WTI soars above $70.00 on positive sentiment and geopolitical tensions

- WTI advances on sentiment, Kurdistan oil exports halt.

- Investors shrugged off the US banking system woes after First Citizens BankShares acquired Silicon Valley Bank.

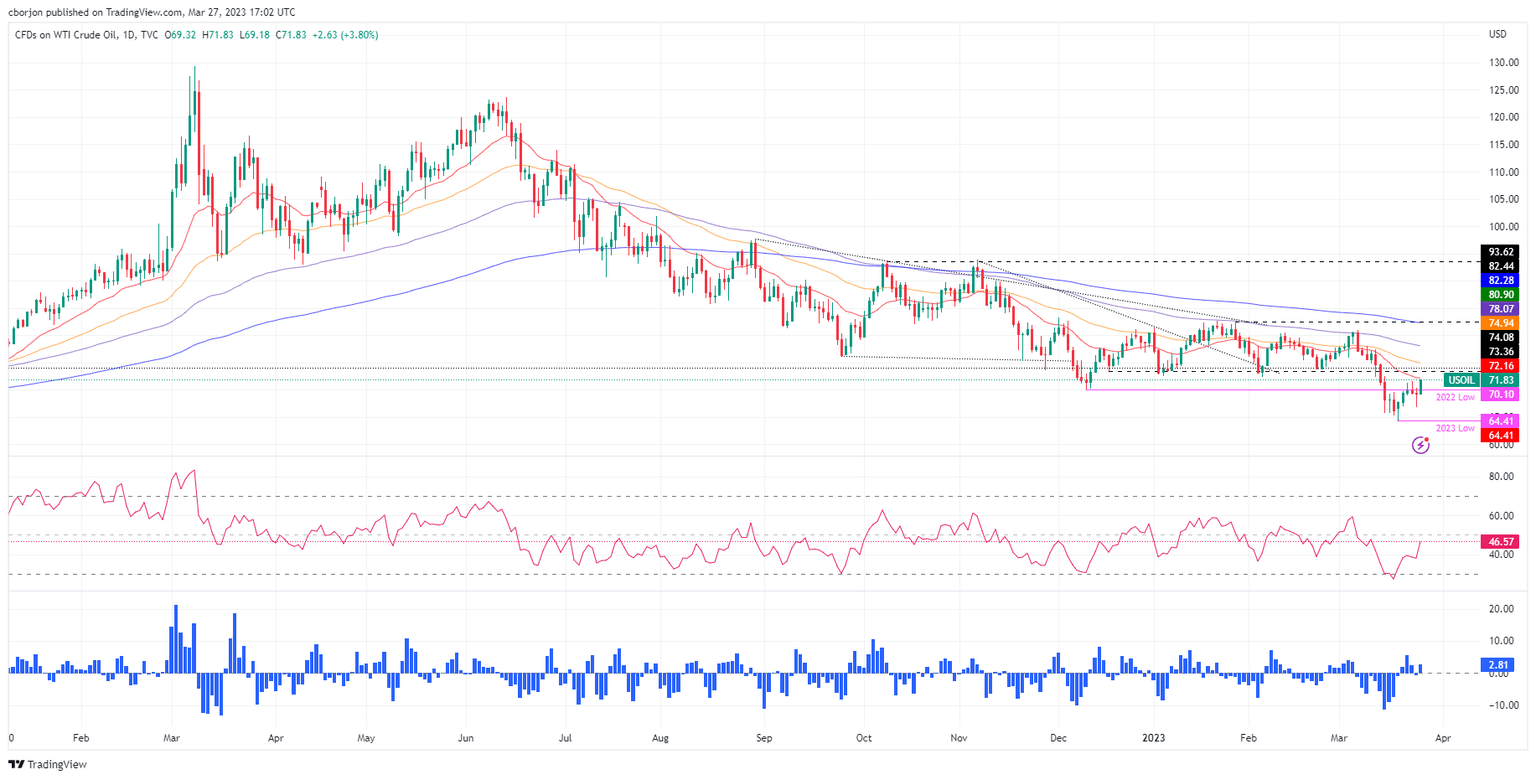

- WTI Price Analysis: Stuck in neutral to the downward trend but could rally to $80.00 once RSI turns bullish.

Western Texas Intermediate (WTI), the US crude oil benchmark, advances sharply on an upbeat sentiment. Another reason for oil’s jump was a halt to oil exports from Iraq Kurdistan and Putin’s nuclear threats. At the time of writing, WTI is trading at $71.13 per barrel.

A confidence vote in the banking system sparked a shift in market mood after First Citizens BankShares, Inc. takeover the Silicon Valley Bank (SVB). Reports emerging that US authorities are considering expanding emergency lending facilities gave another reason for hope, which was cheered by investors.

WTI’s reversed its course after a dragonfly doji emerged on its daily chart after Friday’s close. Hence, oil traders threaten to push prices to the 20-day EMA at $72.10.

In the middle east, an arbitrage case won by Baghdad halted 450K bpd exports from Kurdistan to Turkey due to Kurdistan’s need for Iraq’s consent to ship oil.

Russian President Vladimir Putin’s announcement to deploy tactical nuclear weapons in Belarus in an attempt to intimidate the West due to its support for Ukraine also contributed to the increase in oil prices. NATO described Putin’s comments as “dangerous and irresponsible:, and Ukraine called for a UN Security Council meeting.

At the same time, Russia’s Deputy Prime minister Alexander Novak commented that Moscow is close to achieving its 500K crude output, to about 9.5 million bpd.

WTI Technical analysis

WTI is still neutral to downward biased, though approaching the 20-day EMA. Oscillators remain bearish, with the Relative Strength Index (RSI) below 50, but it’s aiming up. So, if RSI turns bullish, WTI’s could rally to $80.00. Hence, WTI’s first resistance would be the 20-day EMA at $72.10. A breach of the latter will expose the 50-day EMA at $74.93, followed by the 100-day EMA at $78.06, before testing $80.00.

Author

Christian Borjon Valencia

FXStreet

Markets analyst, news editor, and trading instructor with over 14 years of experience across FX, commodities, US equity indices, and global macro markets.