WTI technical analysis: Under pressure in Asia with a spike to a fresh daily low

- The bears are in control while below the 21-DMA and target a break to below the 50 handle.

- The 21-DMA is the first hurdle for the bulls which is located a touch below 55 the figure.

West Texas Intermediate crude has been under pressure in Asia and spiked to a fresh daily low following the trade talks headlines which sparked off a risk-off session.

Overnight, on a spot basis, WTI was up some 0.20% into the close on Wall Street, having climbed from a low of $52.28 only to be rejected at the $53.73 highs and painting a bearish pin bar on the daily charts again.

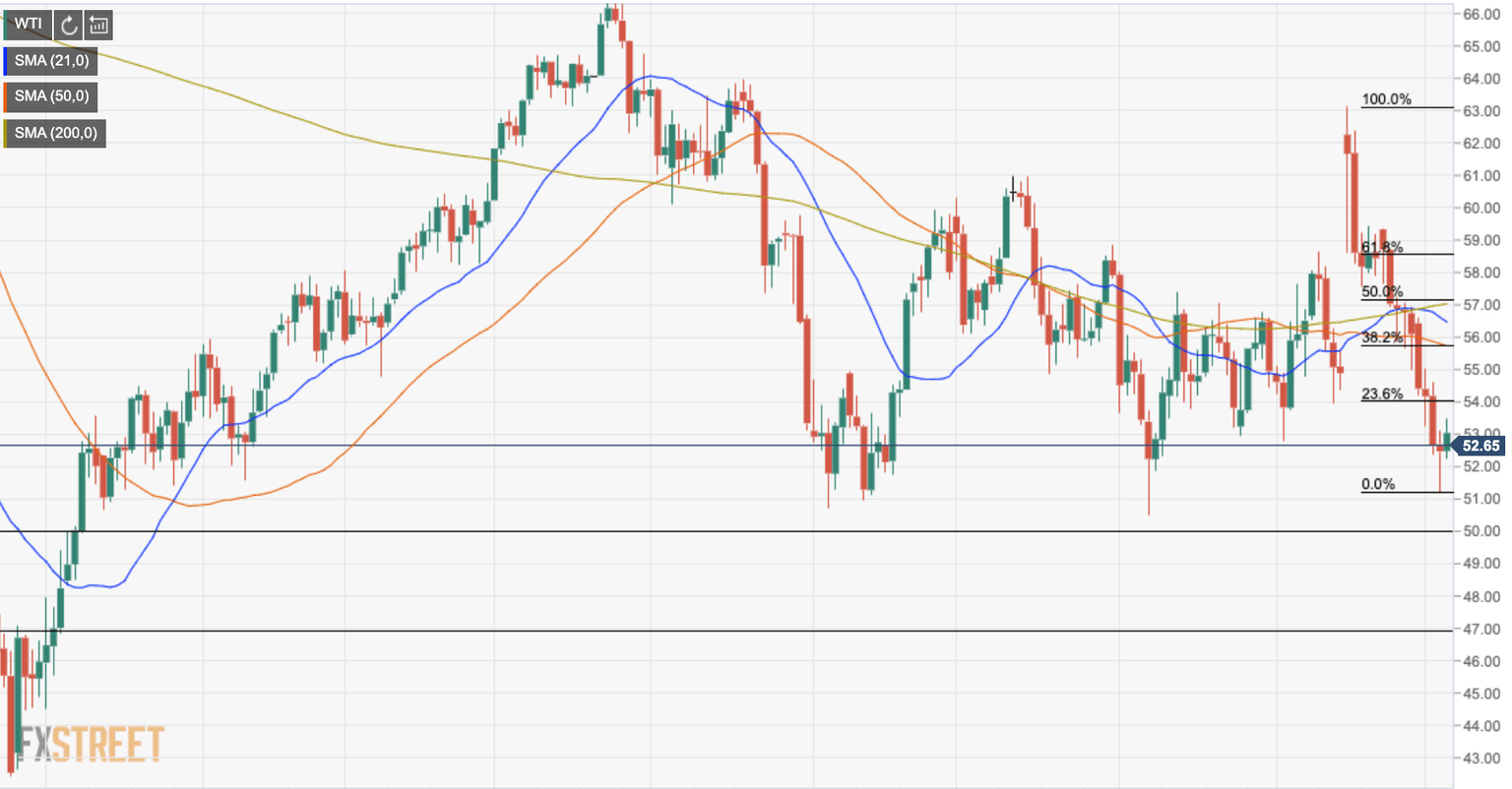

In Asia, so far, the price dropped to a low of $51.39 but was quickly bought up again by the bulls to the current $52.50s. The 21-DMA is the first hurdle for the bulls which is located a touch below $55 the figure. The $50 and 200-DMAs are surrounding the 56 handle while a 50% Fibonacci retracement of the 16th Sep to 3rd Oct lows comes into play in the $57 handle.

However, the bears are in control while below the 21-DMA and target a break to below the $50 handle which then opens the Nov 2018 lows at $49.39. Thereafter, bars can look towards $46.90 level ahead of the18th Dec lows down at $45.77 ahead of the Dec double bottom lows below $42.50.

WTI daily chart

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.