AUD/USD Price Forecast: The 200-day SMA now looks closer

- AUD/USD clinched multi-day peaks near 0.6580 despite Dollar gains.

- The Chinese trade surplus narrowed more than expected in July.

- Commodity prices remained on the defensive on Wednesday.

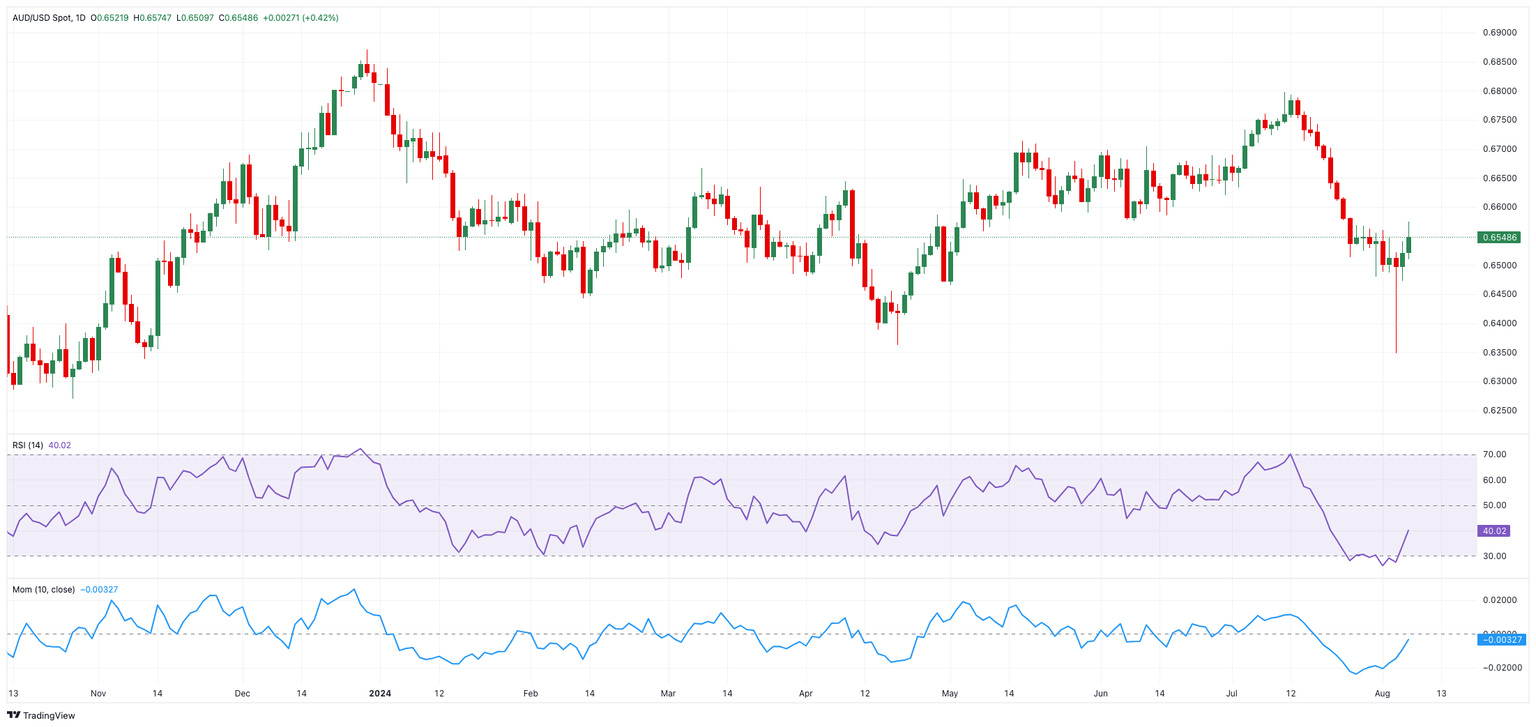

AUD/USD managed to regain the smile and climbed to multi-day highs well north of 0.6500 the figure on Wednesday, also putting further distance from Monday’s YTD lows near 0.6350 and turning positive on the weekly chart.

The AUD’s primary focus remains on the critical 200-day SMA, today at 0.6593. The pair needs to clear this region in a convincing fashion to restore its constructive outlook.

Wednesday’s significant rebound in the Aussie dollar contrasted with the resumption of the downward bias in both copper and iron ore prices, which maintained their multi-week downtrend well in place.

That said, the pair’s second consecutive daily gain came despite further advance in the US Dollar (USD) and disheartening prints from the Chinese docket, where the Balance of Trade showed the trade deficit shrank to $84.65B in July (from $99.05B).

Additionally, the Australian currency remained propped up by investors’ assessment of the recent hawkish hold by the RBA at its meeting last Tuesday.

More on the RBA, the bank reiterated to market participants that it is in no rush to ease policy. The RBA anticipates that domestic inflation will be more persistent, with both trimmed-mean and headline CPI inflation now projected to approach the mid-point of the 2-3% range by late 2026, instead of the June 2026 estimate from the May forecasts.

At her press conference, RBA Governor Michele Bullock noted that “the Board did consider a rate rise” and emphasized that rate cuts are “not on the agenda in the near term.” Bullock also stated that expectations for rate cuts are “a little ahead of themselves.”

Overall, the RBA is expected to be the last among the G10 central banks to start cutting interest rates.

Potential easing by the Federal Reserve in the medium term, contrasted with the RBA's likely prolonged restrictive stance, could support AUD/USD in the coming months.

However, sluggish momentum in the Chinese economy might hinder a sustained recovery of the Australian dollar. China continues to face post-pandemic challenges, deflation, and insufficient stimulus for a convincing recovery. Concerns about demand from China, the world's second-largest economy, also emerged following the country's Politburo meeting, where, despite promises to support the economy, no specific new stimulus measures were announced.

AUD/USD daily chart

AUD/USD short-term technical outlook

Further gains should encourage AUD/USD to dispute the key 200-day SMA of 0.6593, seconded by the transitory 100-day and 55-day SMAs of 0.6600 and 0.6641, respectively, before reaching the July top of 0.6798 (July 8) and the December peak of 0.6871.

The revival of the negative tone may cause AUD/USD to retest the 2024 bottom of 0.6347 (August 5), ahead of the 2023 low of 0.6270 (October 26).

The four-hour chart suggests a mild resurgence of the bullish mood. However, initial support is at 0.6347, followed by 0.6338 and 0.6270. On the upside, the first barrier is at 0.6574, prior to 0.6610 and the 200-SMA of 0.6646. The RSI climbed to around 55.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.