How withdrawals define SandstoneFX’s client-first approach

In online trading, trust is not earned when a client opens an account. It is earned when they decide to withdraw.

For many traders, the withdrawal process is where a broker’s integrity is tested. Transparent handling of client funds, smooth processing, and clear communication separate reliable brokers from the rest.

At SandstoneFX, every part of this process is built to serve one principle: financial transparency. The company believes that access to funds should be straightforward, predictable, and aligned with the standards of top-tier financial regulation.

Transparency Starts with Regulation

Before traders consider the technical side of withdrawals, they often ask a fundamental question:

Can I trust this broker with my money?

Where’s the catch?

We assure you that SandstoneFX operates under top-tier regulatory oversight (such as the FSC CFR, MiFID and more), meaning its procedures and client fund management are subject to strict financial supervision.

This ensures that all withdrawal requests are handled according to clearly defined rules that protect the client’s right to access their funds.

The company’s commitment to transparency is not a slogan but a structural choice. From compliance checks to transaction monitoring, every process is designed to reinforce security and accountability.

A System Designed for Clarity

A reliable withdrawal experience begins with clear systems. SandstoneFX offers multiple channels for clients to access their funds, including traditional bank transfers, debit and credit cards, and selected digital wallets.

Each method operates under verification protocols that ensure withdrawals are only made to accounts in the client’s name.

By combining flexibility with strict security standards, SandstoneFX gives clients both accessibility and peace of mind.

While processing times can vary depending on payment providers, most withdrawals are typically completed within one business day. This operational efficiency reflects the broker’s ongoing investment in financial infrastructure and its focus on delivering consistent service quality.

Efficiency Without Compromise

When traders request to withdraw their funds, they are not just completing a transaction they are testing the broker’s commitment to efficiency and fairness.

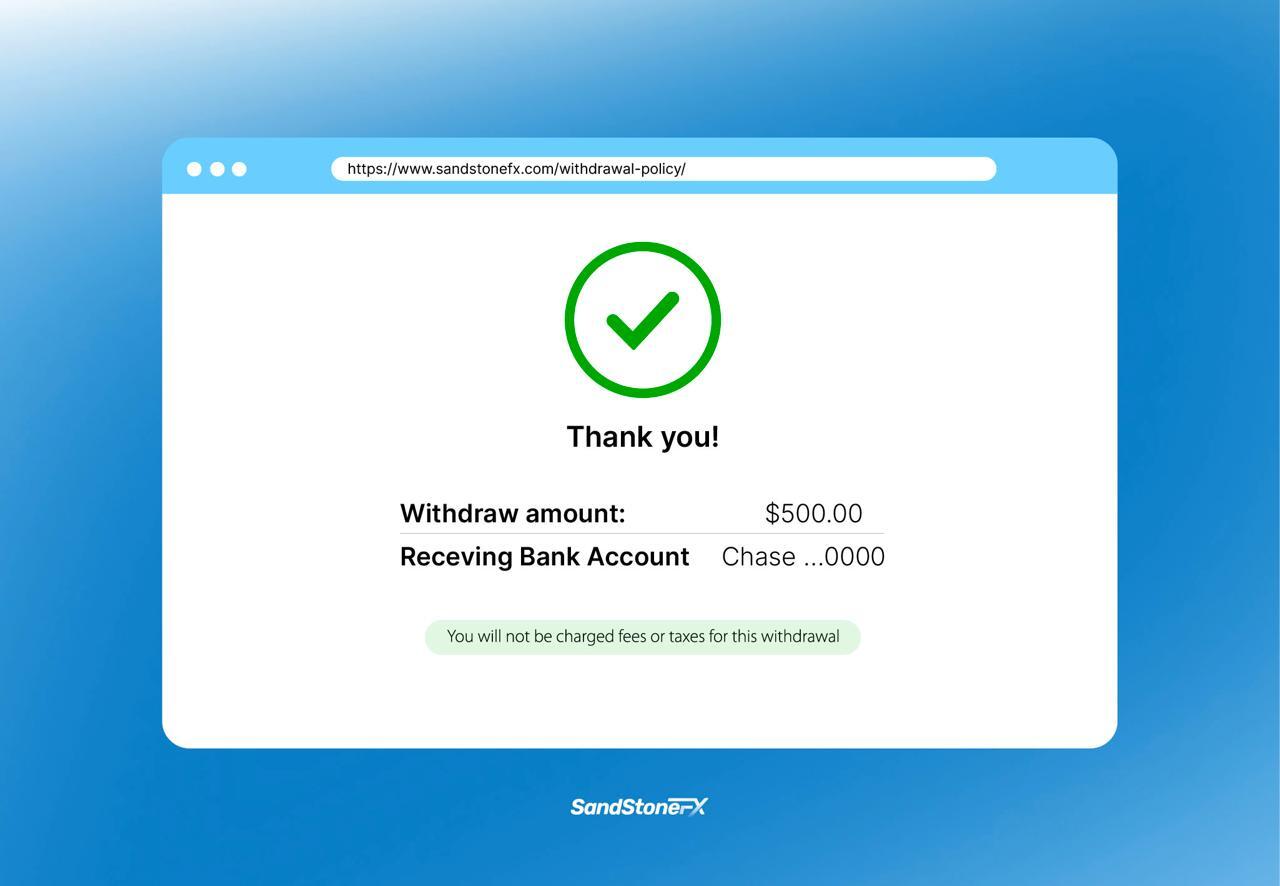

SandstoneFX approaches this step with precision. Standard withdrawals are free of charge, ensuring that clients retain the full value of their balance without hidden deductions or unnecessary fees.

Conversion fees may apply if the client’s base currency differs from the currency of their receiving account, as these are determined by third-party institutions such as banks or card issuers. SandstoneFX supports a wide range of account currencies, including USD, EUR, GBP, AUD, CAD, and several others, to help minimize conversion costs for international clients.

What Happens When Delays Occur

Even the most advanced systems occasionally face delays, often due to external banking networks or incomplete verification details.

When this happens, SandstoneFX communicates transparently, guiding clients through the next steps and ensuring issues are resolved promptly.

Common causes of withdrawal delays include unverified documents, insufficient free balance, or discrepancies in account details. These are standard procedures in compliance with anti-money-laundering and Know Your Customer (KYC) obligations/requirements designed to protect both traders and the financial system.

A Broader Definition of Safety

The safety of client funds extends far beyond technology. True financial security comes from oversight, structure, and discipline.

SandstoneFX’s regulated status and transparent operational model ensure that client funds remain segregated, auditable, and retrievable within clearly defined regulatory parameters.

The company’s approach is simple: integrity in fund management is non-negotiable. From trade execution to fund withdrawal, every process reflects that principle.

Earning Trust Through Access

In the trading industry, many metrics can define success: execution speed, spreads, leverage options. Yet the ability to withdraw funds smoothly and confidently remains one of the most meaningful signals of a broker’s reliability.

SandstoneFX views this process not as an administrative task but as a moment of truth in the broker-client relationship. When clients can access their funds with clarity and confidence, trust is reinforced.

That trust is what allows traders to focus on what truly matters: strategy, performance, and growth knowing that their capital remains under their full control.

Trust, Access, and the Future of Client Experience

As financial markets evolve, brokers that invest in transparency, automation, and secure fund management will define the next standard for client experience. SandstoneFX stands among them, turning every withdrawal into a demonstration of accountability and respect.

No buzzwords, no empty promises, just a consistent commitment to operational clarity and financial integrity.

Disclaimer: Investments can fall and rise. You may get back less than you invested. Past performance is no guarantee of future results when trading CFDs. You should consider whether you can afford to take the high risk of losing your money.