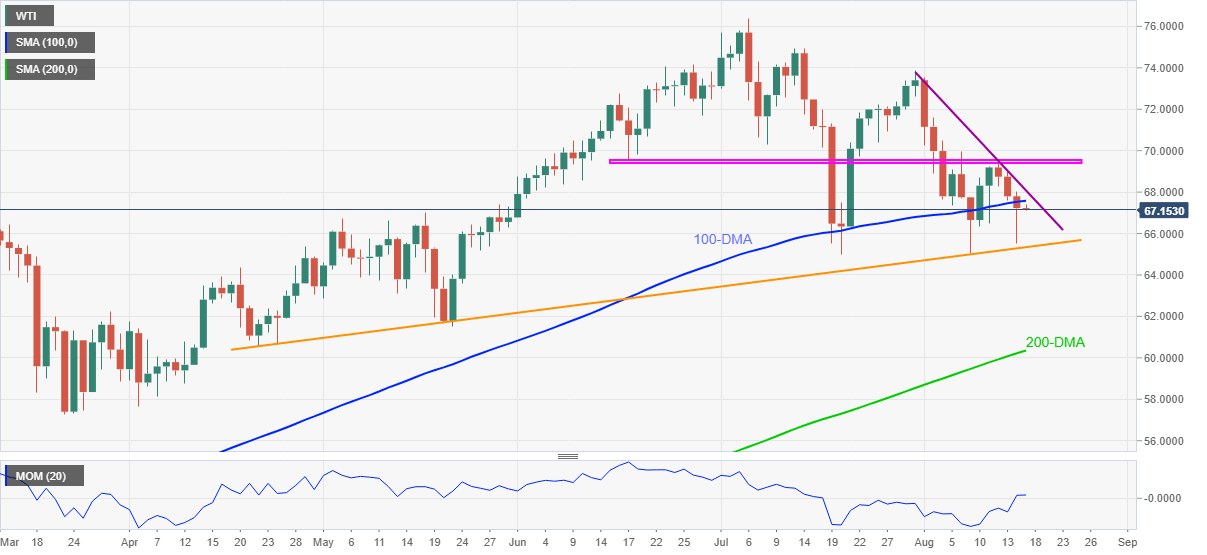

WTI Price Analysis: Bears attack $67.00, four-month-old support in focus

- WTI stays on the back foot for the fourth consecutive day.

- A daily closing below 100-DMA, firmer bearish Momentum favor sellers.

- 200-DMA will follow the trend line support, monthly falling trend line adds to the upside filters.

WTI takes offers around $67.17, down 0.10% intraday, during Tuesday’s Asian session. In doing so, the black gold drops for the fourth consecutive day towards an ascending trend line from late April.

Given the quote’s daily closing below 100-DMA amid a firmer Momentum line, the black gold prices are likely to remain pressured towards the key support line near $65.30.

However, a daily closing below $65.30 will make the commodity prices vulnerable to test the 200-DMA level of $60.35 and the $60.00 psychological magnet.

During the fall, the monthly low and May’s bottom, respectively around $65.00 and $61.50, could offer intermediate halts.

On the flip side, a sustained break of the 100-DMA level of $67.60 will direct the WTI prices towards a downward sloping trend line from July 30, near $68.10.

If at all, the oil buyers manage to keep the reins past $68.10, a horizontal area comprising multiple levels marked since mid-June, around $69.50, will be the key to follow.

WTI: Daily chart

Trend: Further weakness expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.