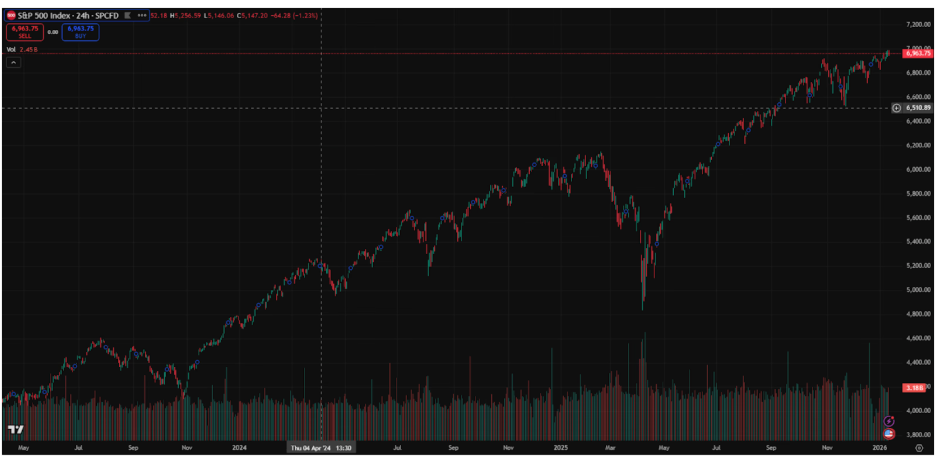

Analysts outline path for S&P 500 to Reach 7,500 by 2026

Market strategists are increasingly examining the possibility that the S&P 500 could approach the 7,500 level by 2026, supported by sustained investment in artificial intelligence, a potentially less restrictive interest-rate environment, and continued corporate earnings growth.

Round-number milestones have historically drawn strong investor attention, often shaping positioning and influencing market narratives. While no forecast is guaranteed, analysts say a convergence of structural and cyclical factors could make such a move plausible over the next two years.

According to Darren Reed, Chief Analyst at trading and investment platform VirPoint, three reinforcing forces stand out: the durability of AI-driven growth, the outlook for monetary policy, and the ability of corporate profits to continue expanding across sectors.View the complete market outlook.

AI Momentum Continues to Reshape Market Leadership

The rapid adoption of artificial intelligence remains one of the most powerful drivers of U.S. equity performance. Early gains were concentrated in semiconductors and large technology platforms, but Reed said the next phase is already broadening into enterprise software, cloud infrastructure, cybersecurity, data management, and industrial automation.

“AI is increasingly moving from a niche technology story to a broad productivity and profitability driver,” Reed said. “When adoption spreads across industries, earnings support tends to become more durable.”

Beyond fundamentals, market structure also plays a role. Systematic trading strategies, passive fund inflows, benchmark tracking by active managers, and renewed retail participation tend to reinforce dominant themes once they become established.

Reed noted that as long as capital expenditure continues and revenue pathways remain visible, investor confidence in AI-exposed companies could persist, supporting higher valuations for a significant portion of the index.

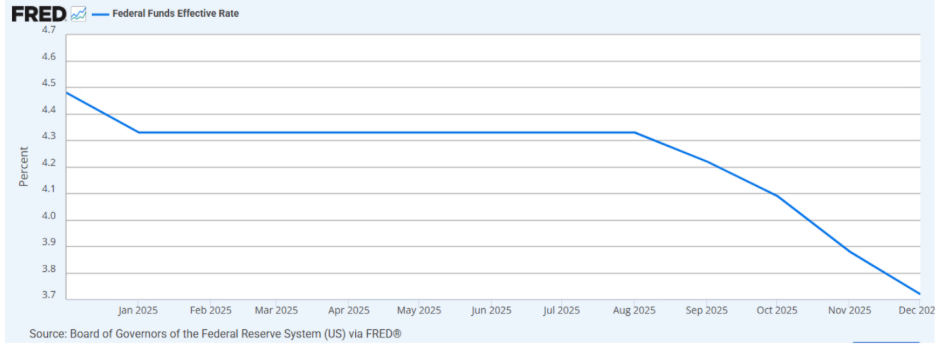

Interest Rates Remain a Critical Variable

Another key pillar of the bullish outlook is the trajectory of interest rates. Lower yields typically increase the present value of future earnings, reduce borrowing costs, and ease financial conditions across housing, manufacturing, and consumer-facing sectors.

A gradual easing cycle driven by moderating inflation rather than economic contraction would be particularly supportive for equities, Reed said.

“The most constructive scenario is a soft landing — inflation cooling while growth holds up,” he explained. “That combination allows earnings to remain intact while valuation multiples receive structural support.”

Lower cash yields can also encourage investors to rotate back into equities, further strengthening demand for risk assets.

Earnings Growth as the Foundation

While sentiment and valuation matter, earnings remain the ultimate determinant of long-term market direction.

Reed said productivity improvements, cost discipline, stabilizing supply chains, and share buybacks could support steady profit expansion through 2026. AI-enabled automation and faster development cycles are also beginning to influence operating margins across multiple sectors.

Importantly, broader participation would make any rally more sustainable. Industrial companies, financial institutions, infrastructure providers, and consumer-oriented firms could all contribute if financial conditions remain supportive.

“When earnings growth is not concentrated in just a few mega-cap names, investors are more willing to assign healthier multiples to the market as a whole,” Reed said.

Why Rate Relief Can Lift the Whole Index

A decline in rates does not only benefit speculative growth stocks. It can act as a broad tailwind:

- Housing and automotive sectors become less rate-constrained

- Small and mid-cap companies gain refinancing flexibility

- Financial conditions loosen, improving risk appetite

- Equity risk premiums become more attractive relative to bonds

- Valuation multiples are easier to justify without requiring explosive earnings growth

Earnings and Valuations Working Together

A credible pathway to 7,500 does not rely on a single factor, Reed added, but rather on the interaction between profits and valuation support.

In this framework, expanding earnings provide the fundamental engine, while easing monetary conditions support higher multiples. Continued AI investment strengthens both by raising growth expectations and improving productivity.

“That is how a level like 7,500 moves from sounding extreme to sounding achievable,” Reed said.

Risks Remain

Despite the constructive outlook, analysts caution that several developments could disrupt the scenario.

A slowdown in AI revenue realization, a rate decline triggered by recession, renewed inflation pressures, or geopolitical instability could all undermine corporate profits or investor confidence.

“These risks don’t invalidate the upside case,” Reed said. “They simply highlight why 7,500 is a scenario rather than a certainty.”

Outlook

Reed concluded that if AI investment remains resilient, interest rates gradually ease, and earnings growth continues to broaden, the S&P 500 could approach the 7,500 threshold within the next two years.

“If all three forces align — even imperfectly — the milestone becomes less about optimism and more about probability,” he said.

Podcast Interview

Darren Reed discusses the full S&P 500 outlook, AI investment trends, and interest-rate scenarios in detail on The VirPoint Trading Desk Podcast.

Watch the full episode here:

Disclosure: Darren Reed is Chief Analyst at VirPoint. The views expressed are his own.

For more market insights, expert analysis, and updates from the VirPoint Trading Desk, follow VirPoint on YouTube and across its official social media channels.

https://www.youtube.com/@VirPoint_Official

https://www.linkedin.com/company/virpoint

https://www.facebook.com/people/VirPoint/61578768718123/