WTI soars over 3% on growing optimist amidst US debt ceiling talks and IEA forecast

- International Energy Agency predicts supply to fall behind demand by 2 million bpd in H2.

- Positive developments in US debt ceiling talks boost market sentiment, lifting oil prices.

- US crude oil prices rise despite increased inventories as China’s economic growth tempers.

Western Texas Intermediate (WTI) advanced more than 3% in the late New York session, exchanging hands at around the $72.90 area due to renewed optimism after UD debt ceiling negotiations pointed to an agreement. At the same time, the International Energy Agency (IEA) revealed that demand would outpace supply, bolstering oil prices.

Oil demand is set to outpace supply, while China accounts for 60% of the demand increase in 2023

The IEA revealed that supply would surpass demand by 2 million barrels per day (bpd) in the second half of the year, with China’s making up 60% of the oil demand increase in 2023.

In the meantime, US President Joe Biden commented that he’s confident about reaching a debt ceiling as he embarks on a trip to Japan. The US House Speaker Kevin McCarthy commented that he planned to be engaged in negotiations, while Biden said he planned to remain in close contact with the speaker and negotiators.

US crude oil prices defy the increase in US inventories, according to the US Energy Information Administration (EIA). Stockpiles rose 5 million barrels in the last week to 467.6 million barrels, compared to analysts’ expectations for a drop of 900K.

Aside from this, China’s recent economic data revealed that the economy is tempering its growth. According to sources cited by Reuters, “A bunch of Chinese macro-economic data for April released on Tuesday confirmed the narrative of a patchy and slow recovery in the country and continue to weigh on oil market sentiment.”

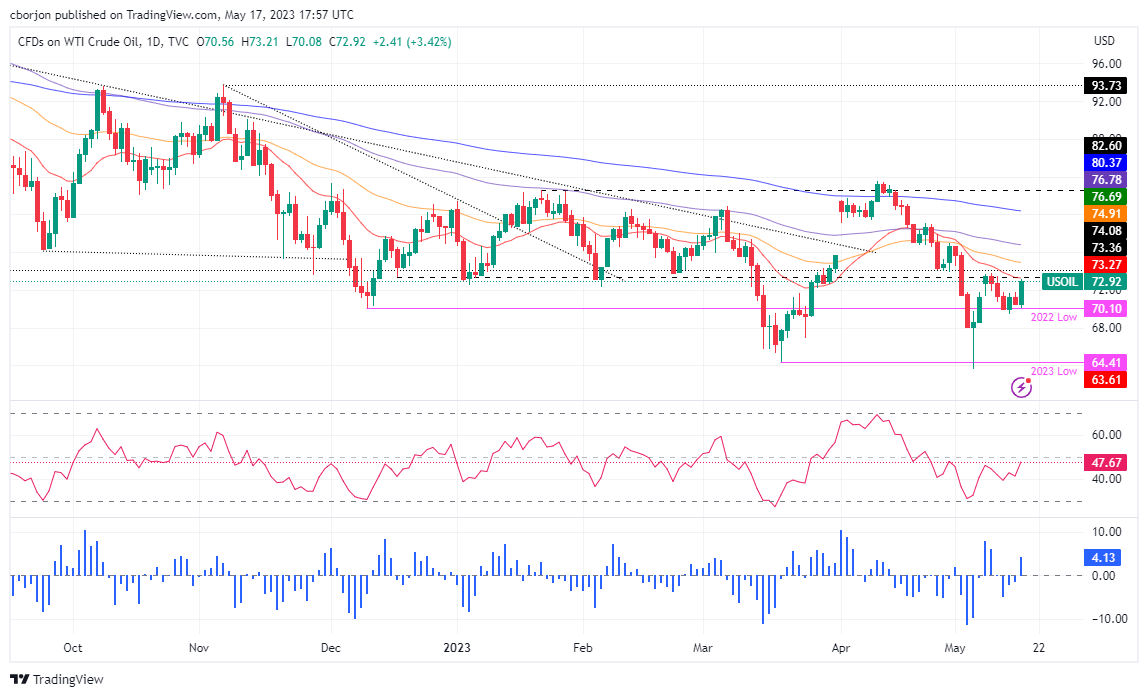

WTI Price Analysis: Technical outlook

WTI has recovered some ground after dipping below the last year’s low of $70.10, reaching a two-week low of $69.44. However, WTI buyers moved in, lifting the price toward the 20-day Exponential Moving Average (EMA), which, once cleared, could pave the way to test the 50-day EMA at $74.91. Once cleared and up next would be the 100-day EMA at $76.78. Nevertheless, the Relative Strength Index (RSI) indicator continues at bearish territory, suggesting that sellers remain in charge. Therefore, WTI’s failure to crack the $73.00 PB area and a dip towards the $69.00 area is on the cards.

Author

Christian Borjon Valencia

FXStreet

Markets analyst, news editor, and trading instructor with over 14 years of experience across FX, commodities, US equity indices, and global macro markets.