WTI Technical Analysis: Near-term bounce towards $54.00 unlikely to survive

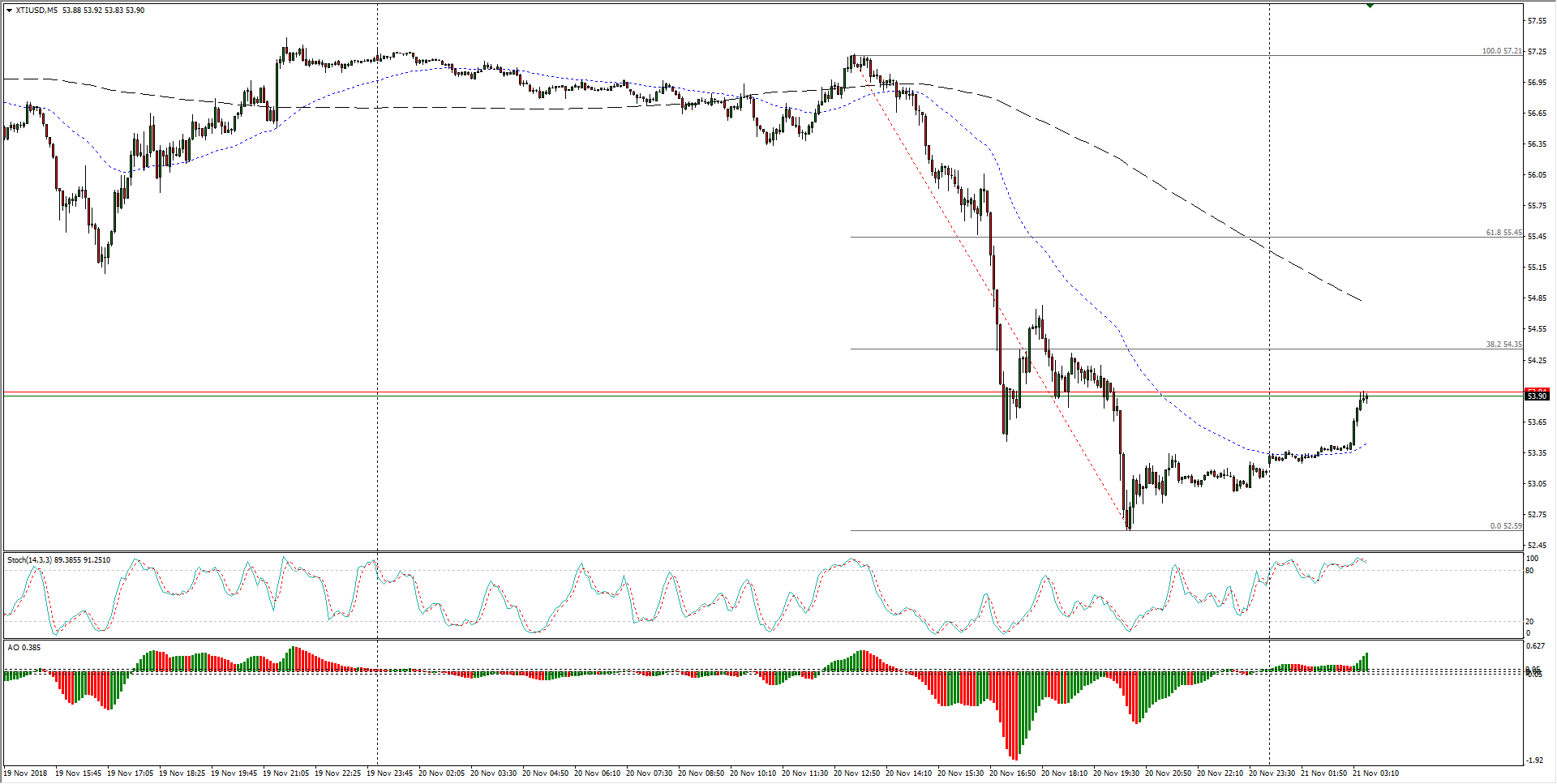

- The last twenty-four hours saw US crude oil prices slip into touching distance of 52.00, a critical low for WTI, and Wednesday's early-session bounce from Tuesday's bottoms is set to hit intraday resistance at the 38.2 Fibo retracement level at 54.35.

WTI Chart, 5-Minute

- The last two weeks have seen US crude prices fail to establish a bullish recovery from the last low set on November 13th at 54.75, and after several days of muted gains US crude barrels are back on the decline.

WTI Chart, 30-Minute

- WTI's last quarter has seen a complete reversion into a bearish trend, and even a bounce into the 62.00 region would see US crude still stuck in a bearish chart stance after tumbling for what is now set to become a seven-week bear run.

WTI Chart, 4-Hour

WTI

Overview:

Last Price: 54.03

Daily change: 58 pips

Daily change: 1.09%

Daily Open: 53.45

Trends:

Daily SMA20: 60.35

Daily SMA50: 67.07

Daily SMA100: 67.75

Daily SMA200: 68.14

Levels:

Daily High: 53.52

Daily Low: 53.38

Weekly High: 60.93

Weekly Low: 55.21

Monthly High: 76.25

Monthly Low: 64.86

Daily Fibonacci 38.2%: 53.47

Daily Fibonacci 61.8%: 53.43

Daily Pivot Point S1: 53.38

Daily Pivot Point S2: 53.31

Daily Pivot Point S3: 53.24

Daily Pivot Point R1: 53.52

Daily Pivot Point R2: 53.59

Daily Pivot Point R3: 53.66

Author

Joshua Gibson

FXStreet

Joshua joins the FXStreet team as an Economics and Finance double major from Vancouver Island University with twelve years' experience as an independent trader focusing on technical analysis.