbeat Chinese Gross Domestic Product released on Monday -the country reported the economy grew at an annualized rate of 6.5% in the last quarter of 2020- provided some support to the positive sentiment, but didn’t last. As the week developed, more social restrictions for longer took their toll on currencies.

Growth advantage on the Australian side

Australia has the extraordinary advantage of being an island, which has helped it control the pandemic. Yet the country is also paying the high cost of mobility restrictions and the subsequent economic slowdown. It reported on Thursday a week without new coronavirus contagions, although a foreign visitor tested positive on Friday. The country reported a total of 28,755 contagions since the pandemic started, and 909 deaths linked to the virus.

In the US, the death toll has reached 420K after reporting over 25 million cases, although the change of government implies a fresh approach to the pandemic. Joe Biden became the 46th US President on Wednesday and signed several executive orders, including travel restrictions and the mandatory use of face-mask. Among other things, he also revoked the licence of a pipeline bringing Canadian oil into the US and rejoined the Paris Agreement on climate change.

Biden has nominated Janet Yellen as Treasury Secretary, and both are aligned regarding the US relationship with China. The end of the trade war is nowhere close, as Mrs. Yellen promised to use a “full array of tools,” to curb China’s abusive practices.

Meanwhile, tensions between China and Australia keep growing. The latter has insisted on inquiring about the origins of COVID-19, which resulted in Beijing banning imports of multiple Australian commodities. The relationship may worsen if the US gets into the battle.

Australian data shows signs of modest economic progress

On the data front, Australia unveiled January Consumer Inflation Expectations, which came in at 3.4%, slightly below the previous 3.5%. The country also published an encouraging employment report, as it created 50K new jobs in December, most of which were full-time positions, while the unemployment rate ticked lower to 6.6%, beating expectations.

The Australian Commonwealth Bank Services PMI resulted at 55.8 in January, according to preliminary estimates, below the previous 57. The manufacturing index, however, improved from 55.7 to 57.2.

The US has little to offer but published Initial Jobless Claims for the week ended January 15, which were down to 900K. Housing-related data was mostly positive, although it failed to impress. On Friday, Markit published the preliminary estimates of its January PMIs. The manufacturing index improved to 59.1 while the services one came in at 57.5, both above the previous and beating the market’s expectations.

Australia will start the week with a holiday but will provide relevant data later into the week. The country will publish the December Westpac Leading Index and Q4 inflation figures on Wednesday, alongside NAB’s Business Confidence.

The US will offer December Durable Goods Orders, expected to have gained 0.9%, and the first estimate of the Q4 Gross Domestic Product, foreseen at 2.8% QoQ from 3.7% in the previous quarter. On Wednesday, the US Federal Reserve will announce its latest decision on monetary policy, although the market anticipates no changes to the current policy.

AUD/USD technical outlook

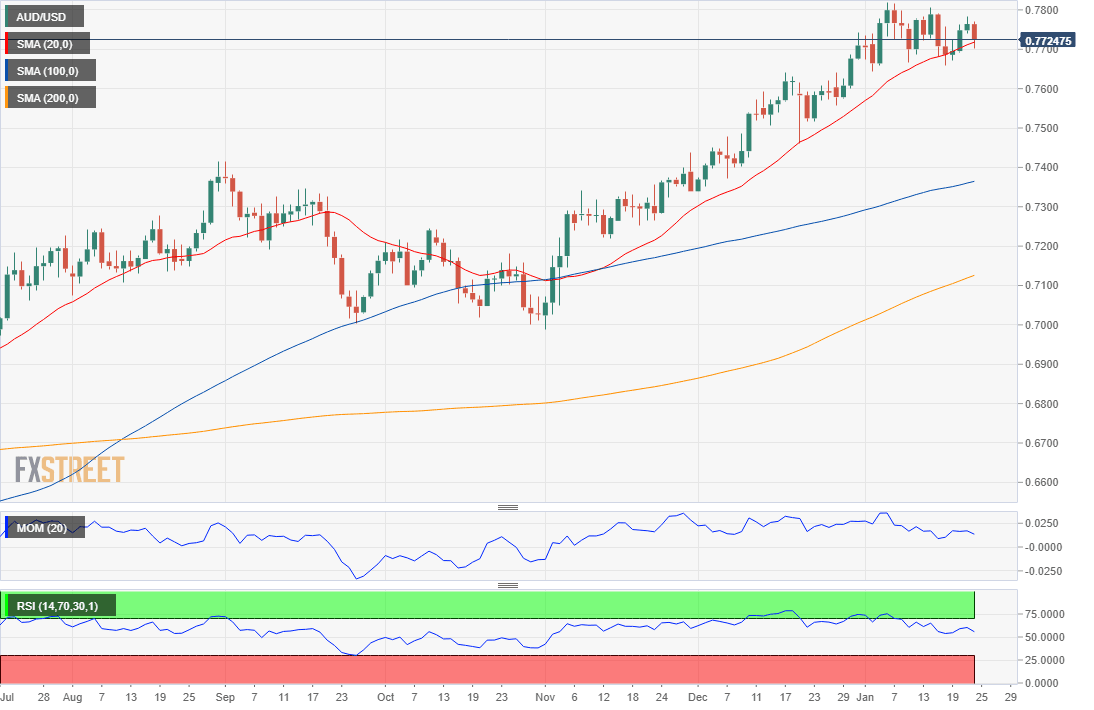

The AUD/USD pair reached a multi-year high of 0.7819 early January, while the monthly low was set at 0.7641. The weekly chart for the pair shows that the risk remains skewed to the upside, as the 20 SMA keeps advancing above the longer ones, all of them below the current level. The Momentum indicator has resumed its advance within positive levels, while the RSI indicator continues to consolidate near overbought readings.

In the daily chart, AUD/USD pressures a bullish 20 SMA, which also advances above the larger ones. Technical indicators, however, eased within negative levels but remain about their midlines. Bears may become stronger if the pair losses 0.7640, the immediate support level. Once below it, the decline could gain momentum towards the 0.7500 figure. The mentioned monthly high is key, and once above 0.7829, it has room to advance towards the 0.7900 price zone.

AUD/USD sentiment poll

The FXStreet Forecast Poll shows that market participants expect AUD/USD to maintain its bullish potential in the near-term, as 50% of the polled experts seen it rising, while 25% bet on a sideways move. The pair is seen on average at 0.7741. The sentiment flips to bearish in the monthly and quarterly perspectives, with the pair expected then to fall sub-0.7600, but for little.

The Overview chart shows that the weekly moving average is flat, while the longer ones have barely turned lower, suggesting unconvinced sellers. Nevertheless, chances for a test of the 0.7000 threshold are slowly increasing.

Related Forecasts:

Gold Price Weekly Forecast: XAU/USD bulls need bipartisan support after Biden's boost

EUR/USD Weekly Forecast: Could US 4Q GDP and the Fed revive dollar’s demand?

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.