Xlence in 2025: A broker overview for serious CFD traders

In an increasingly complex trading environment, the selection of a reliable Contract for Difference (CFD) broker demands a high level of scrutiny. Xlence, an international brokerage brand operated under the trade name of Tradeco Limited, stands out in 2025 as a platform tailored for traders who want technical clarity, rapid execution, and broad asset exposure.

Tradeco Limited is authorised and regulated by the Seychelles Financial Services Authority (FSA), giving those interested peace of mind. For more information about Xlence, this CFD broker review provides an analytical assessment of its offerings. Let’s go.

Execution model and leverage ranges

Xlence claims to have executed trades based on speed and precision, which are requirements for people engaged in high-frequency or intraday strategies. They deliver fast execution times, supported by advanced server architecture. Although execution speeds are not quantified, user feedback from forums points to efficient handling under volatile conditions.

Source: https://www.xlence.com/en/

Additionally, the brand offers flexible leverage of up to 1:1000, a range that accommodates varying levels of risk appetite and margin strategies. This allows for better exposure but also increases the potential for losses. All trading involves risk, and it is of great importance that traders assess their capacity for drawdowns.

Margin requirements scale according to asset class and account tier, meaning retail and professional traders can modulate their exposure. Negative balance protection is available as well, so that an account will not go below zero, yet it is still a good idea to confirm this under account-specific terms.

Asset coverage and platform versatility

Xlence broker provides a comprehensive multi-asset portfolio. Tradable instruments are:

-

Forex: A wide range of major, minor, and exotic currency pairs.

-

Metals: Gold, silver, palladium, and platinum.

-

Indices: Major global indices such as the UK 100, Aussie 200, and German 40.

-

Commodities: Agricultural and energy commodities, including oil and natural gas.

-

Futures: CFDs based on futures markets across various asset classes.

-

Shares: Equity CFDs across U.S. and European stock markets.

This diversity enables users to pursue multi-strategy portfolios. Such breadth can facilitate volatility arbitrage and correlation-based trading.

Source: https://www.xlence.com/en/

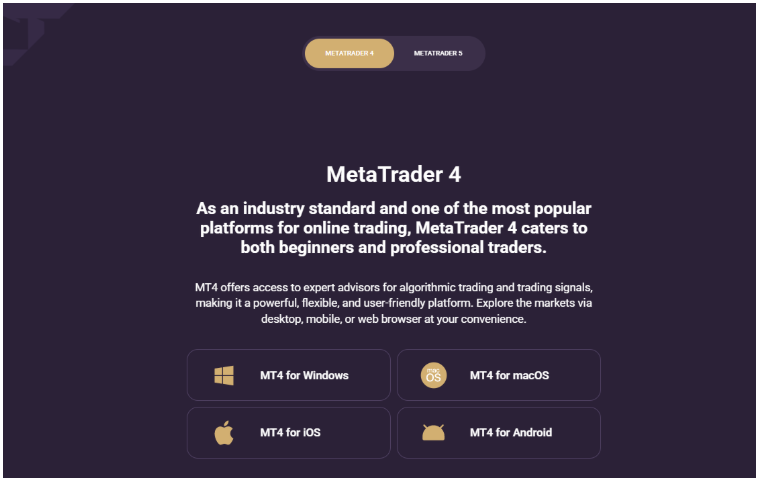

Moreover, the firm supports widely used platforms such as MetaTrader 4 (MT4) and MetaTrader 5 (MT5). With them, customers can implement automated strategies through Expert Advisors (EAs), utilize integrated charting tools, and customize indicators. They are easily accessible via desktop, mobile, and web terminals, ensuring continuity on all devices.

Forex spreads and Xlence FX trading fees

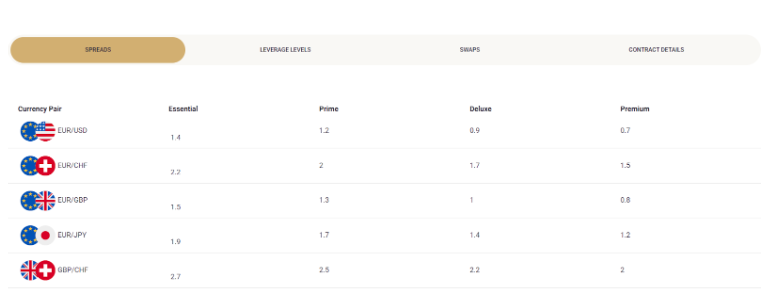

Xlence operates on a low-cost model, with tight spreads across popular forex pairs and competitive conditions on other asset types. For example, EUR/USD spreads start at 0.4 pips on the Ultimate account, with raw spreads accompanied by a fixed commission per lot. Essential account holders can experience wider spreads but commission-free trading.

Source: https://www.xlence.com/en/markets/forex/

Non-trading fees are limited. The company does not charge deposit fees and maintains reasonable withdrawal conditions, though some payment providers may impose third-party costs. An inactivity fee may apply after prolonged dormancy, which is in line with industry norms.

What is more important is that the firm is transparent about everything. Cost structures are clearly detailed on the website and client portal, so members will not be surprised by hidden fees.

Regulation and licensing

Operating under the Seychelles Financial Services Authority (FSA) oversight, Xlence is subject to a recognized offshore regulatory environment. Even when FSA does not impose the same capital and conduct requirements as other top-tier jurisdictions like the FCA or ASIC, it does provide a structured framework for client fund segregation and internal audit procedures.

As always, all trading involves risk, and you should ensure that you understand the risks involved before engaging with leveraged instruments.

Pros and cons

Pros

-

Flexible leverage up to 1:1000.

-

Fast trade execution.

-

Great asset class exposure.

-

Low spreads and transparent pricing.

-

MT4 and MT5 platform availability, supporting automation and technical analysis.

-

Many educational materials to learn at one's own pace.

-

Dedicated customer support.

Cons

-

Inactivity fees and third-party withdrawal costs may apply.

-

Lack of some trading markets such as bonds, cryptos, and mutual funds.

-

The site has no live chat window, email, or phone number.

Xlence is a brand that makes ways for fast trading, low costs, and a large selection of assets for active CFD traders. It suits those who are confident in using leverage and managing risk, and who want flexibility in both tools and markets.

However, traders should be aware of the regulatory environment and make sure they are comfortable with the protections available. For those who understand these factors, it stands as a good choice in today’s global trading landscape.

RW: All trading involves risk. It is possible to lose all your capital. You should consider whether you can afford to take the high risk of losing your money.

Promoted content