AUD/USD Forecast: Is defeating coronavirus enough to maintain the Aussie uptrend? RBA, NFP eyed

- AUD/USD has been extending its uptrend as Australia is winning against coronavirus.

- The RBA decision, US Non-Farm Payrolls, and the next steps regarding lockdowns are eyed.

- Early May's daily chart is showing an uptrend channel.

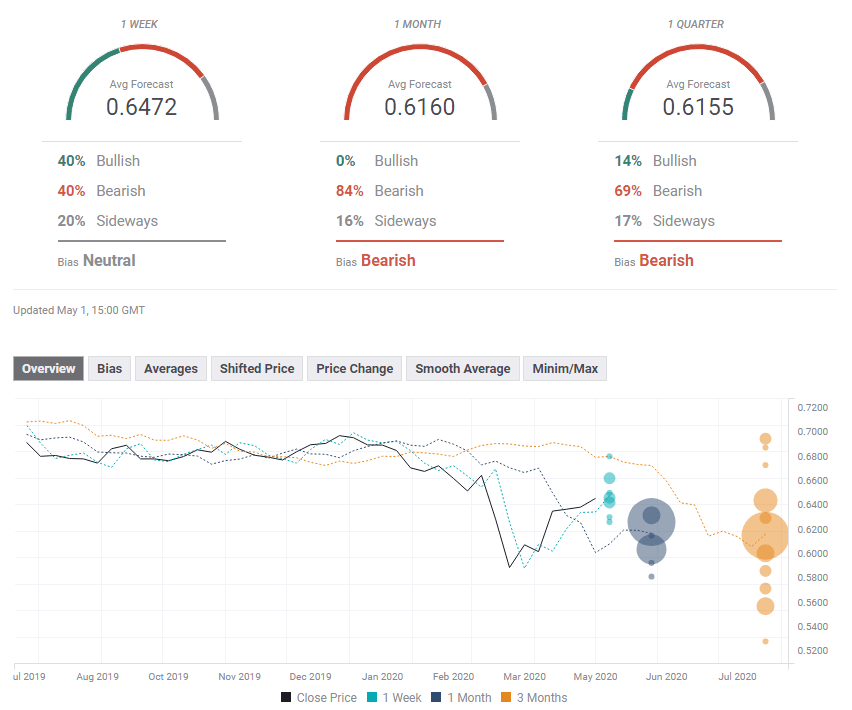

- The FX Poll points to falls in the medium and long-terms.

The Aussie has continued flying like a rugby ball – as the league is preparing to return. Apart from Australia's gains against the virus, it enjoyed the most upbeat market mood. The Reserve Bank of Australia's decision and quarterly report, the Non-Farm Payrolls buildup, and defeating the disease is in the spotlight.

This week in AUD/USD: Mixed signals

Beating coronavirus? The land down under confirmed fewer than 100 COVID-19 deaths at the time of writing, and cases are capped under 7,000. Several states have reported zero new infections in recent days. Australia's success has led by Prime Minister Scott Morrison to announce that restrictions will be eased next week. Similar to New Zealand, both countries acted fast and also enjoyed the fact they have no land neighbors.

Inflation: The Aussie also benefited from relatively robust inflation figures. The Consumer Price Index rose by 0.3% in the first quarter, while Trimmed Mean CPI advanced by 0.5%, both beating expectations. Official Chinese PMIs hovered around 50 – reflecting growth. However, these surveys from Australia's No. 1 trade partner were shrugged off by markets.

SIno-America relations: US President Donald Trump weighed on sentiment and contributed to sending AUD/USD lower after he suggested that coronavirus originated in a Wuhan lab. The worsening relations between the economic giants may have an adverse impact on global trade, which Australia depends on.

Full Fed support: Earlier in the week, the A$ enjoyed the upbeat market mood, partially stemming from the US Federal Reserve's unequivocal commitment to support the economy. The bank enlarged both its municipal and Main Street lending schemes. Jerome Powell, Chairman of the Federal Reserve, said more could be done and called on the government to enhance its spending as well.

Downbeat America data may have contributed to the Fed's sense of urgency. The economy shrank by 4.8% annualized in the first quarter, while accumulated job losses have reached 30 million.

AUD/USD advanced and pared some of its gains amid the general market mood and also Australian-specific developments.

Australian and Chinese events: Lockdown, RBA in focus

At the time of writing, it is still unclear when the PM will announce the relaxing of restrictions, and some depend on states and localities. Nevertheless, the accelerated pace of reopening will likely keep supporting the Aussie. Additional sports events – which Aussies admire – will probably grab attention.

The Reserve Bank of Australia has two opportunities to move the Aussie. The Canberra-based institution is set to leave its interest rate unchanged and not offer additional accommodation at this junction. A positive message may boost the Aussie while fears about the global economy may bring it down.

The second appearance of the RBA is no less significant. The bank's Monetary Policy Statement – or quarterly report – will shed light on how Phillip Lowe, the Governor, and his colleagues see the state of affairs. It could also provide hints about future moves, including Quantitative Easing. Getting into more detail may result in a stronger reaction from markets.

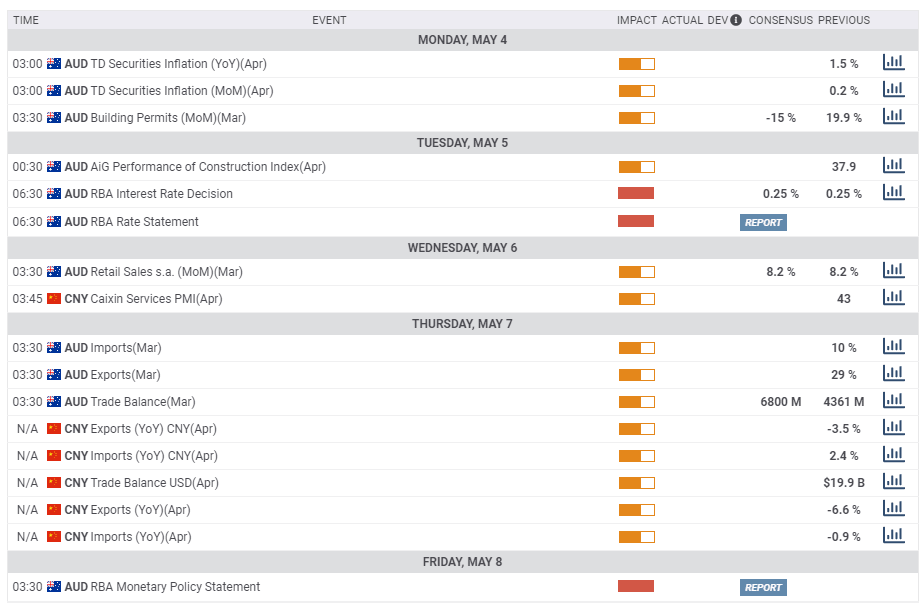

Other events of interest are Retail Sales and Building Permits, which have likely come under significant pressure. China's trade balance figures surprised in MArch with smaller than expected falls in both imports and exports. An increase in imports would be encouraging for Australia's mining industry.

Here the most prominent Australian and Chinese releases on the economic calendar:

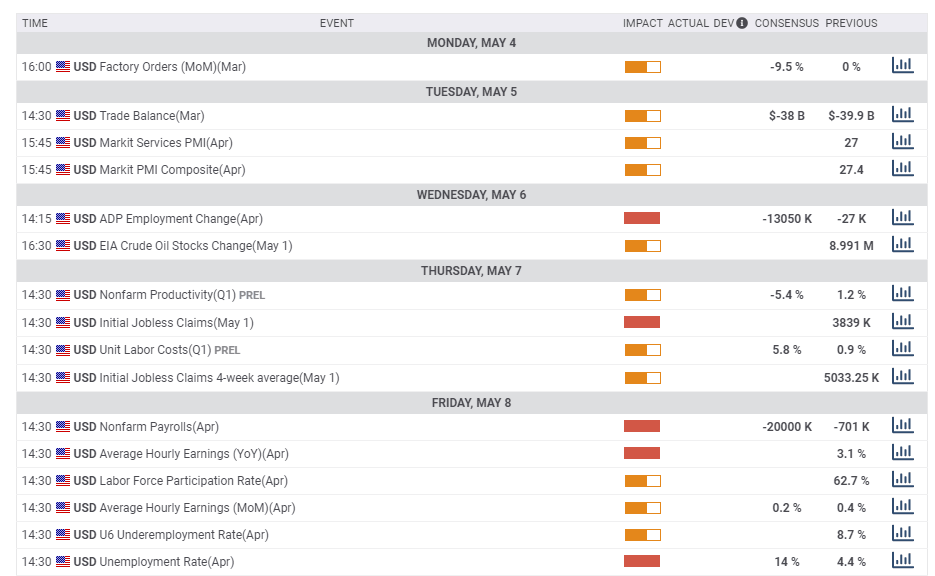

US events: 20 million jobs lost?

No fewer than 20 million jobs lost – that is what economists are expecting in April due to the shelter-in-place orders meant to curb coronavirus. The Non-Farm Payrolls report is also projected to show a leap in the jobless rate from 4.4% to 14% and potentially a drop in the participation rate – reflecting longer-term damage.

Devasting figures may boost the safe-haven dollar while a minor beat – devastating as they maybe – will likely weigh on the world's reserve currency.

Ahead of the NFP comes the buildup. The ISM Non-Manufacturing Purchasing Managers' Index for April will likely remain at the low ground, and the employment component will be eyed as a hint toward the jobs report. ADP, America's largest payroll provider, will provide a more direct clue with its private-sector labor market figures. A substantial fall is projected there.

Weekly jobless claims and other figures could have a more limited effect this week as they do correlate directly to the jobs report. Unemployment claims are for the week ending May 1, outside the NFP survey period.

Coronavirus statistics are also watched after several states let their stay-at-home lapse and other relaxed restrictions. Other places, like New York, are watching their local figures and how others are doing will be factored in. Testing and tracking capabilities are somewhat lacking.

Relations between the world's largest economies could continue impacting market sentiment and AUD/USD. Any conciliatory remarks by President Trump toward China – he initially praised his counterpart Xi Jinping for handling the crisis – may support the currency. Ongoing friction could have the opposite effect.

Here are the top US events as they appear on the forex calendar:

AUD/USD Technical Analysis

Aussie/USD is trading within an uptrend channel since mid-March, and that is a bullish sign. At the time of writing, the currency pair is hovering around the bottom of that channel. Break or bounce? That is an open question.

The currency pair holds above the 50-day Simple Moving Average, enjoys upside momentum, and avoided entering the overbought territory, as the Relative Strength Index remained shy of the 70 marks.

Critical resistance awaits at 0.6570, which was April's peak and also where the 100-day SMA hits the price. The next significant cap is only at 0.6690, which was a swing high in early March, and then by 0.6660, that capped AUD/USD back in February.

Support is at 0.64, which held the currency pair down in mid-April. It is followed by 0.63, where the 50-day SMA hits the price, and then by 0.6250, a double-bottom that was seen last month. The next lines to watch are 0.6210, 0.61, and 0.5990.

AUD/USD Sentiment Poll

The Aussie has been defying gravity and the global downturn during April. Will this change in May? Australia's success with shaking the disease may already be priced in, and a mix of RBA warnings and weak US data could send it down.

The FXStreet Forecast Poll is showing the Aussie holding up in the upcoming week but collapsing afterward. The average targets for the short and long terms have been upgraded but it has been moderately downgraded in the medium term.

Related Reads

Author

Yohay Elam

FXStreet

Yohay is in Forex since 2008 when he founded Forex Crunch, a blog crafted in his free time that turned into a fully-fledged currency website later sold to Finixio.

-637239369470197201.png&w=1536&q=95)