WTI Price Analysis: Oil trapped in a pennant pattern on 1H

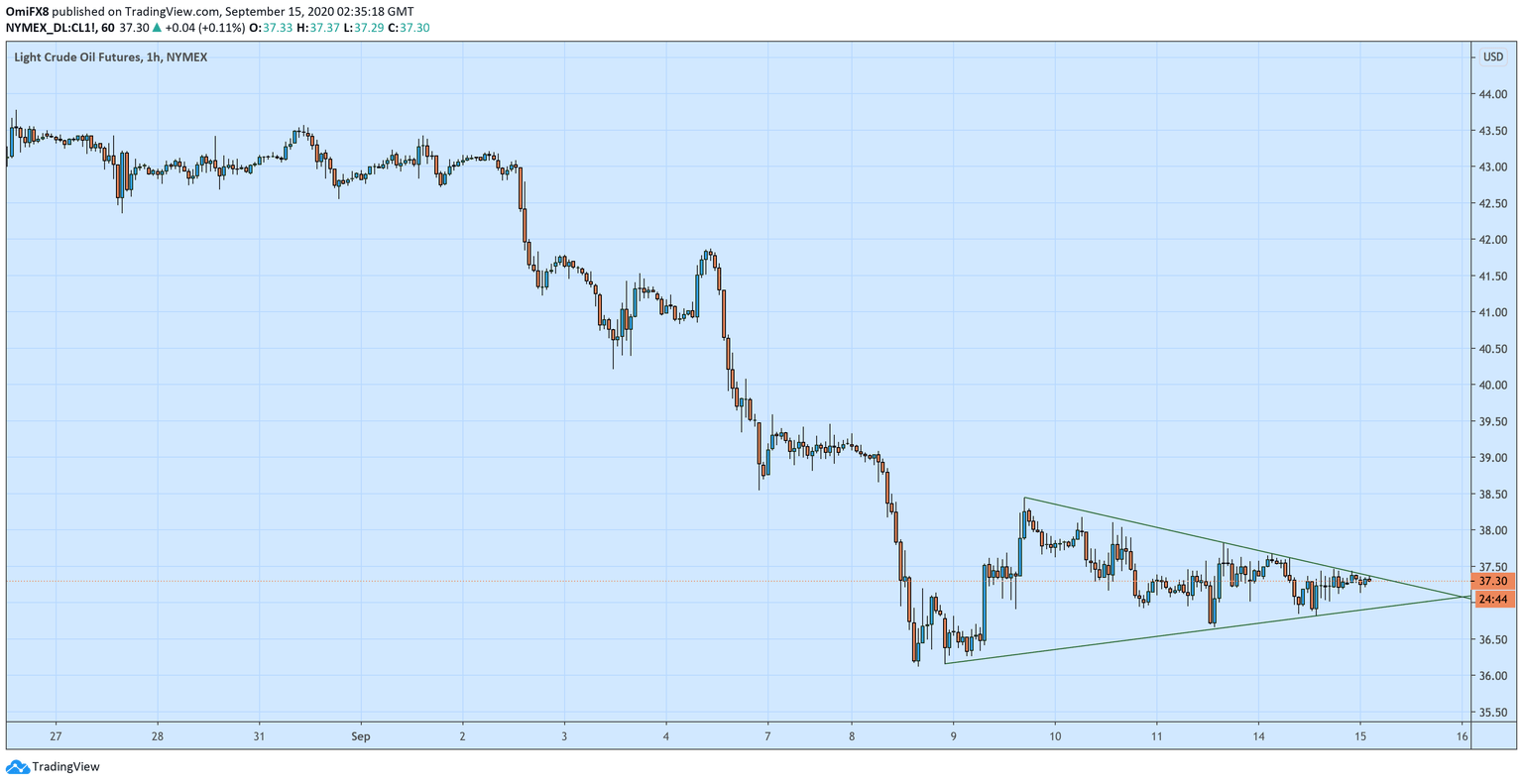

- WTI's hourly chart shows a pennant pattern or contracting triangle.

- A breakdown would signal bearish continuation and expose June lows.

West Texas Intermediate (WTI) crude has carved out a narrowing price range or pennant pattern on the hourly chart.

The upper end of the pennant pattern is currently seen at $37.37. A breakout above that level would mean the sell-off from the August high of $43.78 has ended, and the bulls have regained control.

Alternatively, a move below the lower end of the pennant, currently at $36.92, would imply a continuation of the sell-off from August's high and expose deeper support levels lined up at $34.36 (June 15 low).

At press time, a barrel of WTI is changing hands near $37.30.

Hourly chart

Trend: Bearish below $36.92

Technical levels

Author

Omkar Godbole

FXStreet Contributor

Omkar Godbole, editor and analyst, joined FXStreet after four years as a research analyst at several Indian brokerage companies.