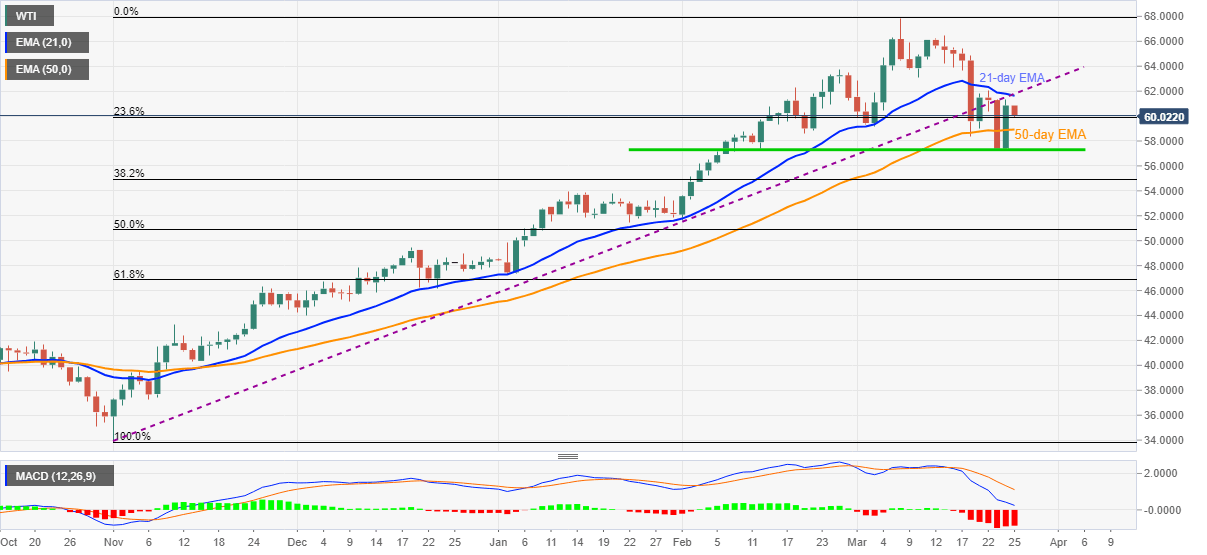

WTI Price Analysis: Fades bounce off seven-week-old horizontal support

- WTI stays pressured after easing from $61.32 the previous day.

- Bearish MACD, key resistance confluence challenge short-term upside.

- 50-day EMA adds to the downside filters, $63.00 offers extra resistance.

WTI remains depressed around $60.00, down 1.24% intraday, during early Thursday. In doing so, the energy benchmark extends the previous day’s U-turn from $61.34 while keeping the downside break of an ascending support line now, resistance, from November 02 and 21-day EMA.

Given the bearish MACD joining the black gold’s sustained trading below the key resistance convergence, WTI sellers eye a 50-day EMA level of $58.93 on the desk as a short-term target.

It should, however, be noted that the quote’s weakness below important EMA will have to defy the horizontal area including multiple levels marked since early February, around $57.30-25.

If at all, the oil prices drop below $57.25, January top near $53.90 should return to the chart.

On the contrary, an upside break of $61.60-80 resistance confluence will be a trigger for the fresh rise targeting $63.00–$63.10 area comprising March 10 low and late February tops.

During the quote’s sustained rise past-$63.10, WTI may not hesitate to refresh the monthly peak surrounding $67.90.

Overall, the commodity is in consolidation mode after a stellar run-up since November.

WTI daily chart

Trend: Pullback expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.