WTI Price Analysis: Grinds higher inside weekly trading range below $90.00

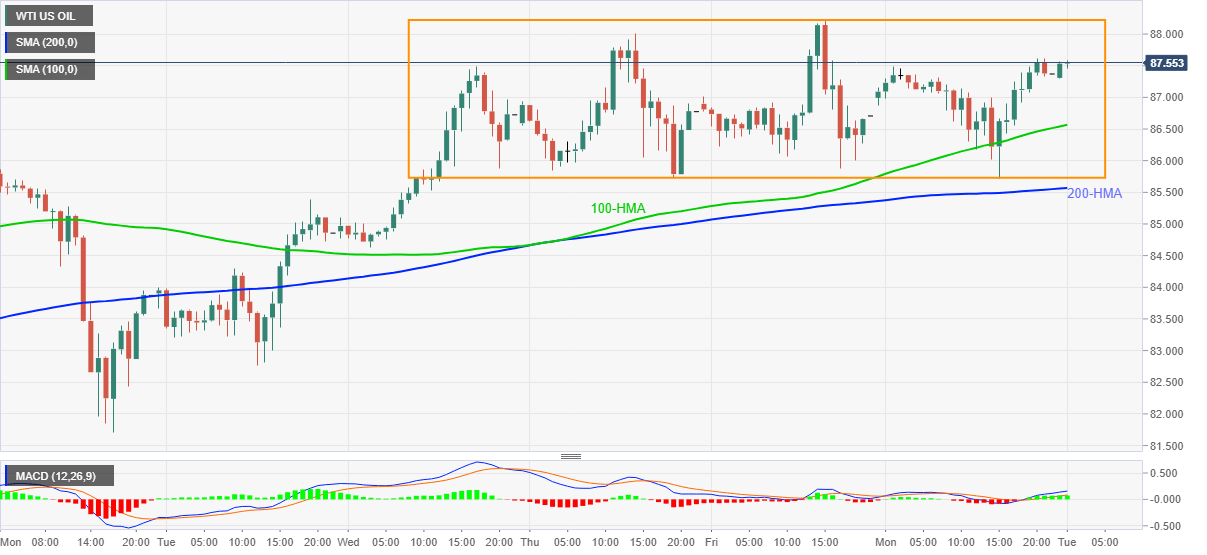

- WTI picks up bids to poke upper line of the one-week-old trading range.

- Firmer trading above the key HMAs, bullish MACD keeps buyers hopeful.

WTI crude oil stays firmer around $88.50 inside a weekly trading range during Tuesday’s Asian session, following a five-day uptrend.

While picking up bids inside the familiar trading area, WTI bulls keep the reins around the highest levels since October 2014.

Given the firmer MACD signals and the commodity’s sustained trading above the 100-HMA, as well as the 200-HMA, WTI crude oil prices are likely to overcome the immediate hurdle, namely the recent high of $88.22.

Following that, the $90.00 threshold will act as an intermediate halt during the quote’s rally targeting the early 2014 lows surrounding $91.30.

Alternatively, the 100-HMA level of $86.55 will initially challenge the pullback moves ahead of the lower line of the stated range near $85.70.

Also acting as a downside filter is the 200-HMA level of $85.57, a break of which will direct oil bears towards late January’s swing low near $81.70.

WTI: Hourly chart

Trend: Bullish

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.