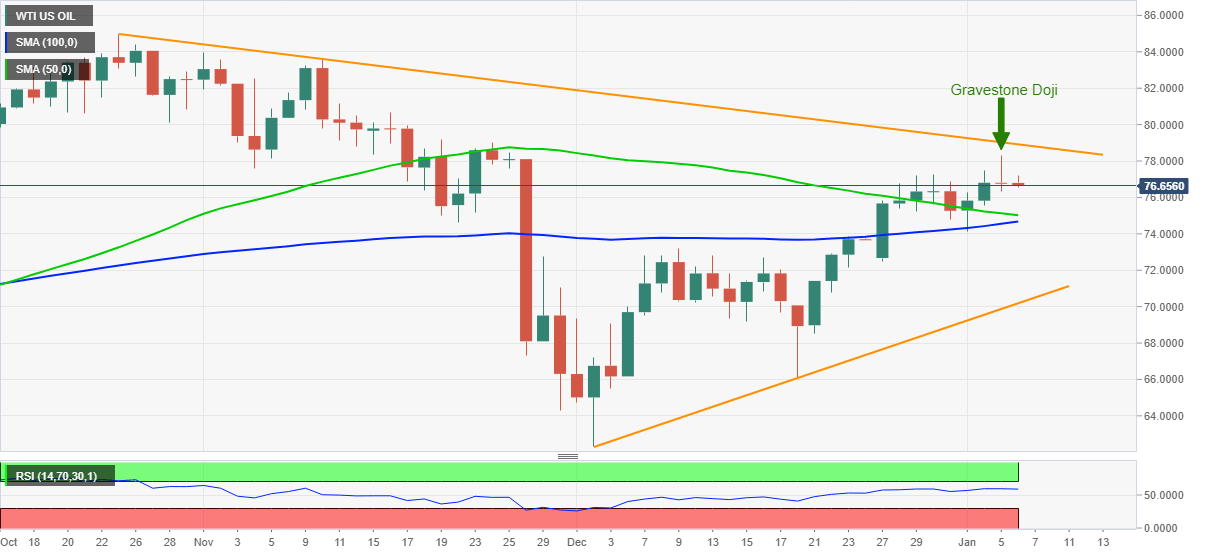

WTI Price Analysis: Mildly offered below $77.00 on Wednesday’s Gravestone Doji

- WTI pulls back from six-week high, pressured around intraday low at the latest.

- Bearish candlestick, sluggish RSI hints at buyer’s exhaustion below multi-day-old resistance line.

- 50-DMA, 100-DMA restricts immediate downside ahead of monthly support line.

WTI crude oil remains on the back foot near the intraday low of $76.56, down 0.20% on a day during early Thursday.

The oil benchmark jumped to a fresh high since November 25 the previous day before reversing gain from $78.30 to retest the opening levels at Wednesday’s end. In doing so, the black gold printed a Gravestone Doji bearish candlestick on the daily chart.

Given the sluggish RSI conditions backing the bearish candlestick below a 10-week-old resistance line, around $78.95, WTI oil prices are likely to decline further.

In doing so, the 50-DMA and the 100-DMA can lure short-term traders, respectively around $75.00 and $74.65.

However, early December’s peak near $73.15 and a one-month-old support line, close to $70.20, will challenge WTI bears afterward.

Alternatively, an upside clearance of the stated resistance line near $78.95 will need validation from the $79.00 round figure before directing the oil prices towards $83.60 and then to November’s high surrounding $84.00.

During the rise, the $80.00 psychological manget will act as an extra filter to the north.

WTI: Daily chart

Trend: Further weakness expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.